What's Snap mode - powered by UniswapX, and how do I use it?

What's Snap?

Snap is a new feature leveraging UniswapX for optimal pricing, zero gas fees, and fail-safe transactions.

Our DEX's Snap trading mode feature allows you to swap tokens on Ethereum quickly and intuitively without incurring any gas fees. The feature operates directly on our DEX interface via Uniswap's UniswapX protocol. UniswapX is a new permissionless, open-source, Dutch auction-based protocol that's designed to give token swappers the best possible deal by aggregating liquidity from various sources, preventing maximum extractable value (MEV) attacks, providing gas-free transactions on the Ethereum blockchain, and eliminating costs for failed transactions.

Why should I use the Snap feature?

Snap allows you to access more competitive rates with aggregated liquidity and trade confidently with MEV protection and zero penalties on failed transactions, courtesy of the UniswapX integration.

What's the benefit or value that Snap delivers?

To capitalize on improved pricing, enjoy gas-free swaps, and eliminate the frustration of transaction failures, all within our user-friendly environment.

Why can’t I place a swap order?

To place a swap order, you must ensure you have sufficient token balance in your wallet.

How do I use Snap?

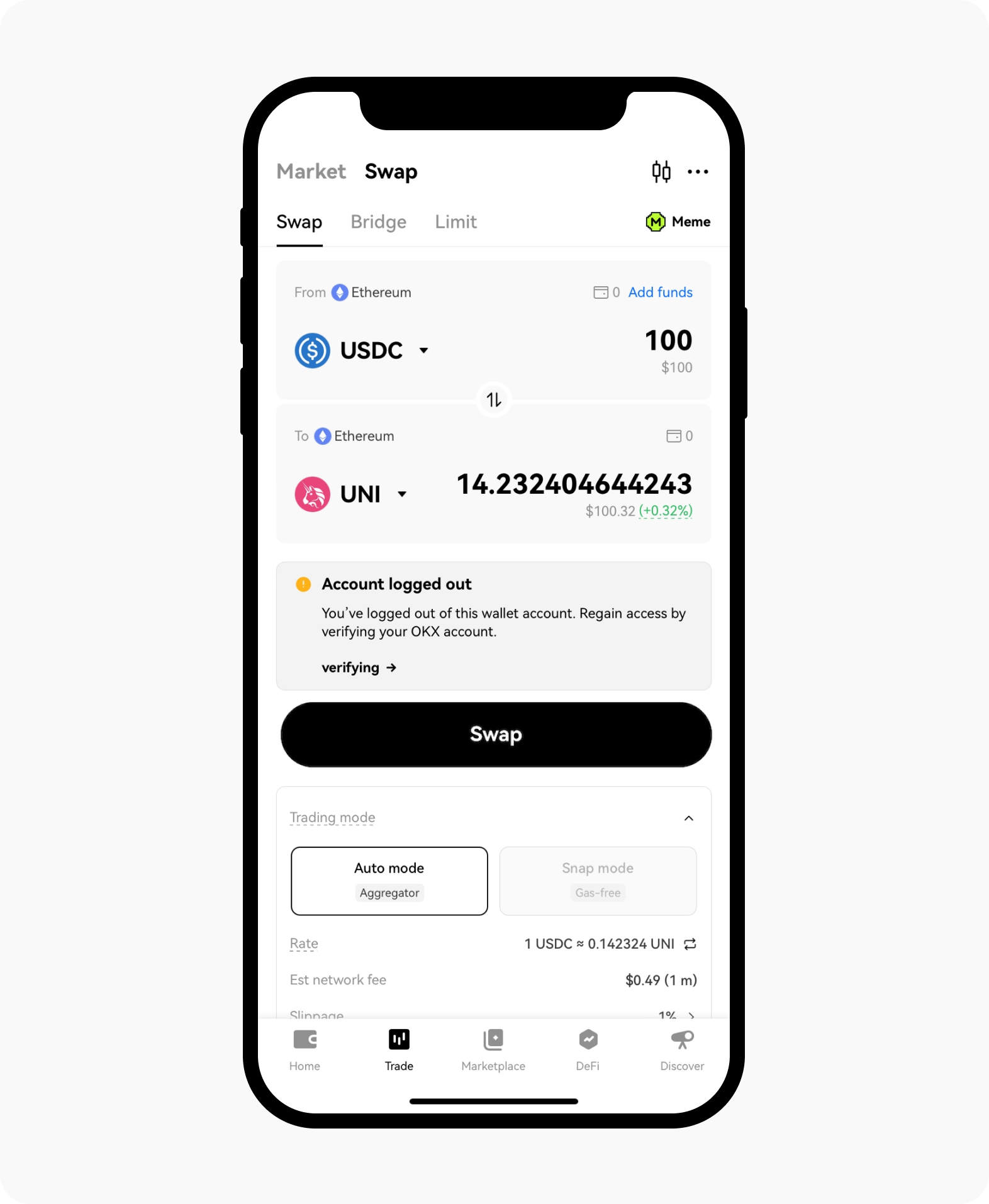

Select the Trade option

Enter Swap option on the Trade page

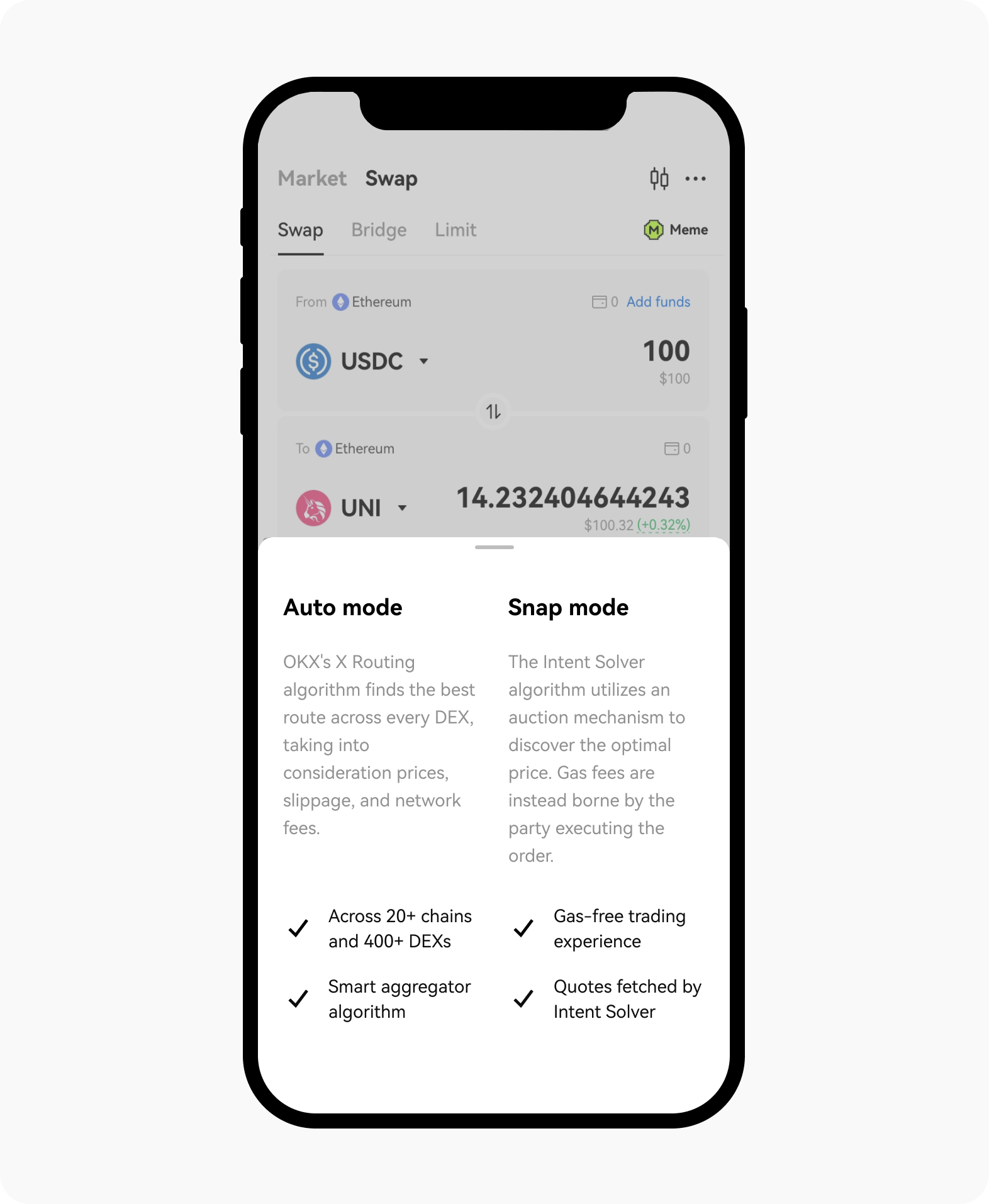

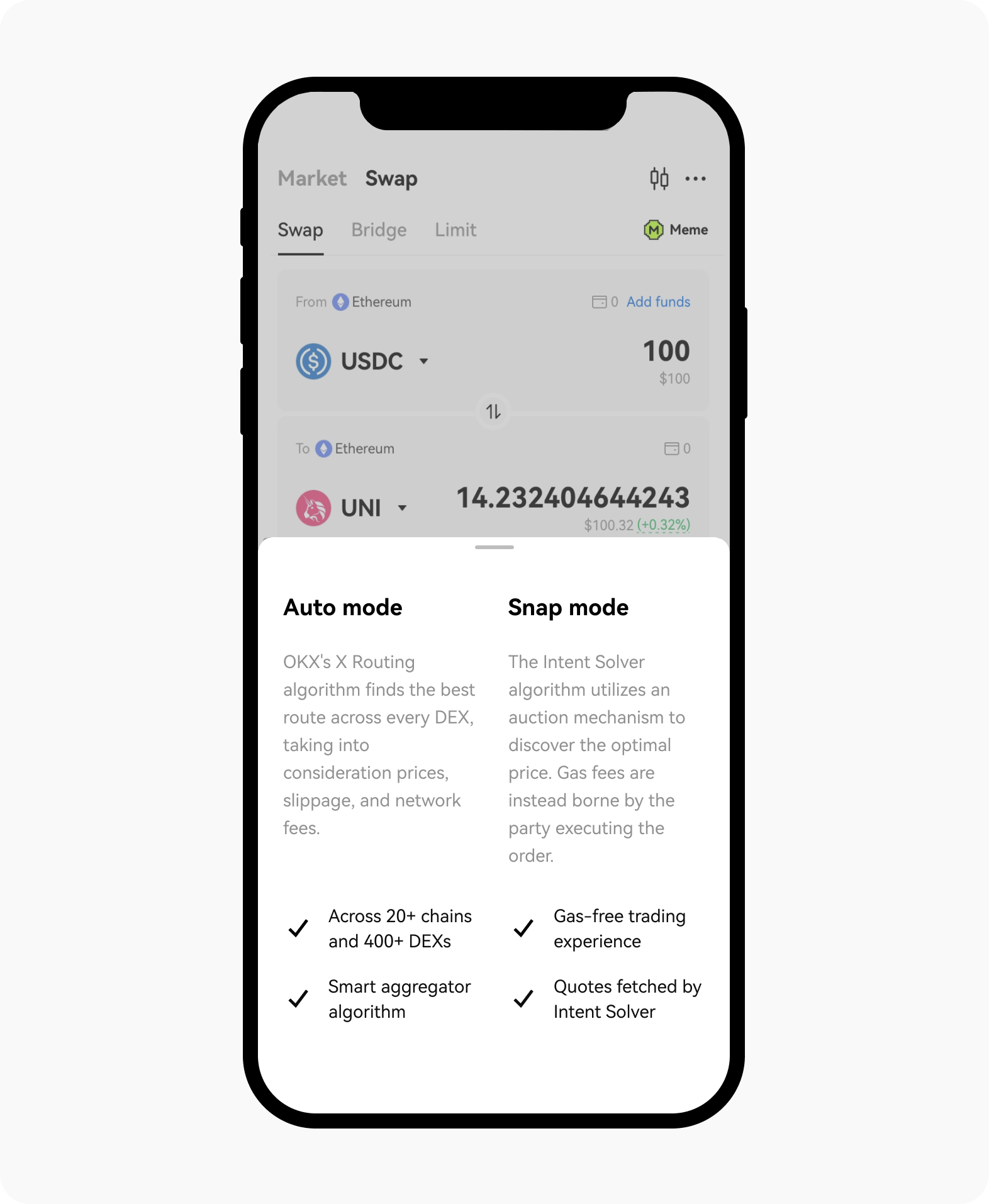

Select the Snap mode

Auto: swapping with the standard X Routing algorithm and gas fees.

Snap (also known as Intent): enhanced trading via UniswapX Protocol, offering gas-free transactions and optimized liquidity.

