零基础学K线 | 14 逃顶形态——圆弧顶

涨跌有趋势,读懂价格语言;

买卖有信号,告别感觉交易。

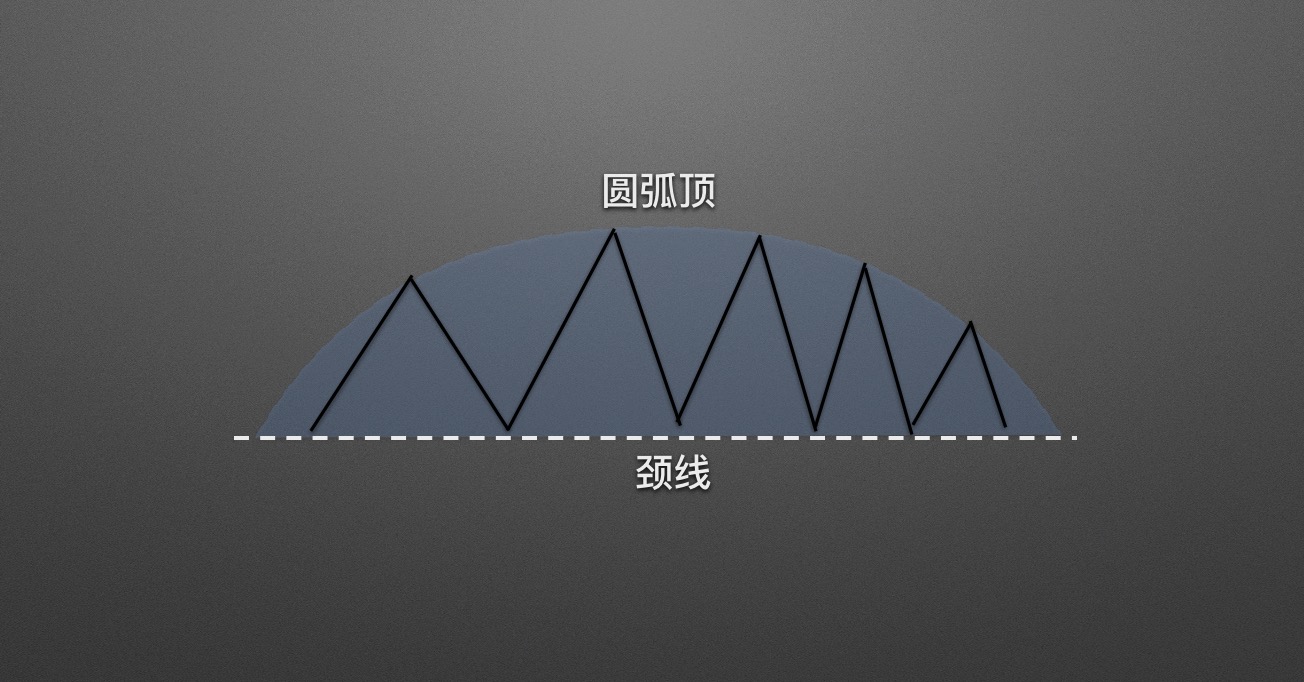

本节为大家讲解一种和圆弧底对立的顶部形态,圆弧顶。首先来看一下圆弧顶是什么样子的。

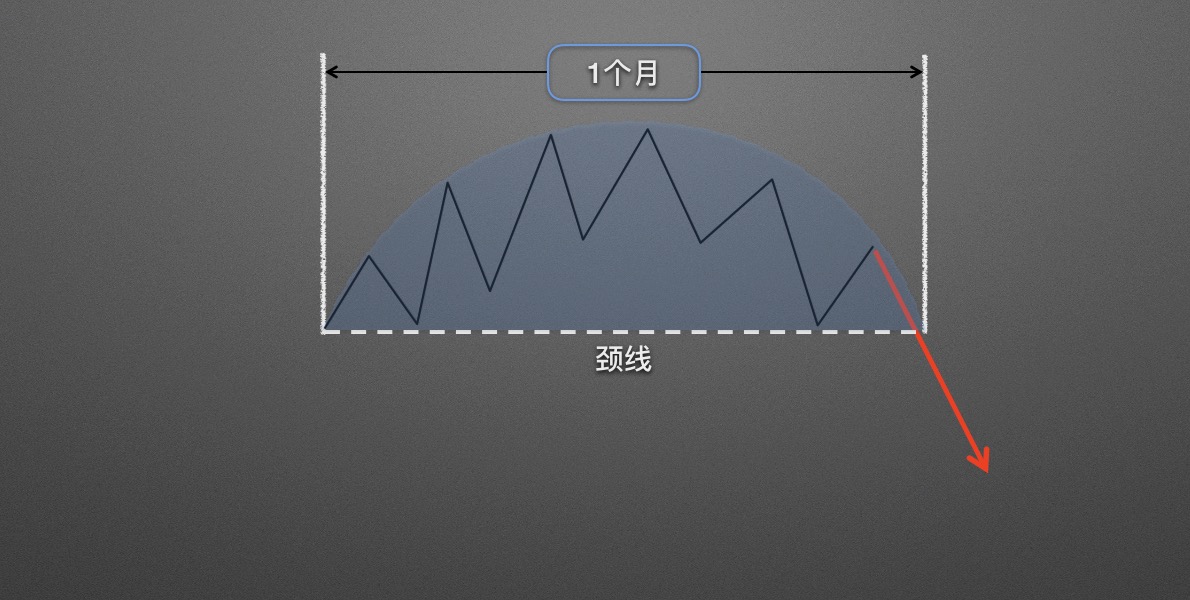

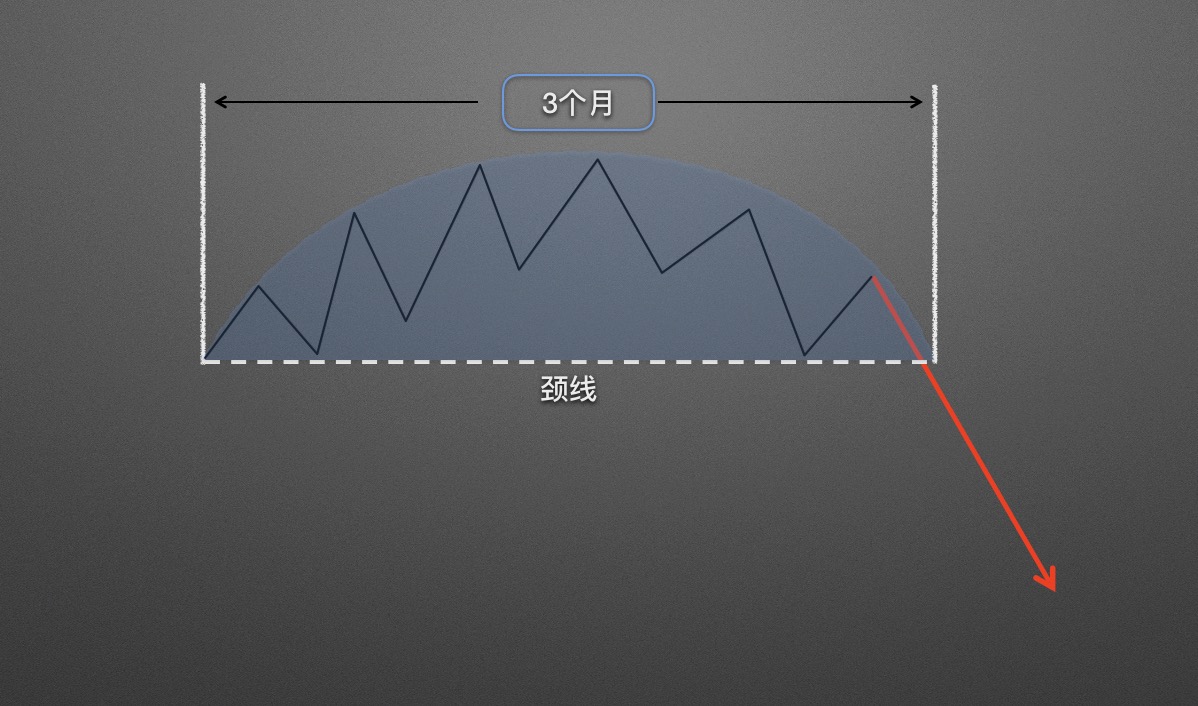

