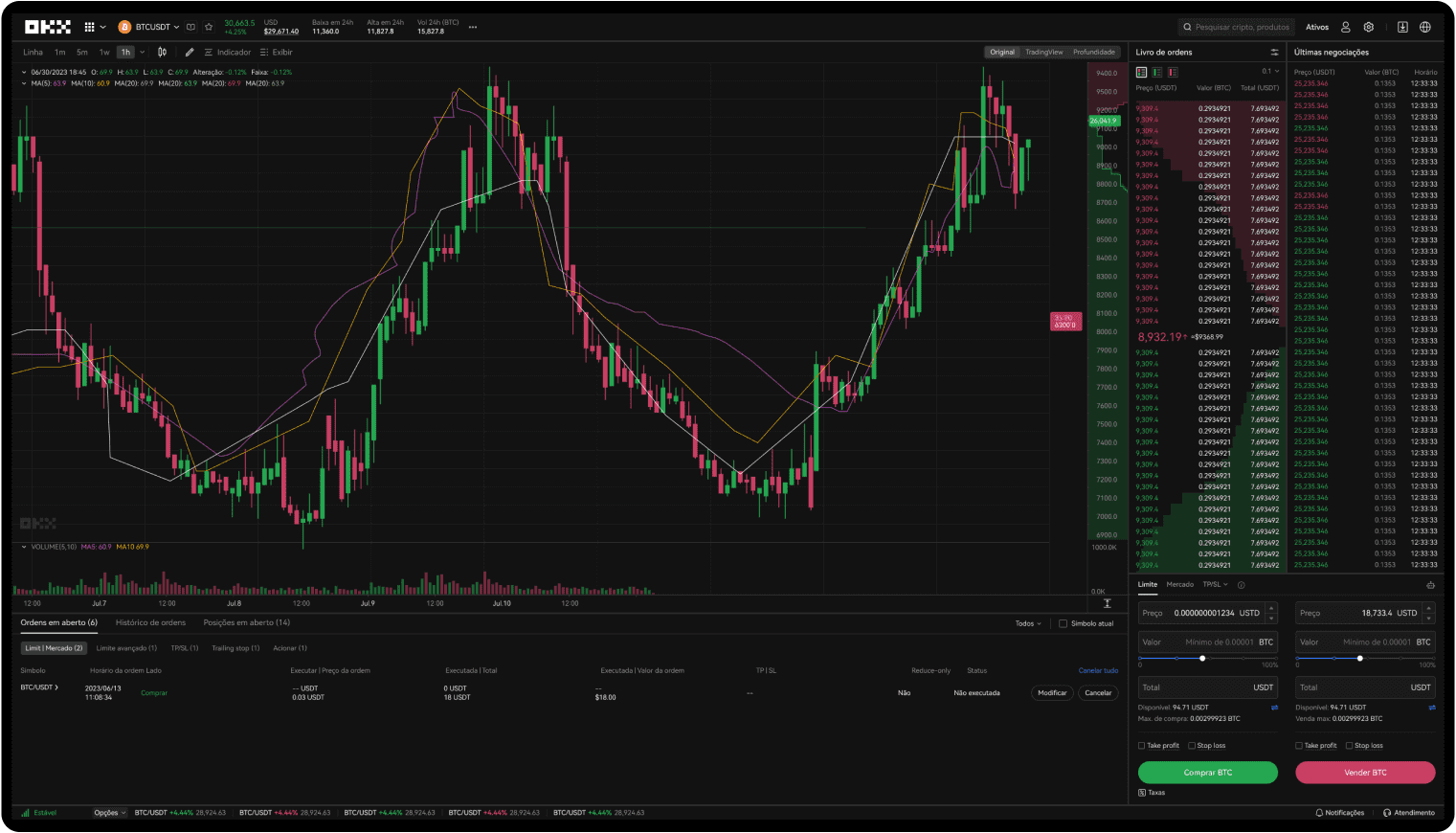

Crie sua conta, negocie o equivalente a R$ 2.000 e ganhe seu bônus!Taxas mais baixas, melhor mecanismo de correspondência do mercado, APIs potentes e muito mais

