How do I trade using Cross and Isolated Modes?

Crypto trading offers various features designed to help traders manage risk and optimize returns. One of these features is the options to trade using Cross Margin and Isolated Margin modes.

Understanding Margin Level

When trading in Cross margin or Isolated Margin modes, one crucial metric is the Margin Level, a key indicator of the risk associated with your positions. A lower margin level signifies higher risk. If the margin level falls to or below 100%, your position may be reduced or liquidated. The margin level is determined using the mark price. To learn more about mark price, visit here.

What's Cross Margin mode?

In Cross Margin mode, all cross positions under the same margin asset share a unified margin balance. In the event of liquidation, your maximum loss is capped at the balance of all margins under the same asset, along with all cross positions under the same margin asset. Trading in Cross Margin mode offers several advantages:

Shared Margin: The available margin is distributed across all positions, helping to prevent liquidation during market volatility.

Efficient Use of Funds: Pooled margins allow for more efficient capital utilization, potentially reducing the need for additional funds.

Risk Distribution: Losses from one position can be offset by profits from another, effectively distributing risk.

How do I trade using Cross Margin mode?

Navigate to the trading interface: When trading futures or margin, start with the selection of your preferred mode

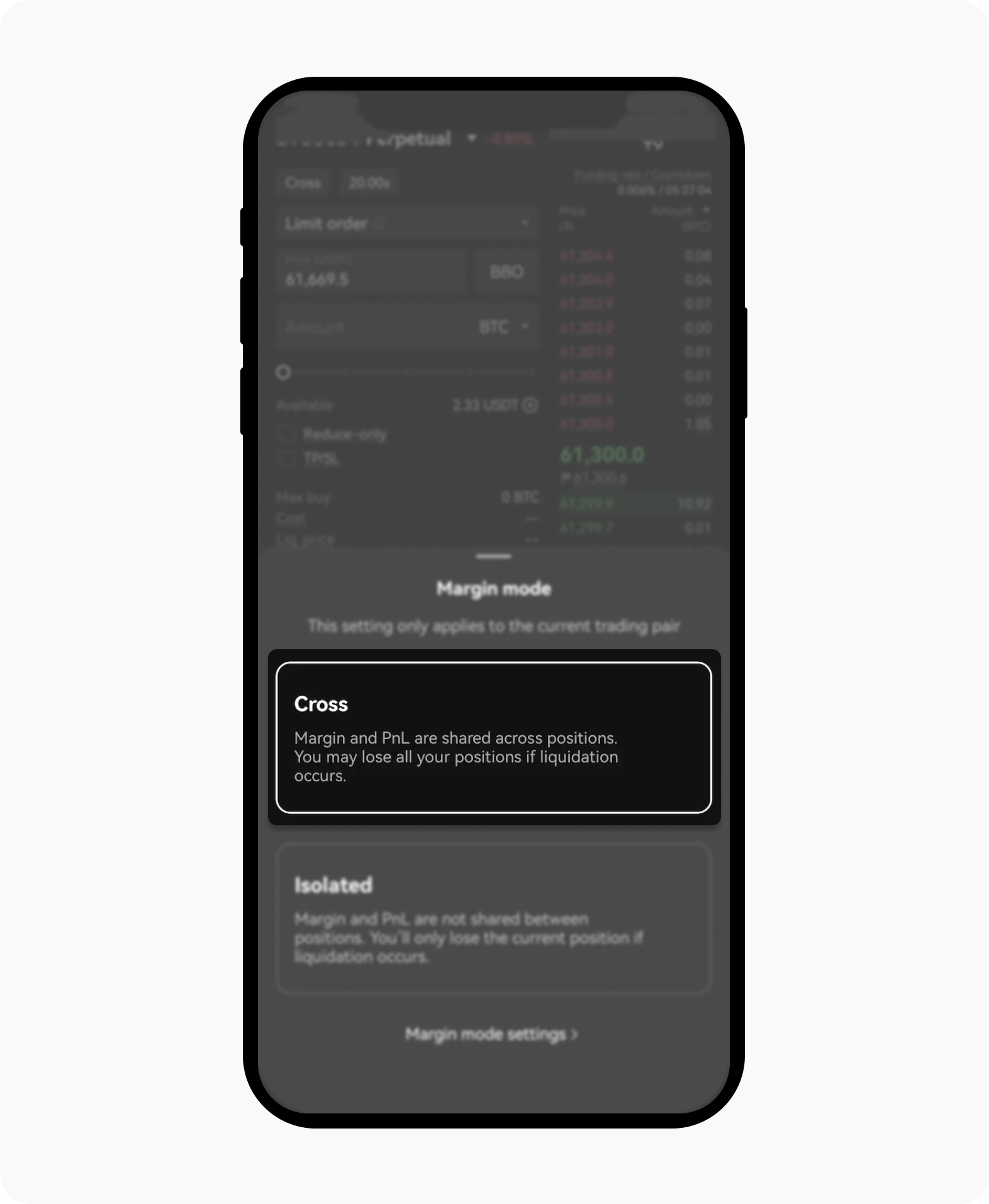

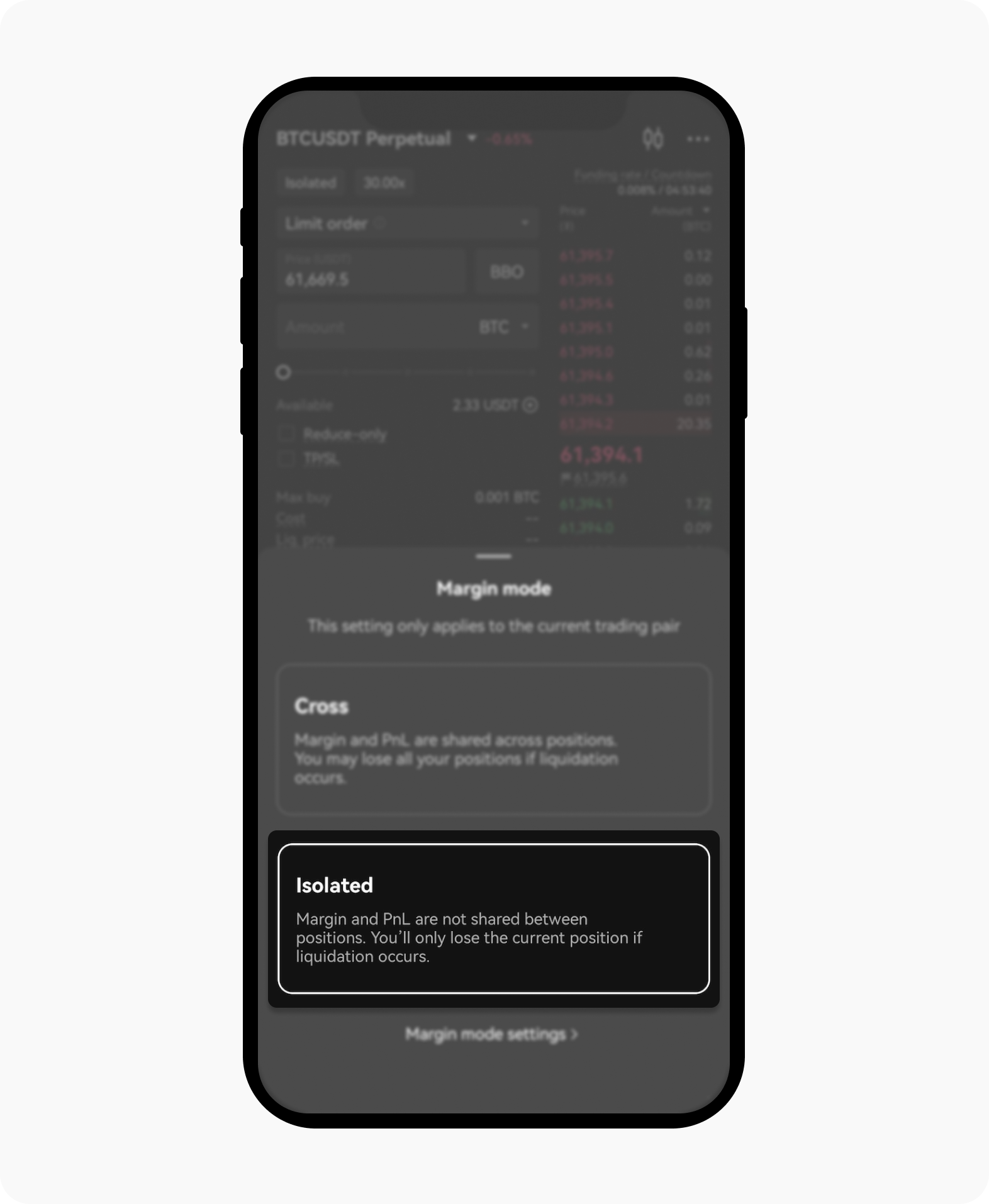

Select your preferred margin mode, whether Cross or Isolated

Select Cross margin mode: in the margin mode options, select Cross Margin

Select Cross to trade with Cross margin mode

Set up your margin: Choose the leverage level (for example, 5x, 10x)

Execute your order: review the order details and execute your trade

What's Isolated Margin mode?