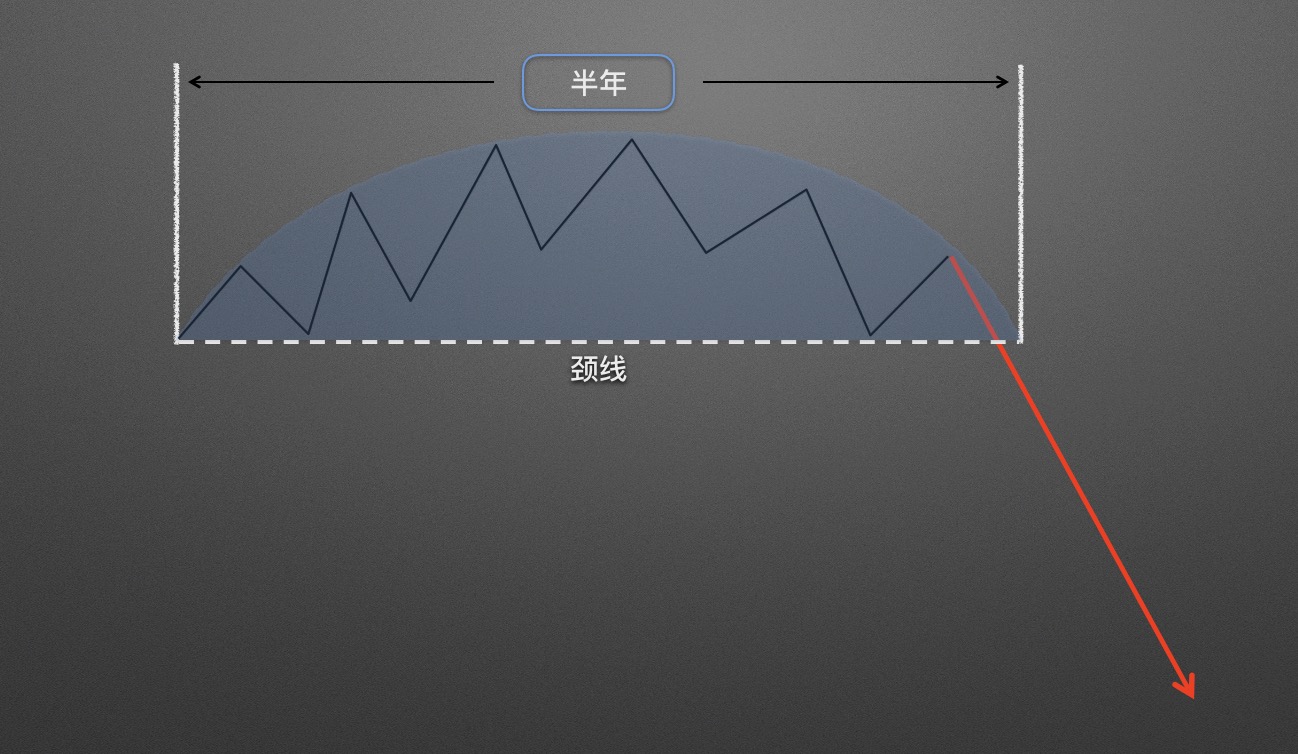

如图所示,在一段整体向上的走势中上涨势头明显放缓,并且将其高点连接后大致呈现半圆形。这种图形称之为圆弧顶。

将这个形态简化图拉出,画一条穿过低点最多的水平直线,称之为颈线。颈线在多种形态中都有出现,是非常重要的参考线。

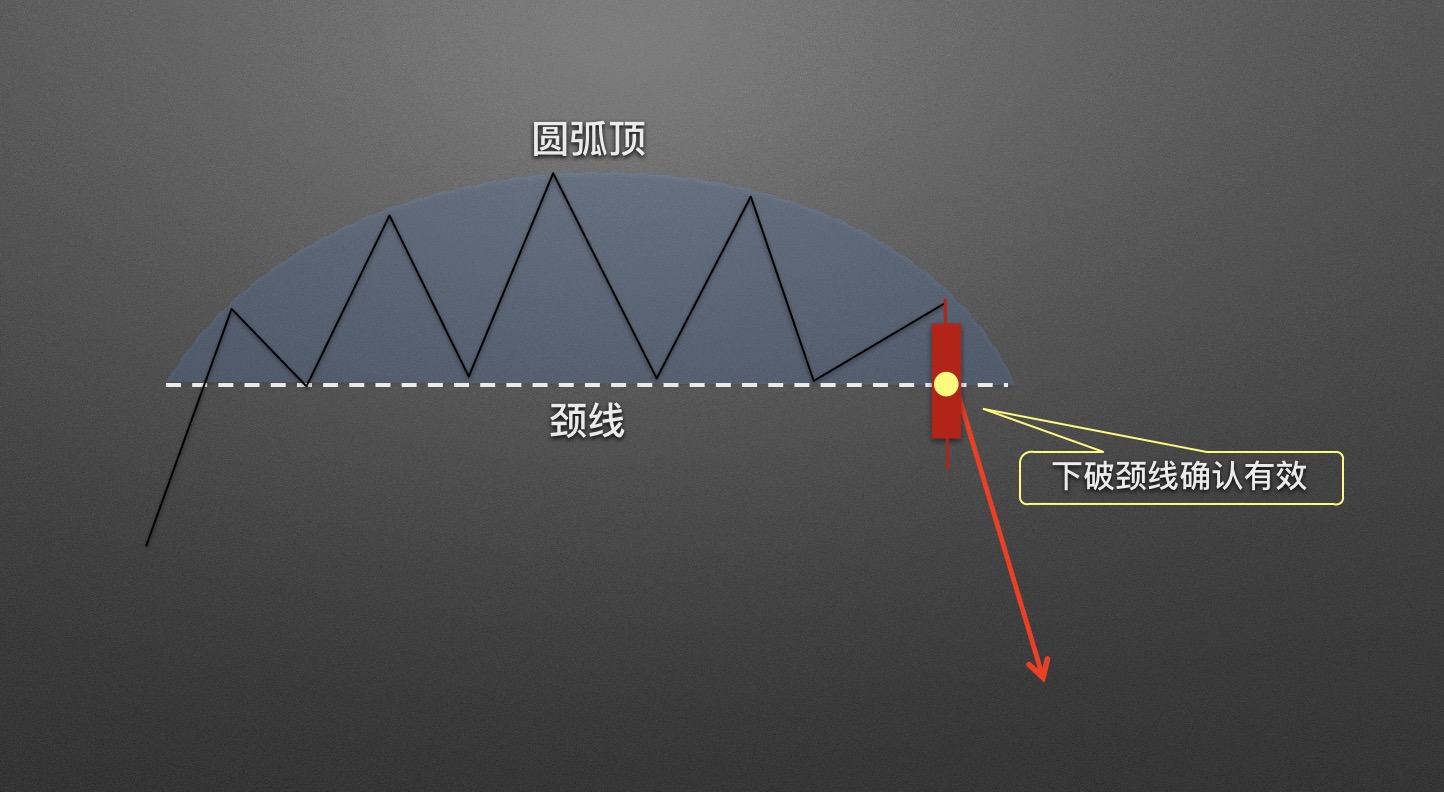

不是所有弧度向上的圆弧形态都是圆弧顶,如何确认圆弧顶是否成立呢?

