OKX DEX FAQs

What's OKX DEX?

OKX DEX is a DEX aggregator that aims to solve all of the above issues by consolidating the different trading prices and paths across more than 100+ DEXs and recommending the optimal path with the least amount of slippage (for example, difference between the bid price and actual executed price of the trade) for you to take. With 100,000+ tokens to choose from across 10+ chains, you're spoilt for choice. But what really makes OKX's DEX unique are:

Best trading price: our DEX consistently offers prices that are better than or equal to that of other DEX aggregators in the industry more than 60% of the time. This significantly reduces the time that customers need to spend on researching and comparing prices across different offers.

Best-in-class security: our proprietary security technology helps you avoid loss by detecting unfavorable trading prices, counterfeit tokens, rug pulls, high burn rates. OKX DEX is also integrated with Flash Bot, which keeps your transaction private to prevent unnecessarily high maximal extractable value (MEV).

User-friendly interface: we integrate features that make it easy for users to exchange the required gas fees to complete their transactions, create your list of favourite tokens for easy tracking and even enjoy features such as limit orders that are more commonly found on CEX. Furthermore, users can enjoy easy fiat-to-crypto conversions on their OKX CEX accounts and easily transfer these to their OKX Wallet without having to leave the OKX ecosystem, thereby making the trading experience seamless.

Privacy: our DEX is separated from CEX, thereby guaranteeing user anonymity and privacy.

Cross-chain trades: you can perform trades across more than 10+ blockchains, thereby increasing the variety of trades that users can execute within a single platform.

Free to use: absolutely no platform fees, so you get to keep more of your trades.

What are the different types of DEXs and how do they work?

There are primarily 3 types of DEXs:

Order book (off-chain and on-chain): this model is closest to that of centralized exchanges in which the system (for example, order book) compiles all orders across the various prices at which traders are willing to buy and sell at and then matches buyers and sellers in order to fulfill the trades.

Automated market maker (AMM): AMMs leverage smart contracts to settle trades directly on the blockchain. A key feature of AMMs is the use of liquidity pools which are made of funds contributed by investors from the community. In return for locking in their funds, these investors earn a certain amount of interest from trading fees.

DEX Aggregators: DEX Aggregators provide a one-stop hub that consolidates prices across multiple DEXs and aims to provide users with the best price with minimal slippage. DEX aggregators aim to make it easy for users to compare prices and often layer over other security features and algorithms that help users to optimise their trades.

Why trade on DEX?

Self-custody: we allow you to have complete self-custody of your own trades, so any movement of tokens happens directly on the wallet that the user links to their DEX accounts.

Security: unlike centralized exchanges that might potentially be hacked, all assets traded on DEXs are stored directly in the user's wallet, thereby providing a greater degree of security in token storage.

Privacy: unlike centralized exchanges that require users to pass their identity verification process, users are not required to submit any personal information when they trade on DEX, thereby allowing them to trade almost anonymously.

Potentially lower fees: unlike centralized exchanges that usually charge higher transaction fees for providing value-added service or advanced trading tools, users pay little or even zero platform fees, allowing them to keep more of their profits.

Diversity of options: anyone can mint tokens from blockchains and create a liquidity pool for it on DEX, resulting in a myriad of options for users to choose from.

What are the possible trade-offs of using a DEX?

Riskier tokens: offering a wide range of options and no centralized authority also means that anyone can mint a token. This might give rise to scams such as that of a 'rug pull' in which the creator of a token attempts to attract as many users to purchase the token in the hope of an benefitting from an increase in token price before running away with the money.

Liquidity: as DEXs are reliant on the community to provide liquidity and each liquidity pool consists of separate token pairings, this can result in a lower level of liquidity available per trading pair.

On-ramps and off-ramps: most DEXs don't allow direct fiat-to-crypto exchanges. As such, users are usually inconvenienced as they have to use a separate platform to exchange their local currency for crypto or vice versa.

Less intuitive user interfaces: one of the biggest obstacles to getting started on using DEX is the more complicated user interface that might be confusing to a new user. Additional research might be required on the users' end to compare prices across different DEXs in the search for the most secure trades that provide the optimal price.

