Rules on Managed Trading Sub-accounts

What is a managed trading sub-account

A special sub-account type where investors entrust their sub-accounts to trading teams

It can guarantee the asset safety of investors and the strategic safety of trading teams, and both parties can enjoy a better VIP rate during the binding period

What types of users are suitable for creating managed trading sub-account

Users suitable for creating managed trading sub-account are below:

Investors create multiple managed trading sub-accounts and authorize different trading teams to manage, providing more guarantee on earnings

While managing assets for investors, the trading team can operate different trading strategies and protect the confidentiality of trading strategies

The volume during the binding period is allocated to the trading teams' master account, upgrading VIP level and reducing fee rate, to increase earnings. Please refer to the fee rate table for OKX's fee standards

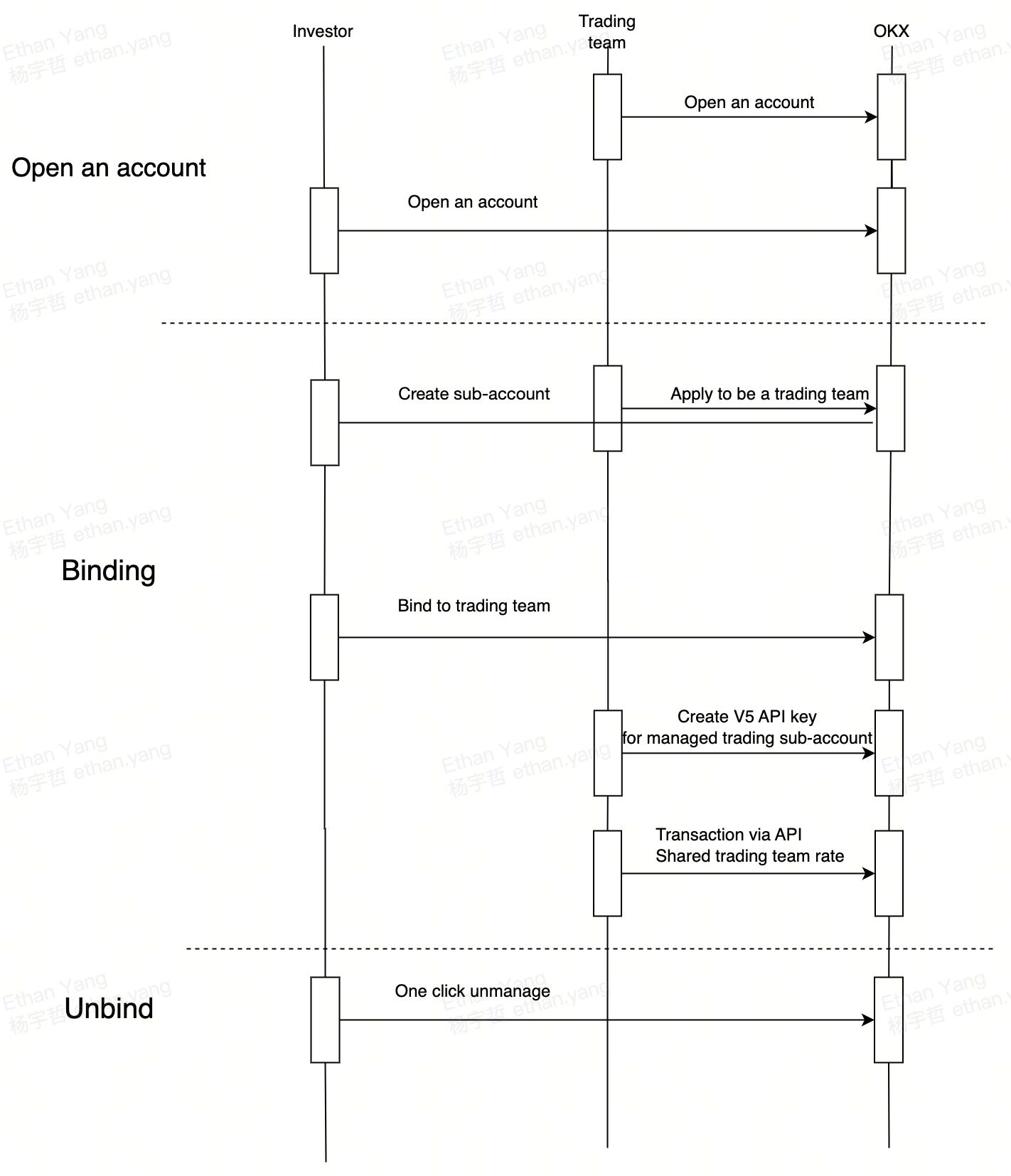

The flow chart of both parties on managed trading sub-account

Investors and trading teams are both required to create accounts in OKX;