Snap, also known as Intent mode, can be selected on the Swap page

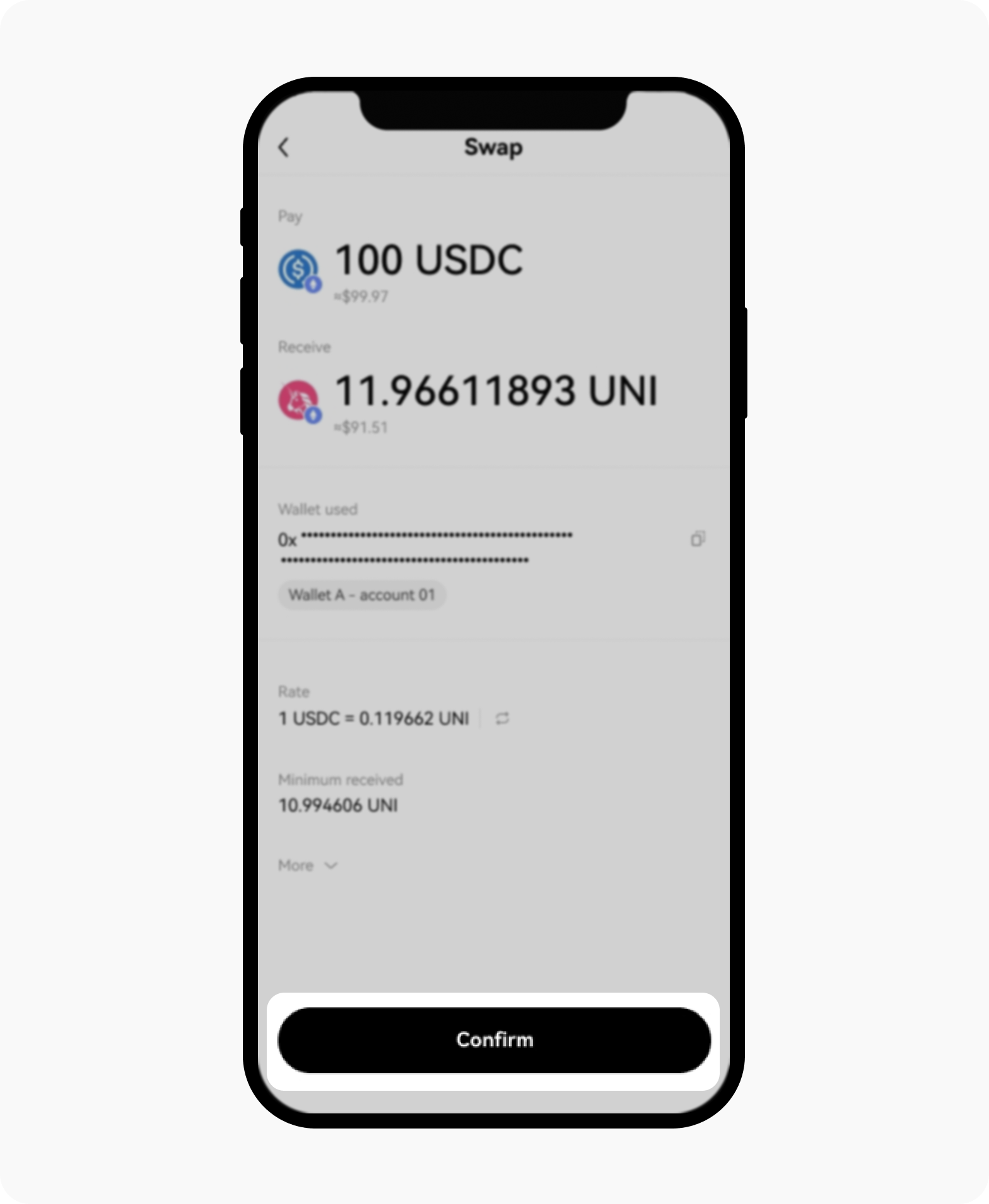

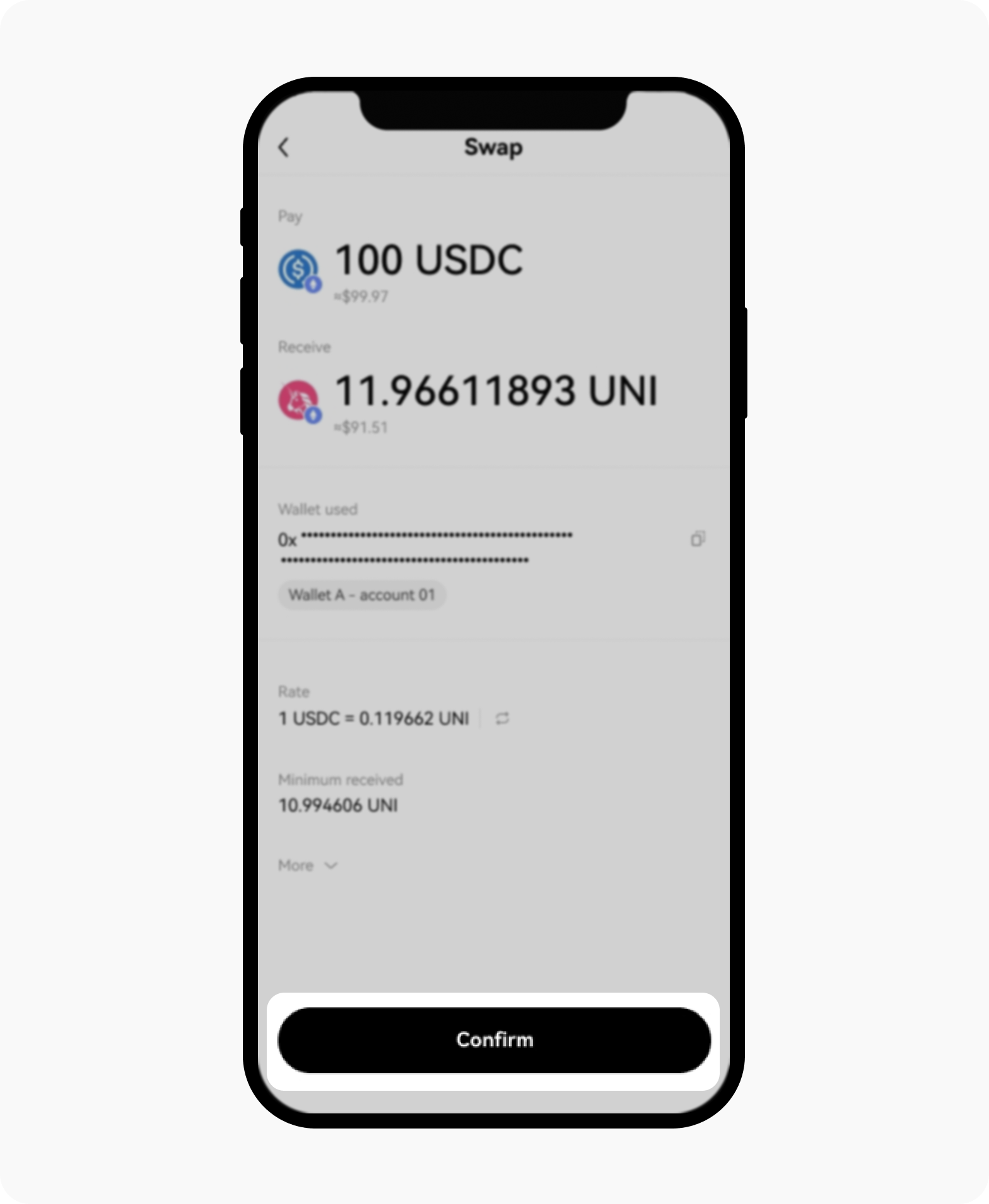

Confirm the Swap

Check out all of the details before confirming your Swap

Note: when swapping with ether (ETH), you must wrap the ETH before you can swap them for other tokens. The wrapping process is where you send your ETH, for example, to a smart contract that converts it into WETH, which conforms to the ERC-20 token standard. The smart contract then holds your ETH and issues an equivalent amount of WETH in return. The process is reversible — you can unwrap WETH back into ETH at any time by sending your WETH back to the smart contract, which will return your original ETH. For Snap-mode transactions, you can only swap ETH for other tokens once it’s wrapped into WETH. The wrapping process is where you send your ETH, for example, to a smart contract that converts it into WETH (WETH is an ERC-20 token). The smart contract then holds your ETH and issues an equivalent amount of WETH in return. The process is reversible — you can unwrap WETH back into ETH at any time by sending your WETH back to the smart contract, which will return your original ETH. Then only it can be swapped with other tokens.