In Isolated Margin mode, your position margin is limited to the value of the assets you are trading. During liquidation, your maximum loss is confined to the margin of that specific position.

Risk containment: Losses are restricted to the isolated position, preventing them from impacting other trades.

Position control: Traders gain better control over individual positions, allowing for independent management.

Custom margin allocation: Traders can allocate specific margin amounts to different positions according to their risk tolerance.

How do I trade using Isolated Margin mode?

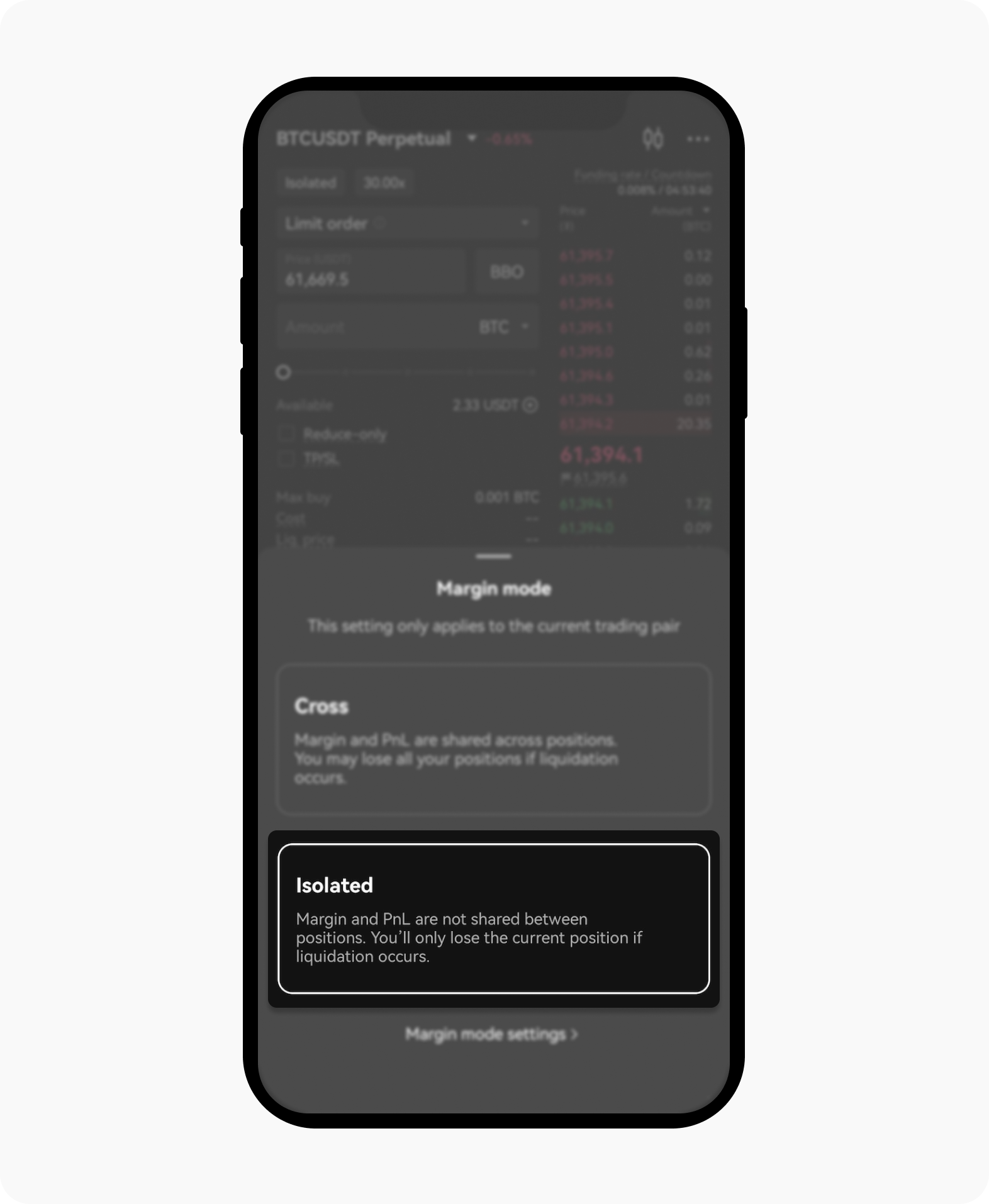

Navigate to the trading interface: when trading futures or margin, start with the selection of your preferred mode

