Trading Signal Bot FAQs

Welcome to the OKX Signal Bot Frequently Asked Questions Section. Here, you can find answers to some of the most commonly asked questions about the Signal Bot feature to help you better understand OKX's Signal Bot:

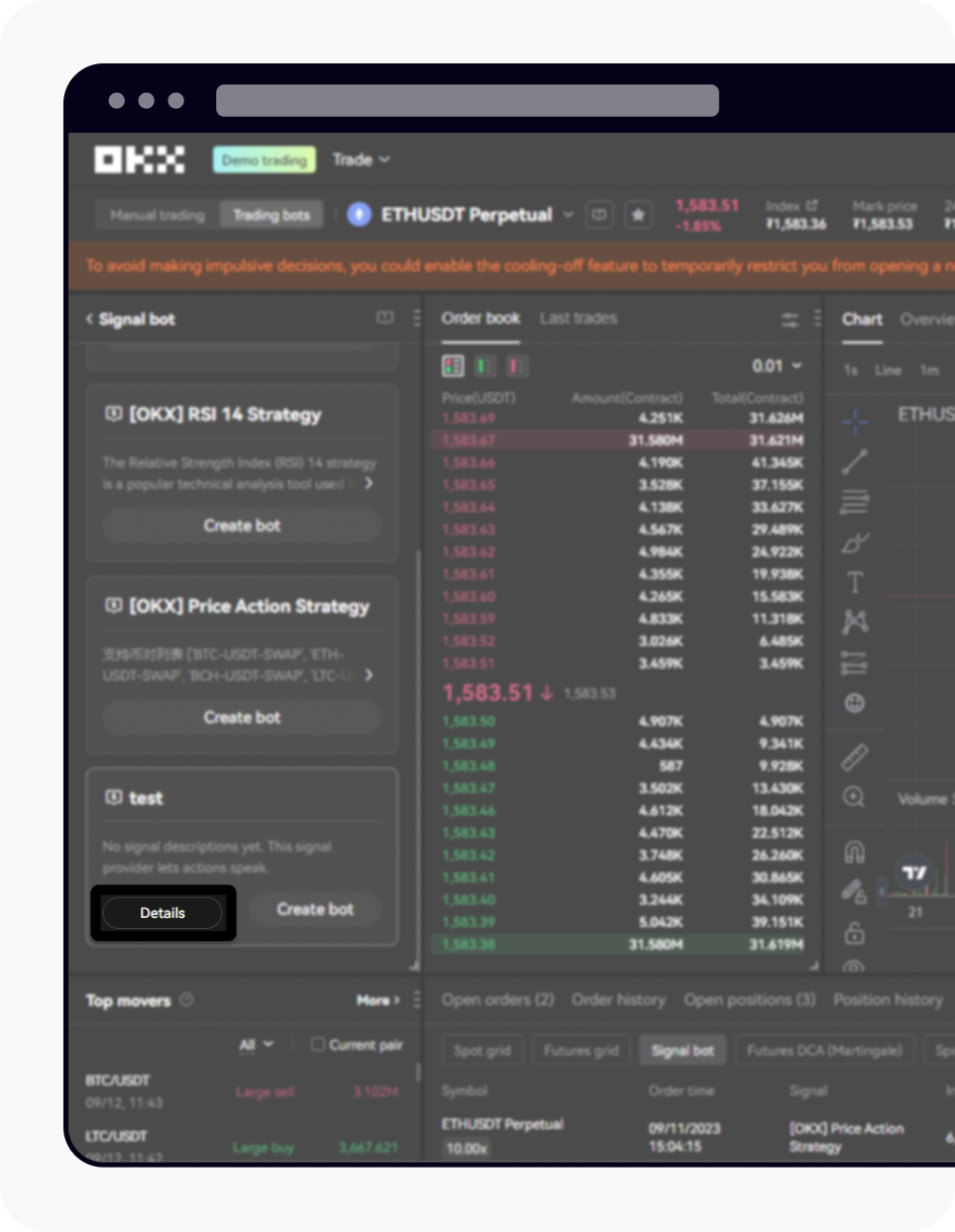

1. How do I access the Signal Bot in Demo Trading?

Demo Trading allows OKX users to trade in a simulated environment that mimics real-world market conditions. This enables traders to try out their strategies, gain insights into the markets, and refine their decision-making abilities without any risk of incurring losses.