Authorisations & functions of both parties on managed trading sub-account

Investor |

Trading team |

|

|---|---|---|

Before Binding |

Investors can create a "managed trading sub-account". As a special sub-account type, API keys can never be viewed or created through this managed trading sub-account The funds in the managed sub-account will not be included in the quantitative team's master account Investors can trade, view positions, pending orders, and order history Investors cannot use the Managed trading sub-accounts setting: Auto-unbinding and Alert notification Investors can bind different trading teams by typing in their UUID to seek out their corresponding information The number of managed trading sub-accounts created by investors shall be consistent with the number of conventional sub-accounts, which shall be limited by VIP level |

First, you need to apply to become a trading team. If you need to apply, please contact the corresponding business development manager to apply The number of sub-accounts managed by trading teams is subject to the regulations of key accounts and is irrelevant to the VIP level |

Binding |

A managed trading sub-account can only be bound to 1 trading team once. If unbinded, it cannot be bound to other trading teams. Investors can log in to sub-accounts, but they do not have permission to view and create API keys Investors can make in-and-out transfers on the assets under managed trading sub-account via their master account, but for the sake of normal implementation of trading teams' strategies, please inform the teams in advance In order to ensure the security of the trading team's strategies, trading is not allowed during the binding period. Whether investors can view positions, pending orders, and historical records depends on the trading team's trading history viewing permission settings The volume generated during the binding period is allocated to trading teams' master account Managed trading sub-account Fee Rate = Minimum [ Fee Rate from Trading team Account, Fee Rate from Investor's Master Account ]. Managed trading sub-account can enjoy taker fees from master accounts without any limits. While for maker fees, when managed trading sub-accounts inherit from the trading team's fee rate, the lowest fee they can enjoy is 0 Once the account is bound, fee rate and account level will be updated on T+1 day for managed trading sub-account In order to ensure the safety of investors' assets, investors can unbind with one click. After unbinding, the trading team will receive an email reminder Trading history: By Default it's set not visible Confirmed by both investor and the trading team, the trading team can set the trading history viewing permission of the managed trading sub-account. If the trading team agrees, investors will be permitted to view trading history Includes: current/historical orders, current/historical positions, assets, strategies Auto-unbinding and Alert notification: When the total equity value of the sub-account or the asset fluctuation of any currency-based balance reaches the unbinding set value, it will trigger automatic unbinding and unbinding emails. Please set the unbinding value carefully; you will receive an alert email if you are alerted. Total equity of sub-account: Alert threshold: When the total equity is lower than the set value, the alert email will be triggered immediately (every 24 hours), and you can choose not to accept the email Unbinding threshold: When the total equity is lower than the set value, the unbinding email will be triggered immediately, and it will automatically unbind Balance of Crypto-margined: You can set up to three cryptos, or you can not set the warning and unbind of a single crypto Alert threshold: When a single crypto asset is lower than the set value, the alert email will be triggered immediately (every 24h), and you can choose not to accept the email Unbinding threshold: When a single crypto asset is lower than the set value, the unbinding email will be triggered immediately and it will automatically unbind |

After successful binding, you can create API keys for investors on the page and trade for investors through API The trading type is made as set by the investor. If it needs to be changed, please contact the relevant investor Trading teams guarantee strategic safety. During the binding period, investors can not trade The volume generated during the binding period is allocated to trading teams' master account, the level will be upgraded according to the trading volume Investors can unbind it with one click, and relevant trading teams will receive emails as a reminder of unbinding After negotiation between the investor and the trading team, the trading team can set the trading history viewing permission of the managed trading sub-account The trading team cannot use the managed trading sub-account settings, but can view the settings of specific investors: Auto-binding and Alert notification The trading team will also receive the alerts and auto-bundling emails set by investors |

Unbinding |

Restore operation permissions. You can log in, trade, view / operate assets, and the transaction volume generated after unbinding is collected into the investor's master account Trading history viewing permission: Before unbinding, the trading history set by the trading team is visible seen: you can view current/historical orders, current/historical positions, and strategies Before unbinding, the trading history set by the trading team is not visible: only the current orders and current positions can be viewed, and these positions can be operated Investors cannot use the Managed trading sub-accounts setting again: Auto-binding and Alert notification If investors need to bind trading teams again, please create another managed sub account for binding |

When the sub-account is unbound, the API keys created by trading teams will be invalid, and investors cannot view them When the sub-account is unbound, investors cannot view historical trading records When the sub-account is unbound, the number of bindable sub-accounts is released, which means one off from the sub-accounts bound to trading teams |