Why does a transaction fail?

When there's network congestion, for example, on the Ethereum network, the network fee could rise sharply. When you don't have enough balance to pay such a fee, the transaction may fail.

Some tokens require a certain level of slippage tolerance when being swapped at a DEX to make sure the transaction goes through. For example, if a token requires a slippage tolerance at 3% but you set it at 1% when swapping the token, this transaction may fail.

When the market fluctuates, the level of liquidity will also change. When the total transaction amount is lower than the minimum receiving amount, the contract will stop the transaction, causing it to fail.

When a user submits multiple similar transactions but the balance is only enough for one, all the others submitted after that will fail.

How to speed up a transaction?

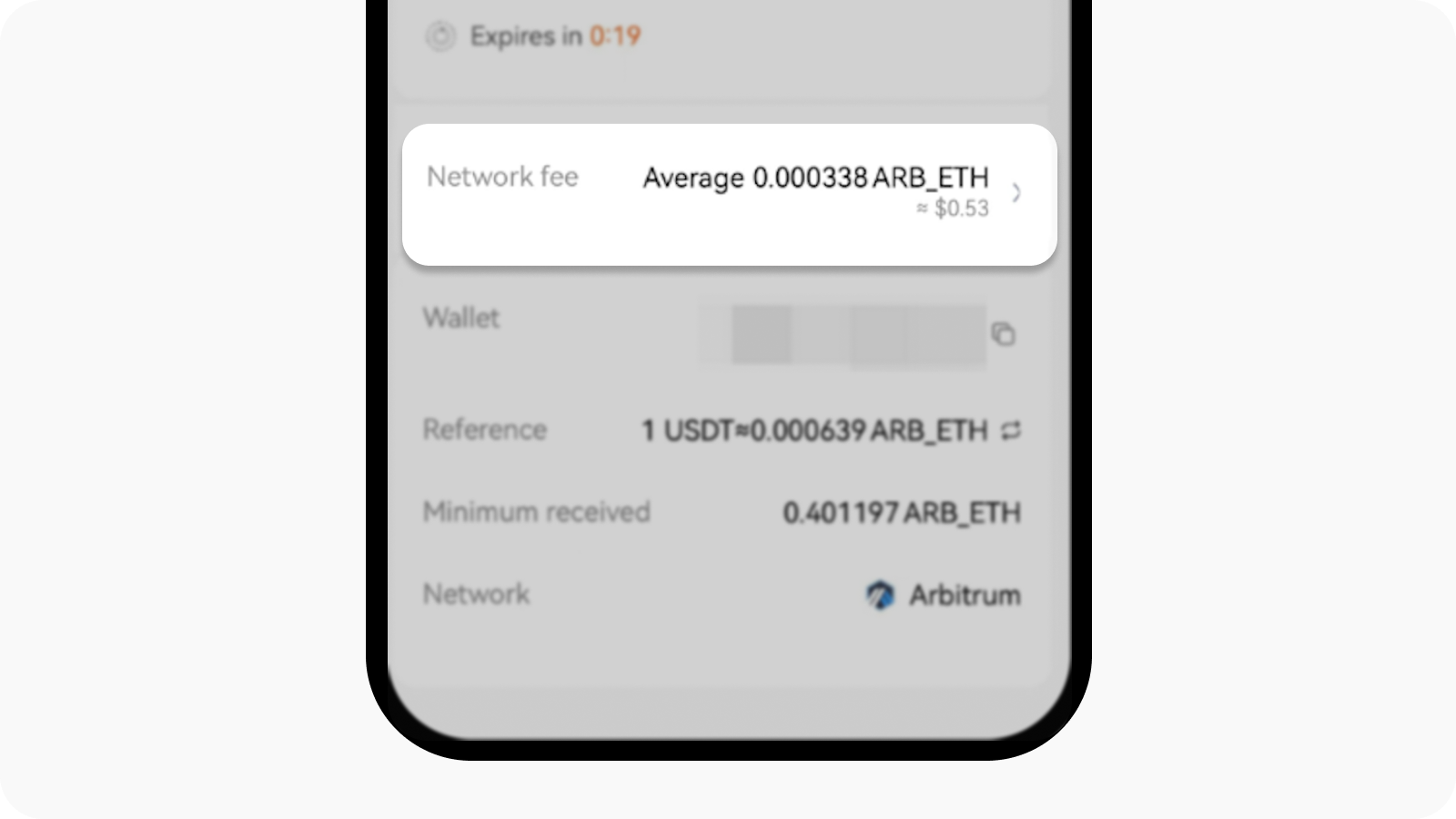

When you initiate a transaction on Ethereum or other EVM networks, your network fee (also known as the gas fee) is for using the network, which is paid to miners or validators who process your transaction. If you choose a lower level of network fee for your transaction, it may take a longer time to process. There's also a possibility of network problem that'll cause your transaction to stuck and make you wait for a long time. At OKX DEX of the OKX Wallet, you can choose how fast you want to have your transaction processed by modifying the network fee for contract interaction from a slower Gwei to an average or fast Gwei. You can also maintain the slow Gwei fee and continue to wait for the network to process the transaction, or reject the contract interaction and wait for the average network fee to drop before proceeding with it.

Select Network fee to set the speed of the process

Do I still need to pay network fees when a transaction fails?

When you send/transfer tokens and interact with contracts, or perform other activities on the blockchains, you must pay network fees to miners or validators for processing the transactions. Miners or validators must compute the network resources consumed during transaction processing. As a result, you're required to pay the fee regardless of whether the transaction succeeds or fails. This fee isn't charged by the wallet, so we can't refund it. Therefore, we don't recommend choosing a low level network fee to save money because it might lead to transaction failure or blockage. If the transaction is blocked, you need to pay another transaction fee to eliminate the blockage, making this an unfavorable trade.

How to check the price of purchased tokens?