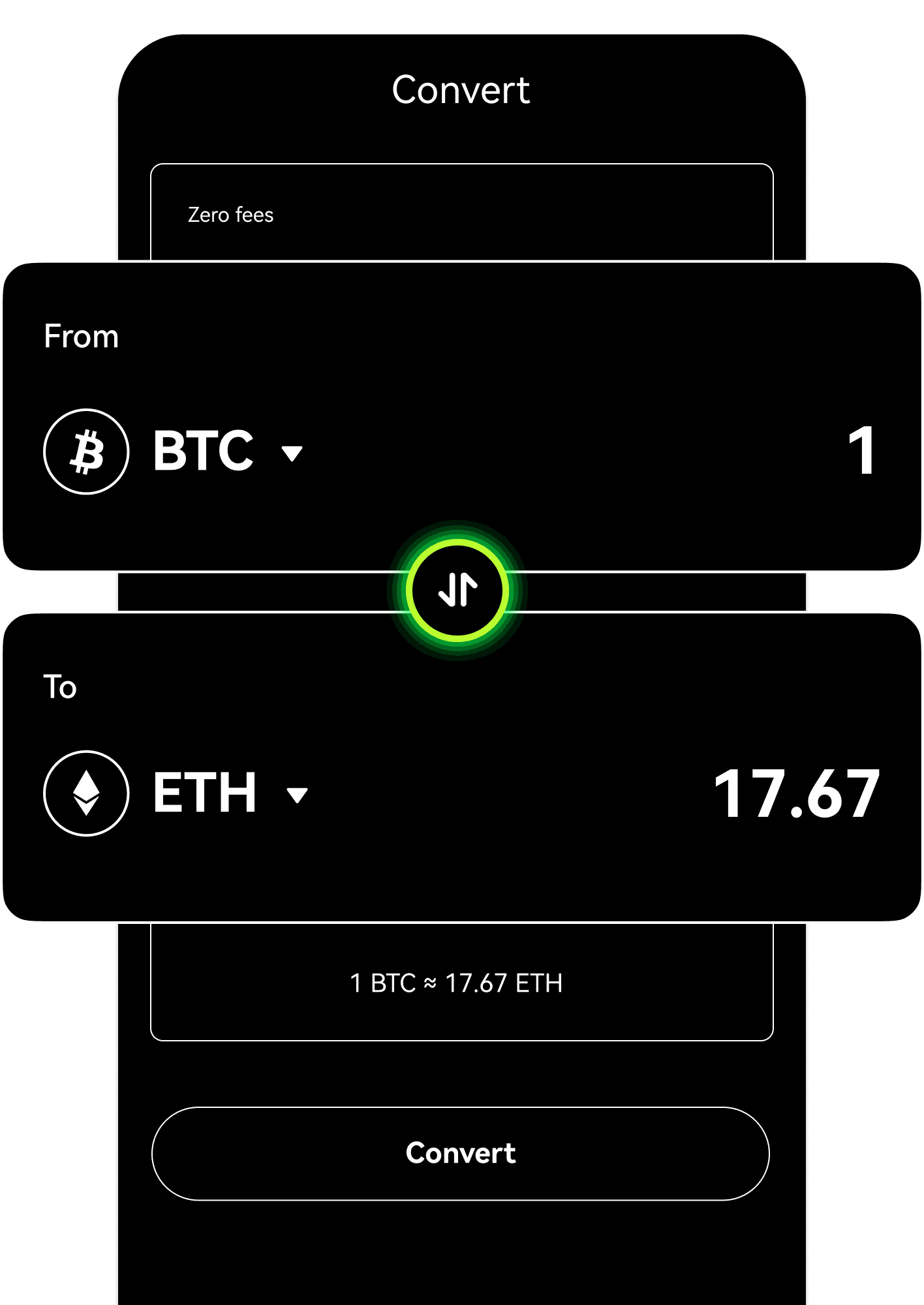

Você é iniciante em cripto? Não tem problema. Compre sua primeira cripto de forma simples e vá melhorando suas habilidades.

Da primeira negociação de cripto à primeira compra de NFT, vamos orientar você por todo o processo. Tire todas as suas dúvidas e não perca suas noites de sono.

Na OKX, você pode confiar.

Técnico Pep Guardiola

Explica "formação maluca do futebol"

Reescreva o sistema

Boas-vindas à Web3

Snowboarder Scotty James

Traz a família inteira

Quais produtos a OKX oferece?

Como comprar Bitcoin na OKX?

Em que países a OKX está disponível?

O que é cripto?