如图所示:当某根K线收盘后,实体压过颈线,才可以认为圆弧顶形态成立。

根据圆弧顶出现的位置不同,我们将其分为两类。

1)上涨初始阶段的圆弧顶,形态构筑的时间相对较长。

2)下跌途中的圆弧顶,形态持续的时间明显缩短。

圆弧顶形态大家已经有了初步的认识,那么它在实战操作中应该如何运用。

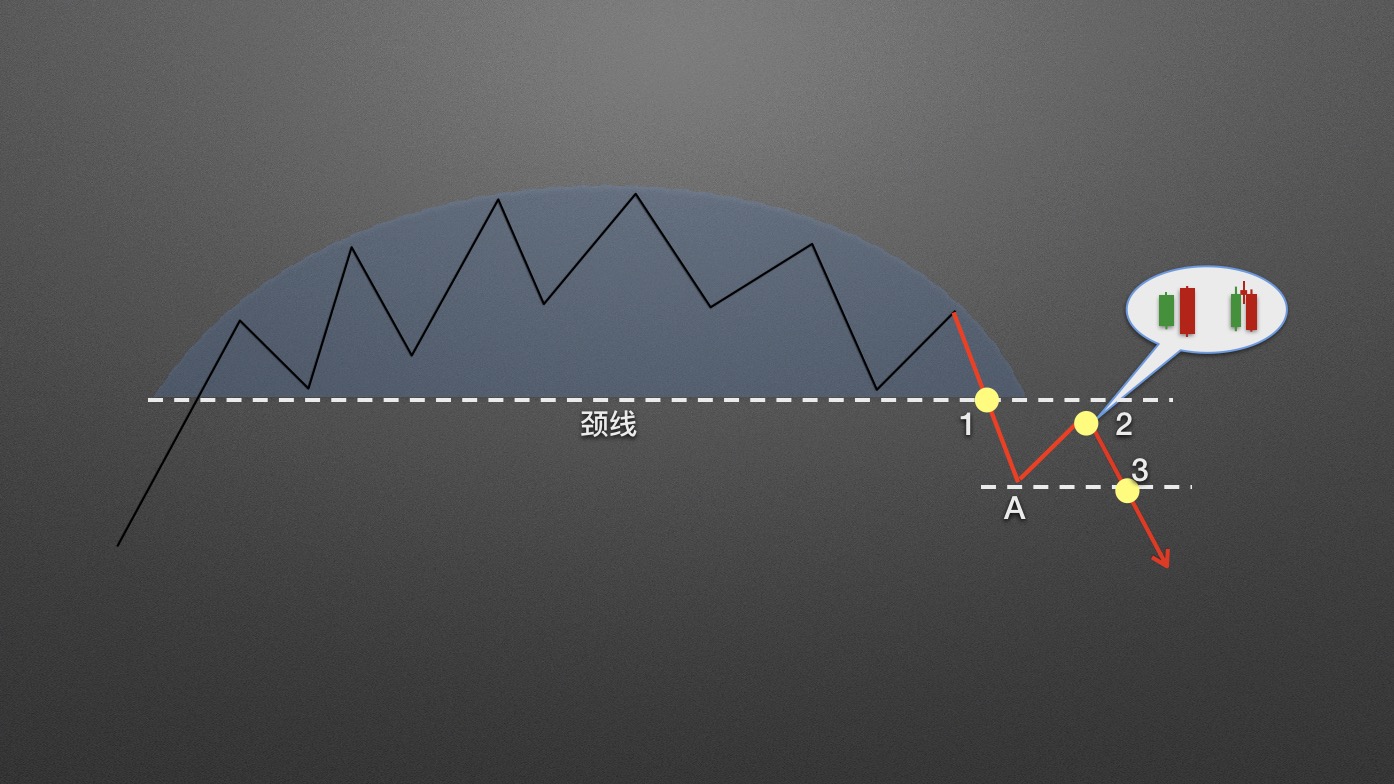

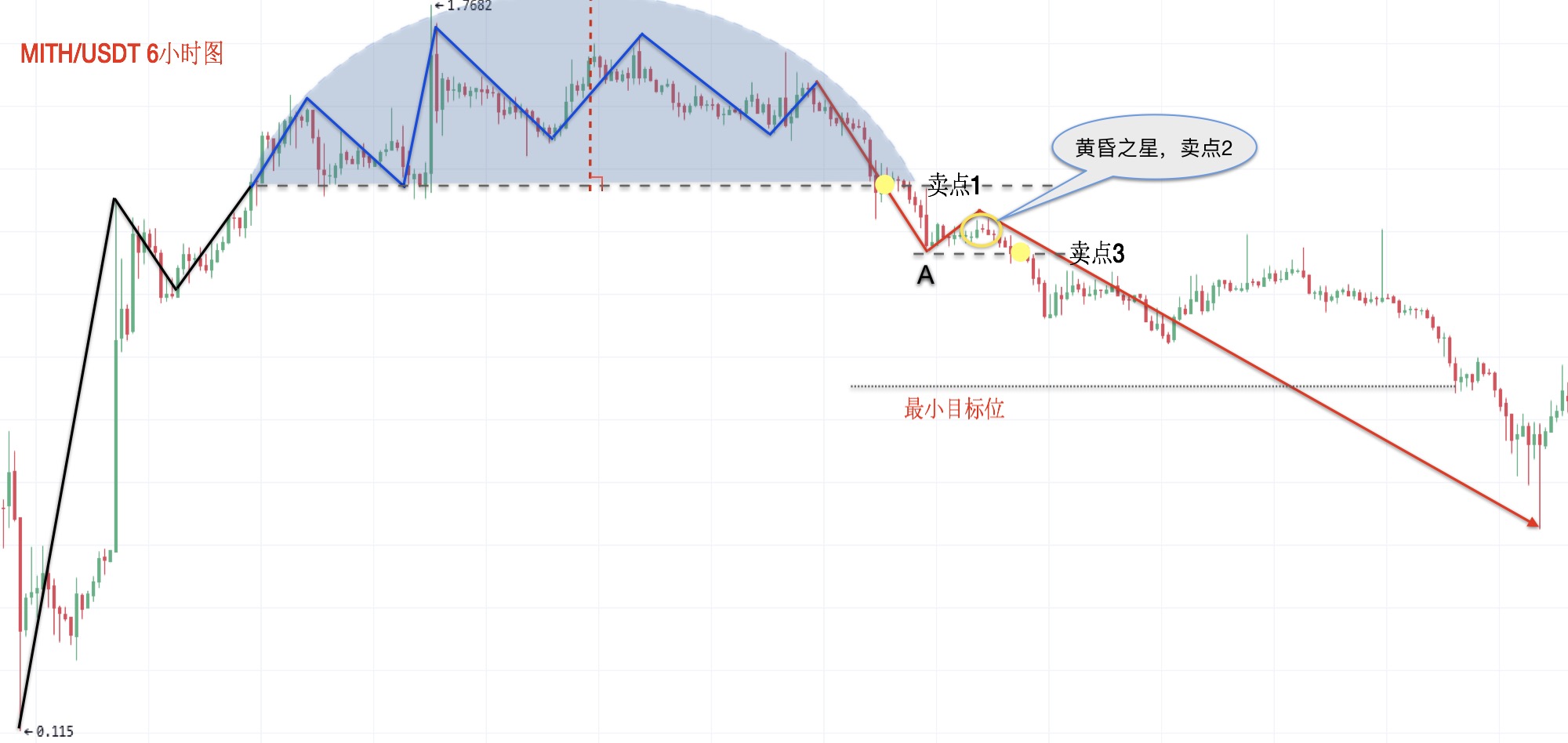

当币价向下穿越颈线后,第一类卖点产生,这类卖点相对比较激进,成功率也相对较低。