Launch the OKX app and switch to OKX Wallet

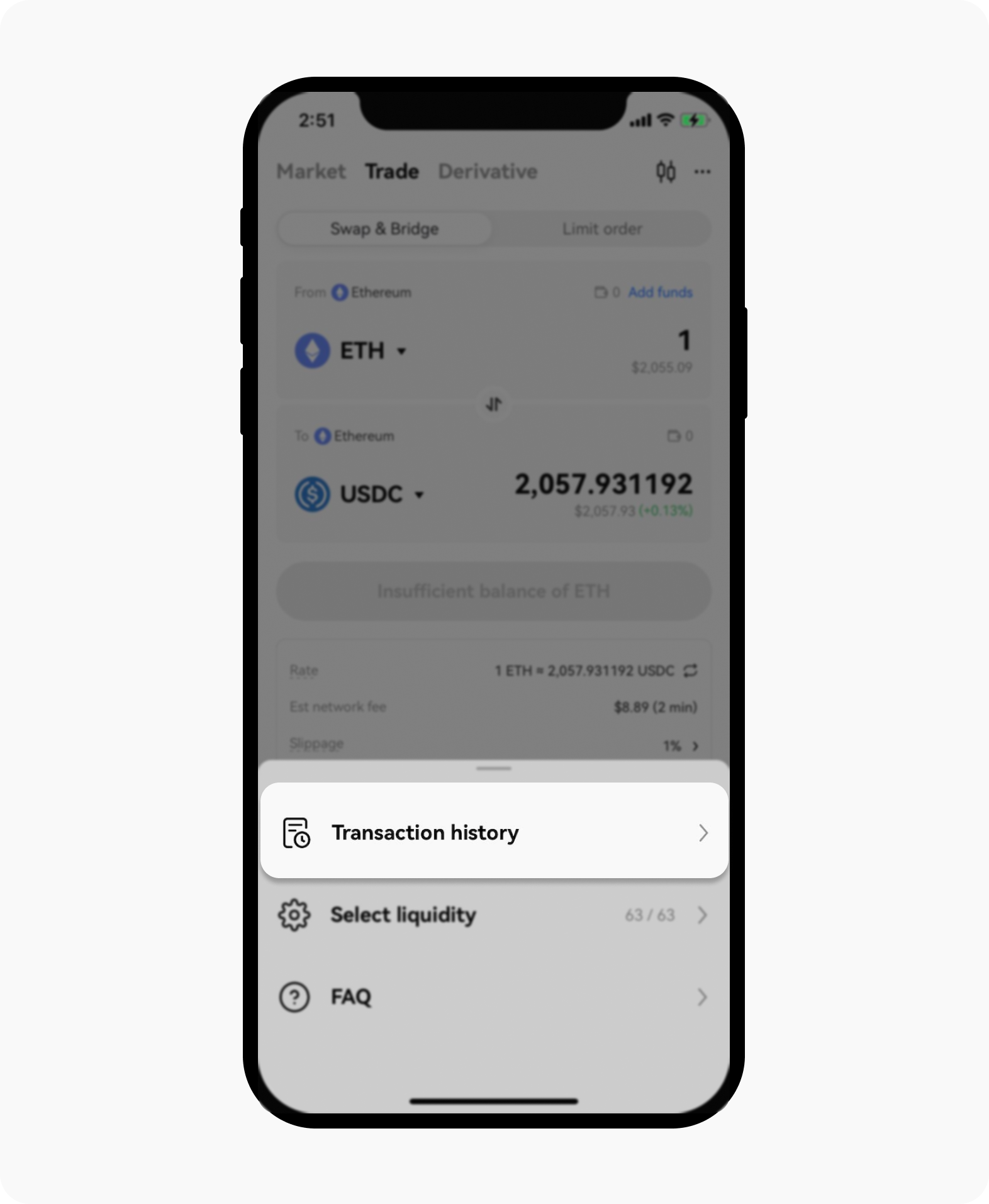

Select Trade, before selecting the three horizontal dots menu to prompt a selection of options

Select Transaction history

Select any of the crypto to enter its details page, for example ETH → WETH, and you'll see that 0.001 ETH was swapped to 0.001 WETH, and the network fee was 0.001746 ETH

Select Transaction history to view the list of purchased tokens and their price

Why is the token price displayed in the wallet inconsistent with the price executed on a transaction?

What's slippage? How does it impact the price?

If a token price is different from the price executed in a transaction, it's likely due to slippage. Slippage is the difference between the expected price of a trade and the price at which the trade is executed. Due to the varying levels of liquidity of each platform, traders often face the risk of losing assets because of the slippage. For example, if you initiate an ETH purchase order on DEX, you expect the transaction to be executed at the selected price. But when the transaction is complete, if the final price is higher or lower than the price you selected when placing the order, it means you've encountered slippage.

Slippage is an implicit cost that is unavoidable for most transactions, especially on DEXs. Slippage is especially prominent in times of market volatility or insufficient liquidity of trading platforms. The more often you experience slippage, the more money you lose.

How to avoid slippage?