Select Isolated Margin mode: in the margin mode options, select Isolated Margin

Select Cross to trade with Isolated margin mode

Set up your margin: Choose the leverage level (for example, 5x, 10x)

Execute your order: review the order details and execute your trade

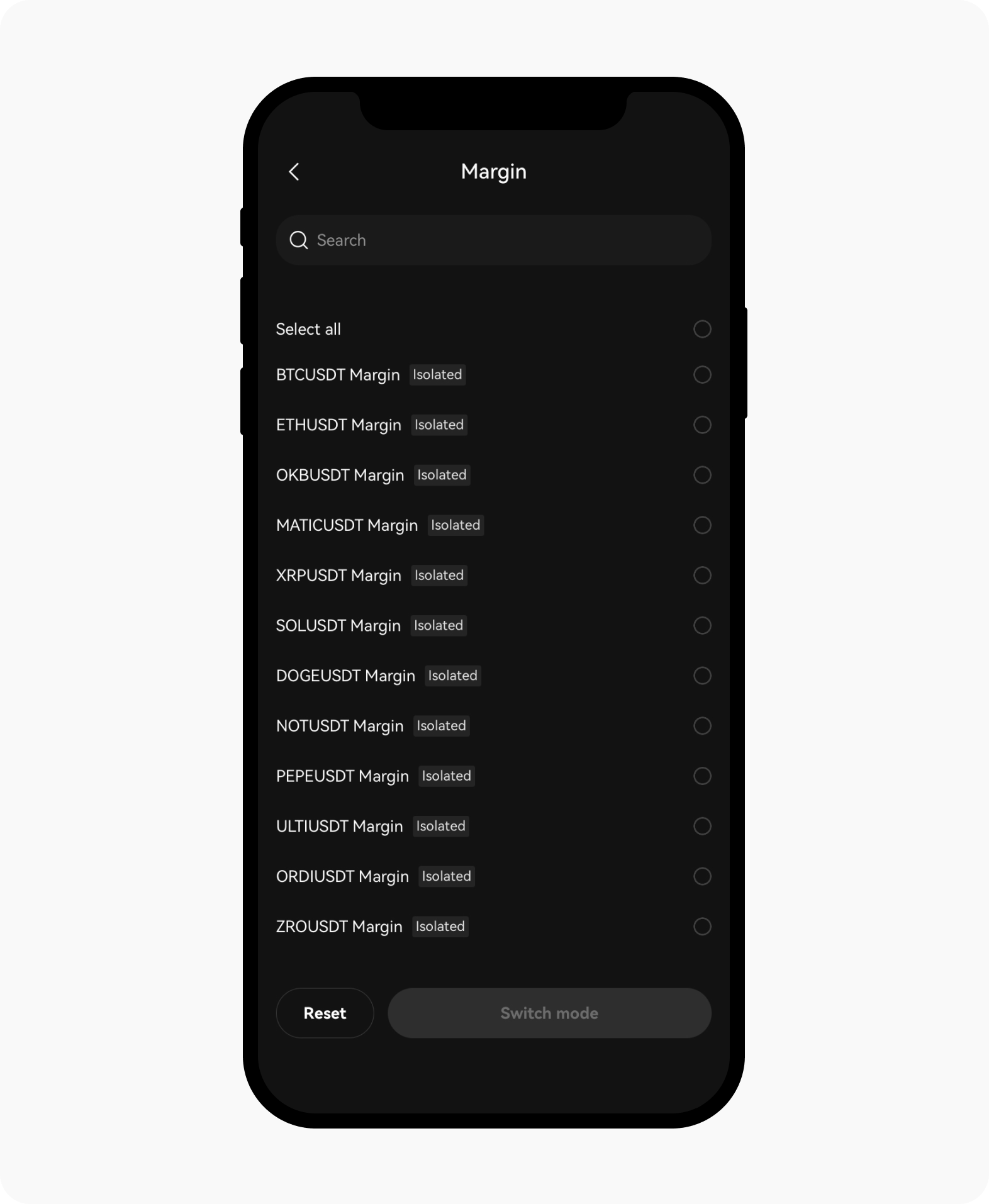

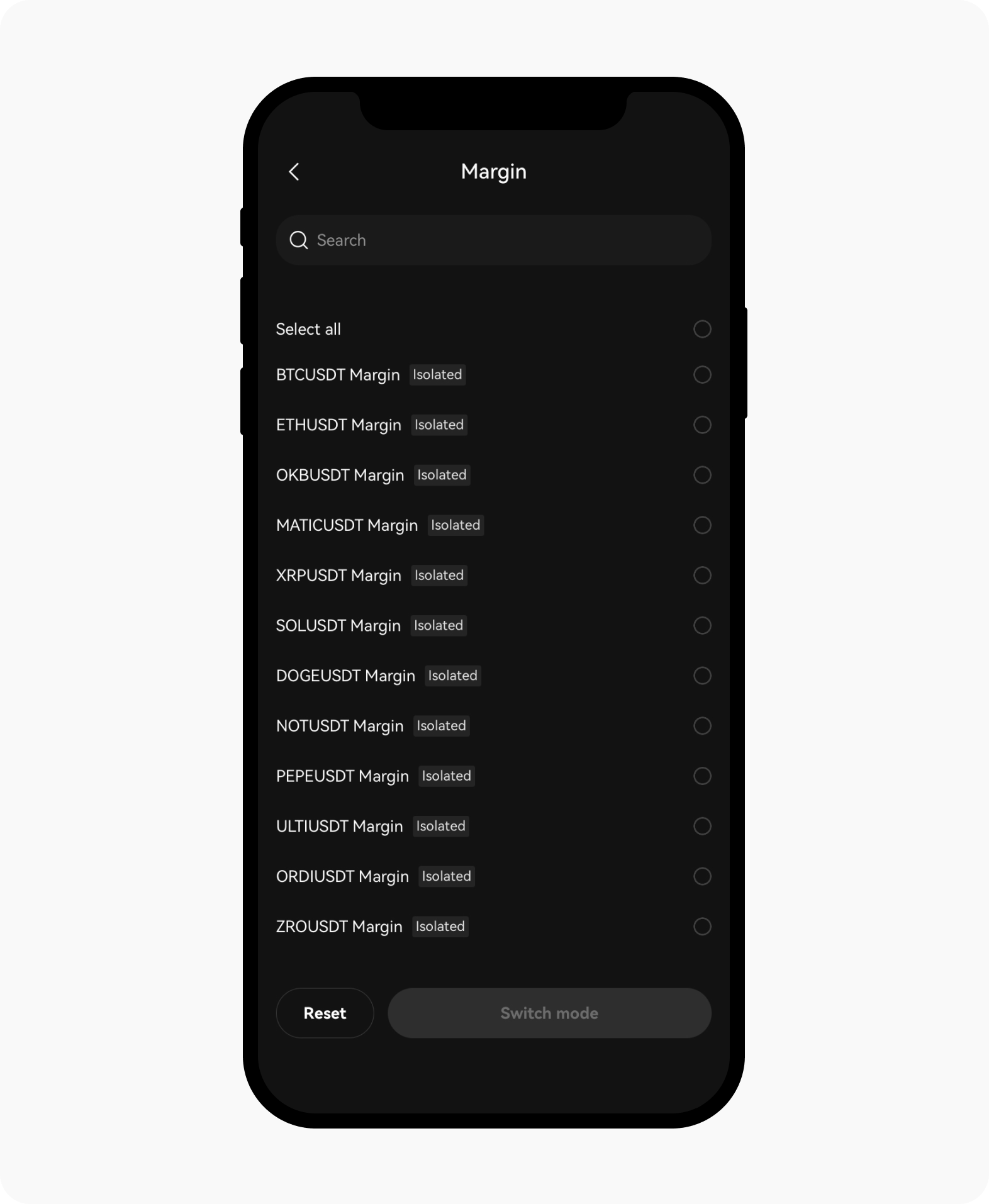

How do I configure Margin mode settings across multiple assets?

If you're an experienced trader with a robust strategy, you may want to configure Margin mode settings for multiple assets at once. Rather than adjusting each pair individually, here's a streamlined way to do it within the settings:

Locate for the Margin mode settings within the Margin mode pop-up menu

Adjust your margin mode settings by making the change in the settings section

Select your preferred margin mode for the pairs you're trading and confirm your selection by selecting Switch mode

Start configuring your Margin mode settings for multiple assets at one go

Both Cross Margin and Isolated Margin modes offer unique advantages for traders looking to optimize their margin trading strategies. By understanding how each mode works and their respective benefits, you can make informed decisions that align with your risk tolerance and trading goals. Whether you choose the flexibility of Cross Margin or the risk containment of Isolated Margin, effective margin trading requires careful planning, monitoring, and risk management.