当币价跌破颈线形成反抽,出现下跌吞没、黄昏之星等看空信号时,第二类卖点产生,这类卖点属于稳健型卖点,成功率明显提高。

当币价再次向下运行并跌破A点时,第三类卖点产生。多数情况下以第三类买点出现后介入最为安全。

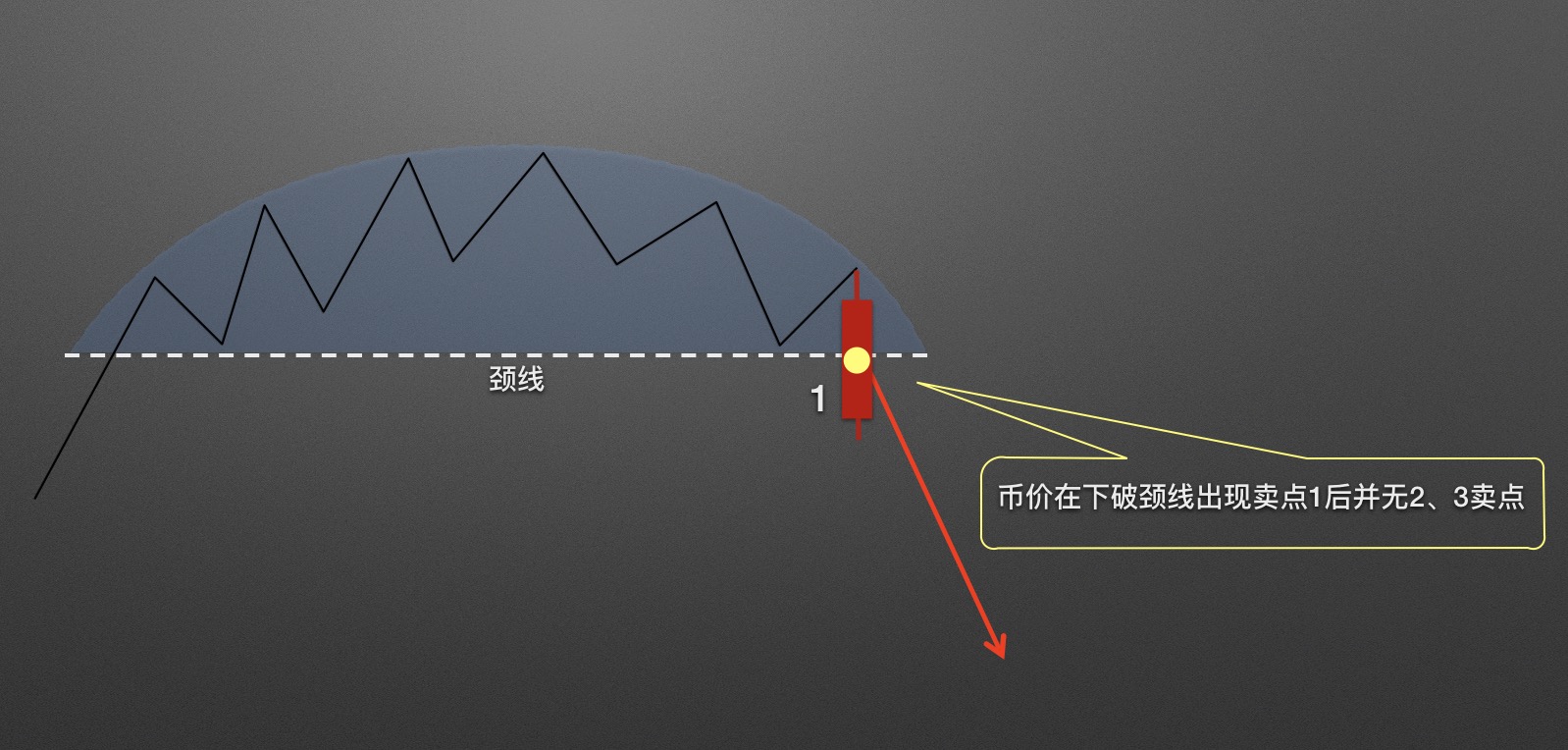

并不是每一个圆弧顶形成后都会出现三个卖点,在极度弱势的市场中极大可能只出现一个卖点。在这种情况下币价通常以一根有力的大阴线下破颈线,随后币价便一路下跌。

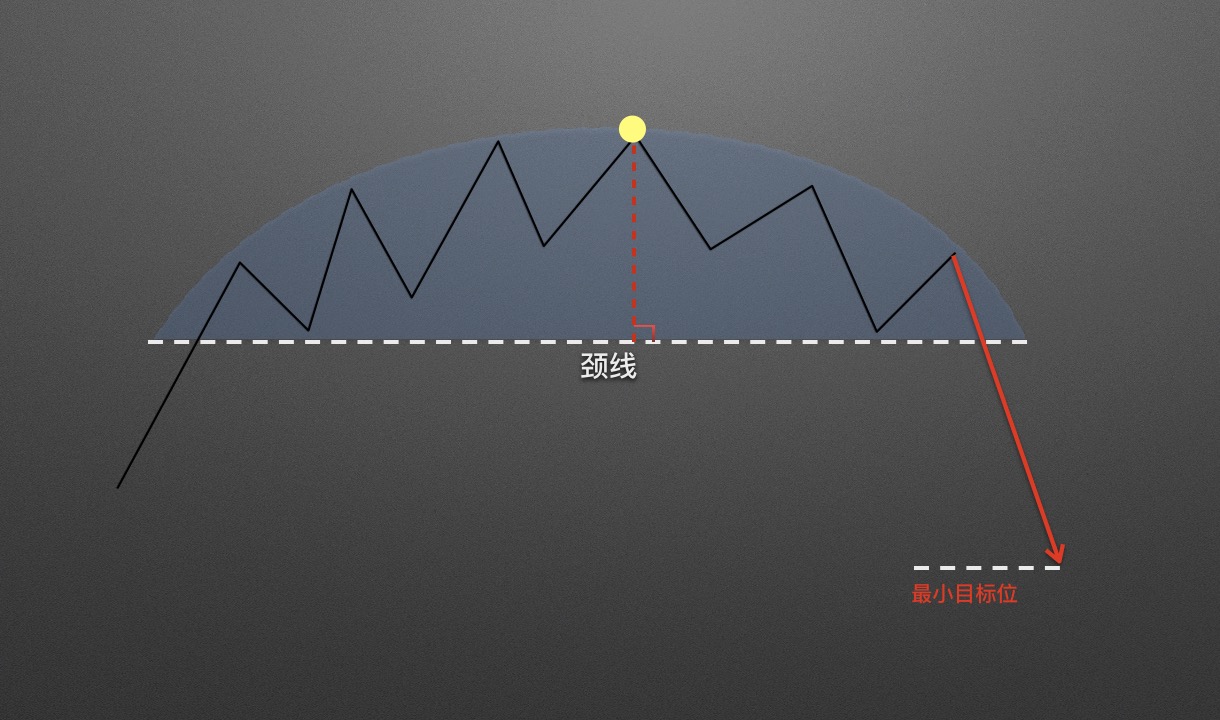

下跌已经确认,如何预测下跌深度呢?