Slippage can't be completely avoided, but the losses caused by slippage can be reduced. First, only trade on platforms with good liquidity and well-established infrastructure. Also, it's best to choose assets with high trading volume and high liquidity. In addition to that, instead of placing a large order directly, you can choose to trade in a smaller volume that's easier to close. If your order amount exceeds the existing liquidity, DEX can't execute the transaction. If a large order is split into several small ones, they're more likely to go through as it reduces the chances of insufficient liquidity. Next, set the maximum slippage. When the actual amount you'll receive is smaller than the amount by the maximum slippage setting, the transaction will be canceled to prevent losses. OKX DEX is a one-stop multi-chain and cross-chain aggregation trading platform. Through the X Routing algorithms, OKX DEX automatically calculates the optimal transaction path and splits orders, providing users with the best quotes with lower slippage and lower network costs.

Why do some tokens have higher slippage?

Some tokens require a high slippage, such as SafeMoon, which is used for the buyback of liquidity pool tokens, crypto burning, and for incentivizing token holders. With such tokens, OKX DEX has launched automated slippage to help users improve the success rate of transactions with optimal slippage.

Where does OKX DEX get the prices of tokens?

OKX DEX, with the X Routing algorithms, automatically finds the on-chain liquidity pools with the best depth, intelligently splits orders, and thoroughly calculates quotes, slippage, and network fees, thereby providing the optimal path for transactions.

Find out more about DEX here.