预判圆弧顶最小目标位的方法很简单。穿过圆弧的价格高点向颈线做垂线段,将线段移动至颈线之下,获得最小目标位。

我们还可以通过圆弧顶的形成周期,粗略地预测未来币价下跌幅度。

多数情况下,圆弧顶跨越的时间越长,后期潜在跌幅就越大。

下面来看三组圆弧底实际案例。

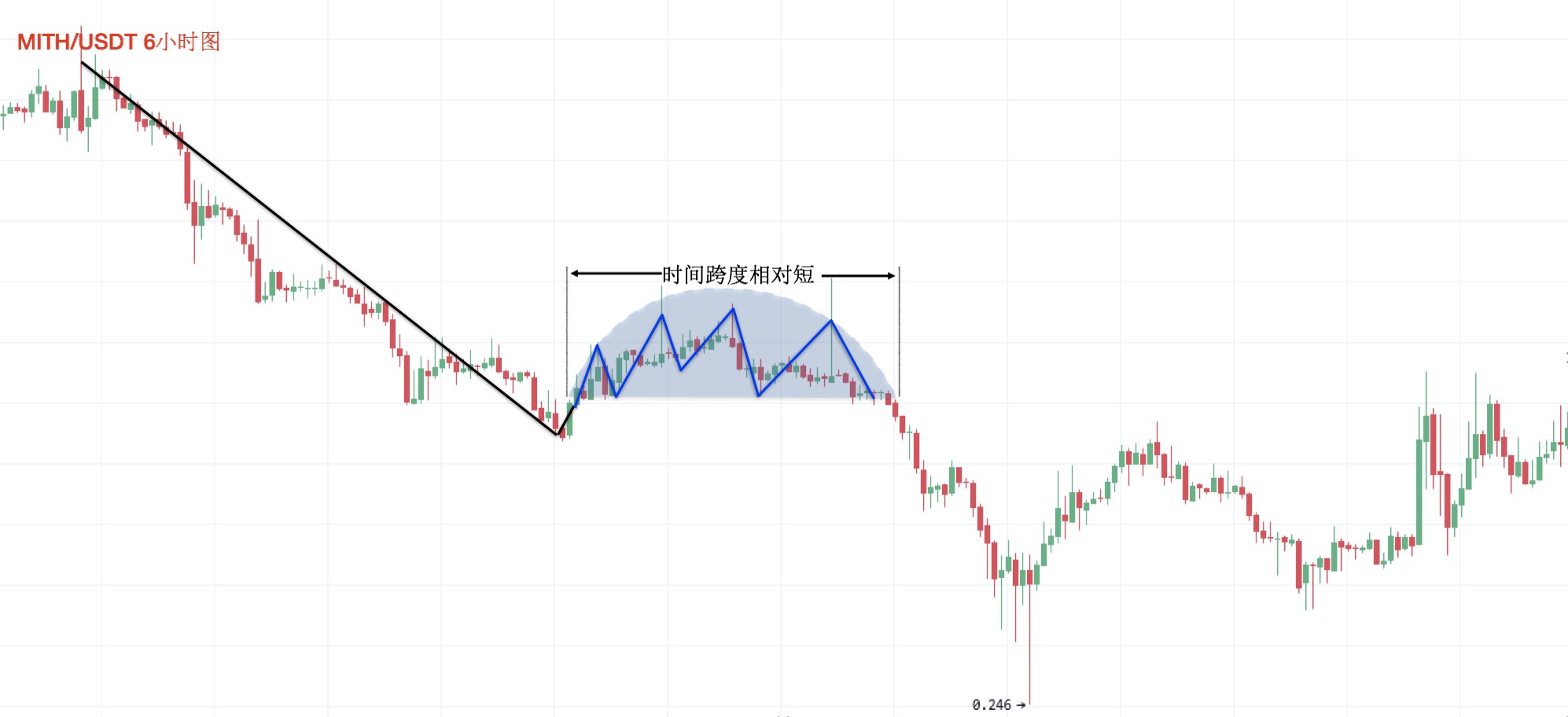

案例一:截图来自欧易 MITH/USDT 6小时图,在经过一段下跌走势后币价形成圆弧顶,时间跨度比较短。在该形态中,只出现了一个卖点,随后币价出现大幅下搓,并快速跌超最小目标位。

案例二:截图来自欧易 MITH/USDT 6小时图,币价在经过一段快速上涨后形成圆弧顶,并出现比较标准的三类卖点,而后币价持续回落,超越最小目标位。

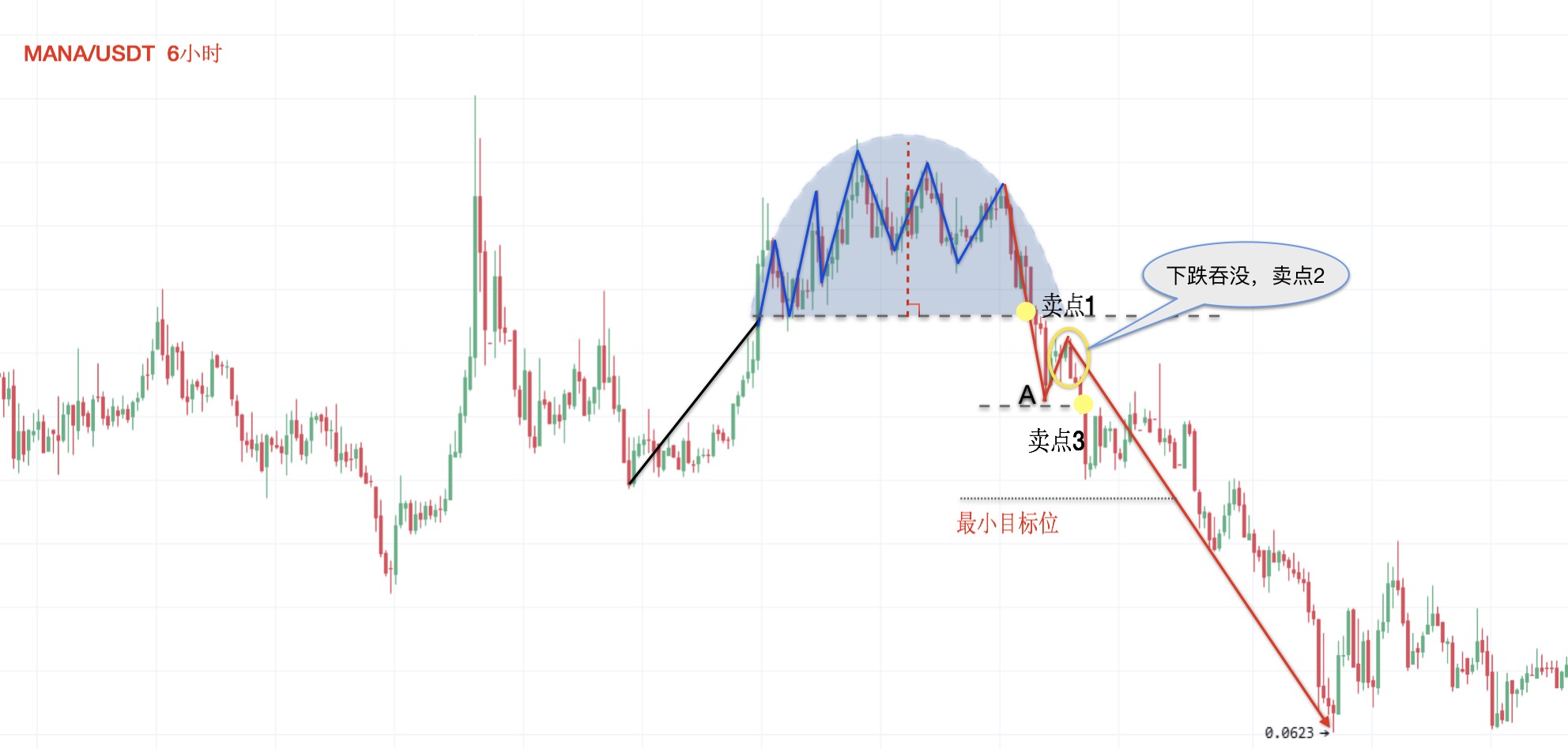

案例三:截图来自欧易 MANA/USDT 6小时图 币价在经过一段小幅上涨后形成圆弧顶,依次出现三类卖点,且最终下跌深度超过最小目标位。

就像圆弧底不是每次都能成功一样,圆弧顶也有失败的时候。什么情况出现后圆弧顶形态会失败呢?

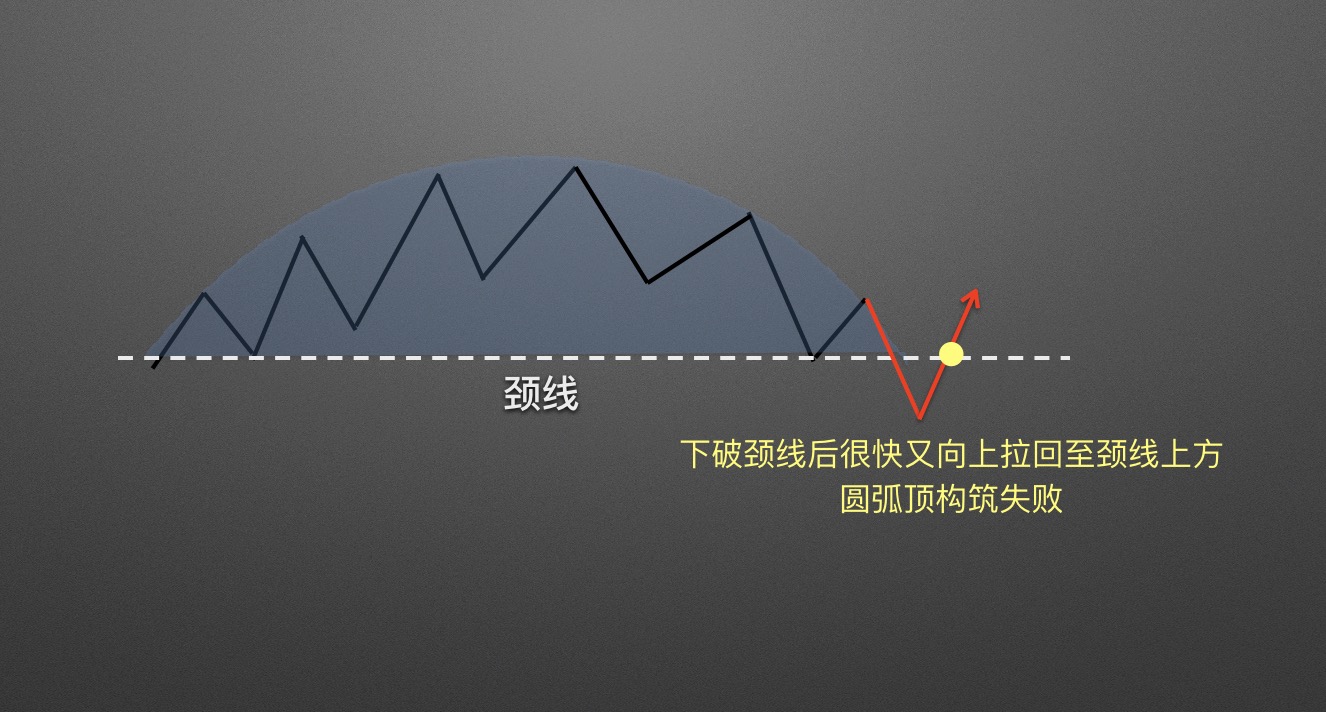

第一种情况,币价在下破圆弧顶颈线不久便再次回升至颈线上方,下破颈线失败,圆弧顶构筑失败,出现这种情况应该把卖出的筹码再买回来。

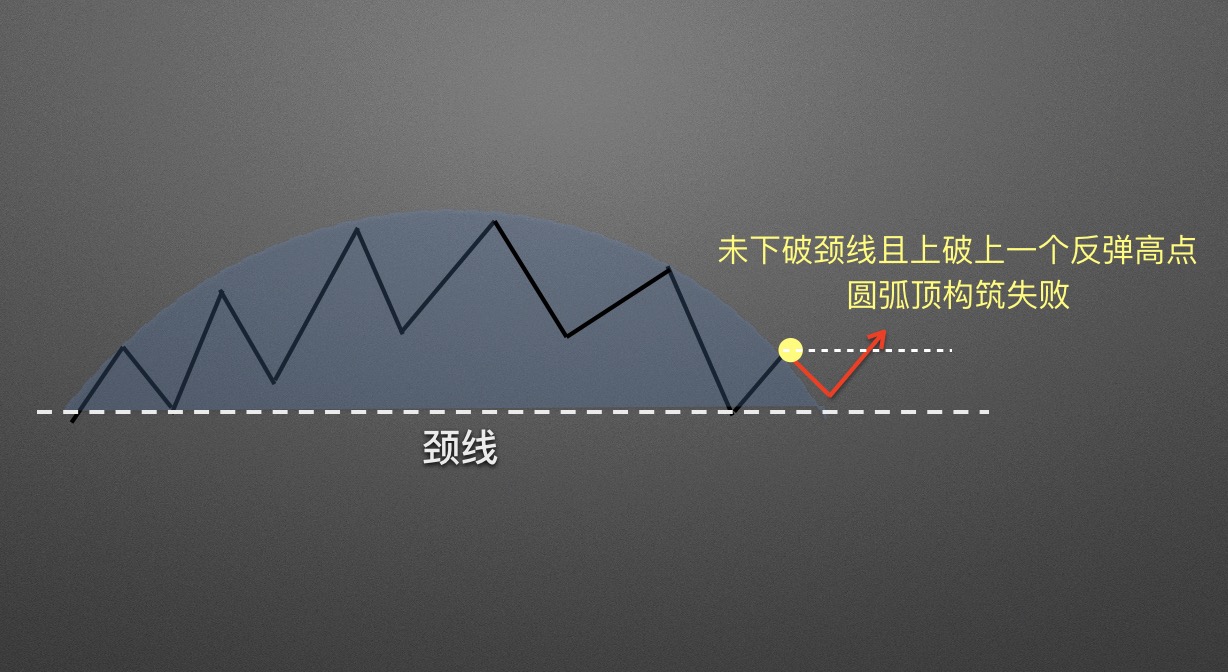

第二种情况,圆弧顶形态形成后币价并没有下破颈线,并且回升上破临近反弹高点,此时圆弧顶构筑失败。

圆弧顶失败案例展示:

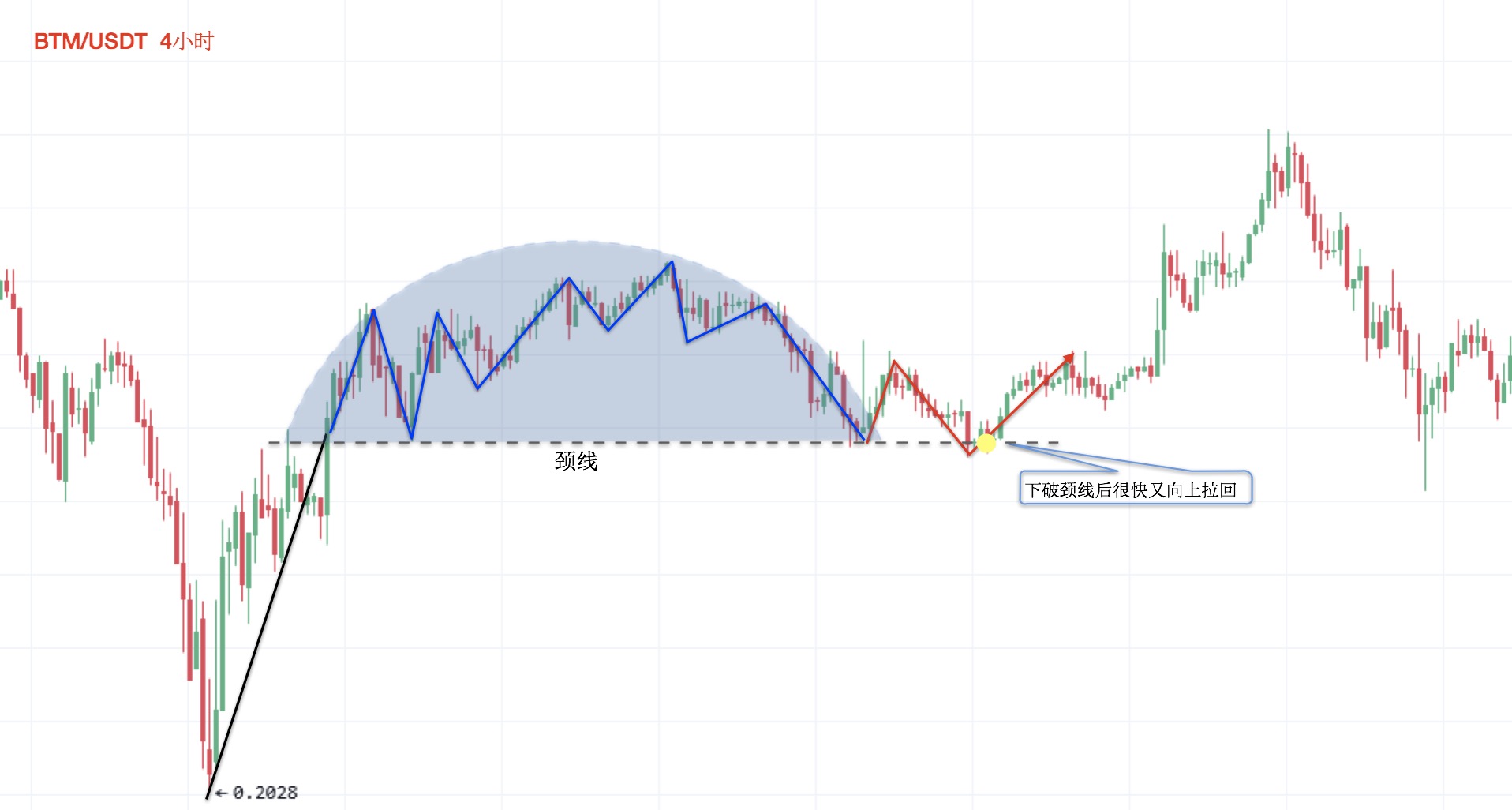

图一,币价下破颈线失败,圆弧顶形态失效,价格形成上涨。

图二,币价形成圆弧形,但迟迟未能跌破颈线,最终上破临近反弹高点,圆弧顶失效。

逃顶形态的内容就介绍到这里,下期课程我们将分享“庄家布局形态”。

© 2025 OKX。 本文可以全文复制或分发,或使用不超过 100 字的摘录,前提是此类使用仅限非商业用途。对全文的复制或分发必须明确注明:“本文版权所有 © 2025 OKX,经许可使用。” 允许的摘录必须标明文章标题并注明出处,例如“文章标题,作者姓名 (如适用) ,© 2025 OKX”。不允许对本文进行任何衍生作品或其他用途。

相关信息:数字资产交易服务由 OKX Australia Pty Ltd (ABN 22 636 269 040) 提供;关于衍生品和杠杆交易的信息由 OKX Australia Financial Pty Ltd (ABN 14 145 724 509,AFSL 379035) 提供,仅适用于《2001年公司法》(Cth) 下定义的大额客户;其他产品和服务由提供这些产品和服务的相关 OKX 实体提供 (请参阅服务条款)。

本文所含信息仅为一般性信息,不应视为投资建议、个人推荐或购买任何加密货币或相关产品的要约或招揽。在做出决策前,您应自行进行研究并寻求专业建议,确保理解相关产品的风险。过去的表现并不代表未来的结果,切勿承担超过您能够承受的损失风险。如需了解更多信息,请阅读我们的服务条款和风险披露和免责声明。

本内容翻译与英文版本不一致时,以英文版本为准。