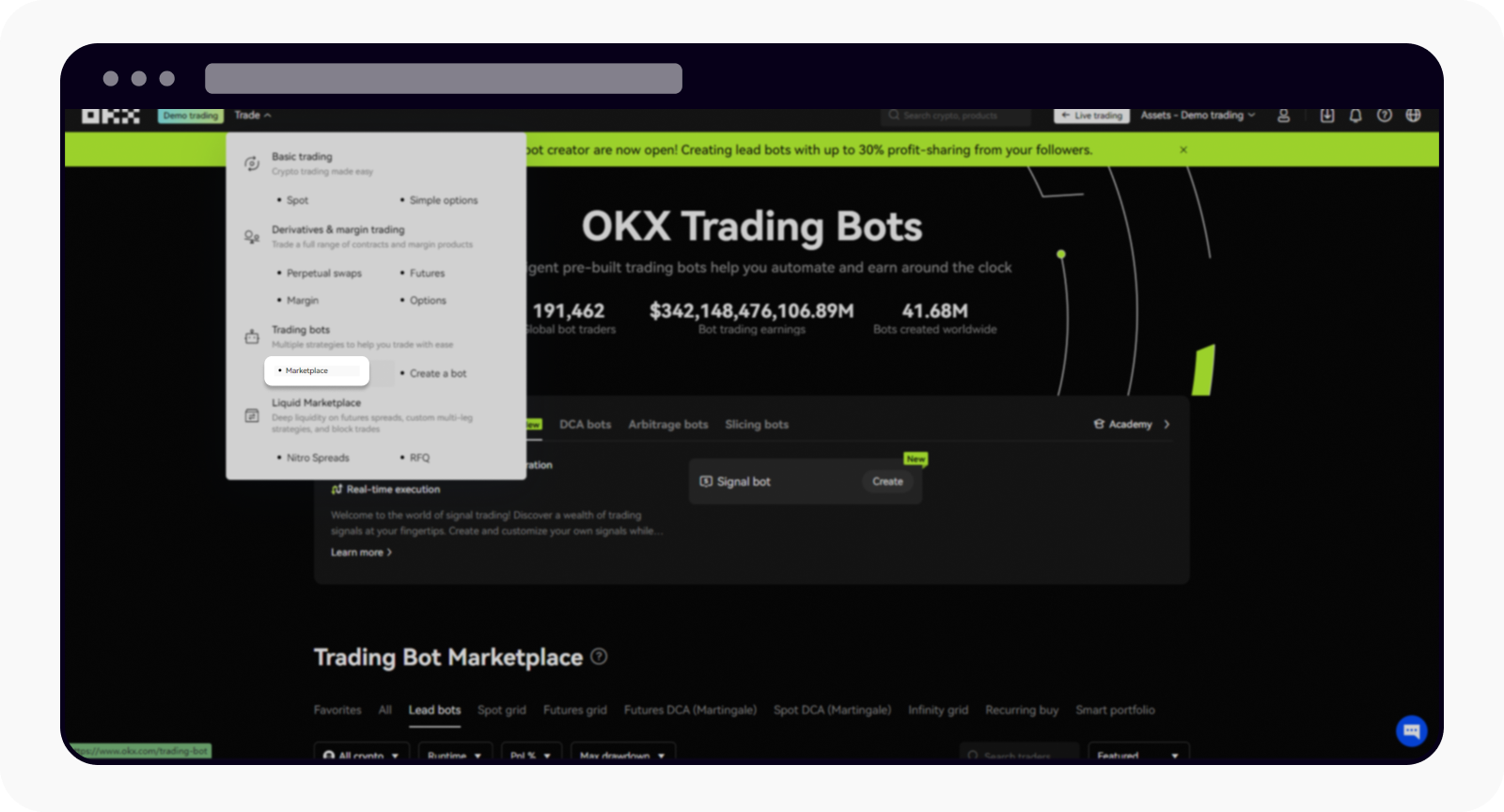

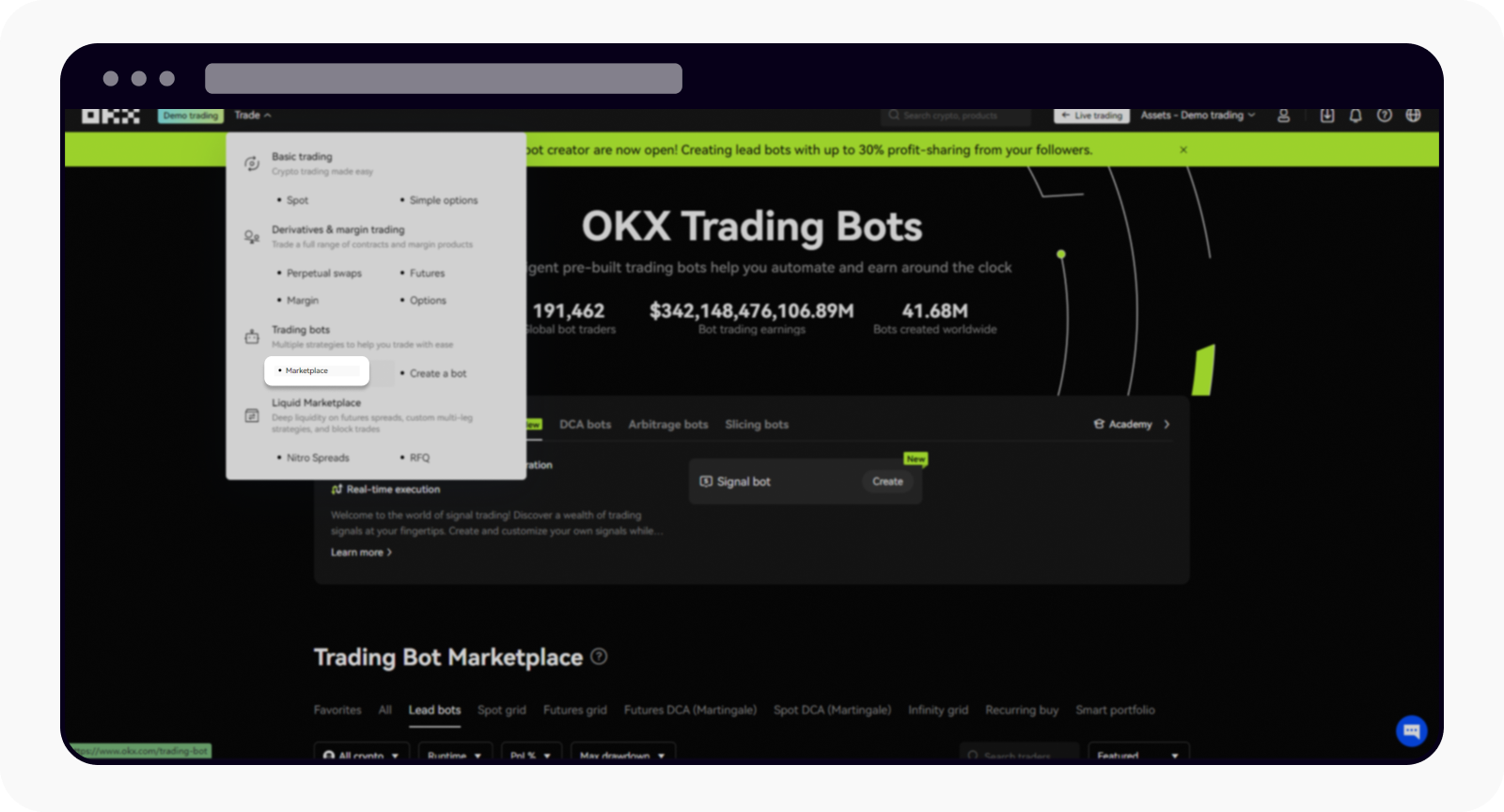

Login to your OKX account > Trade > Demo trading

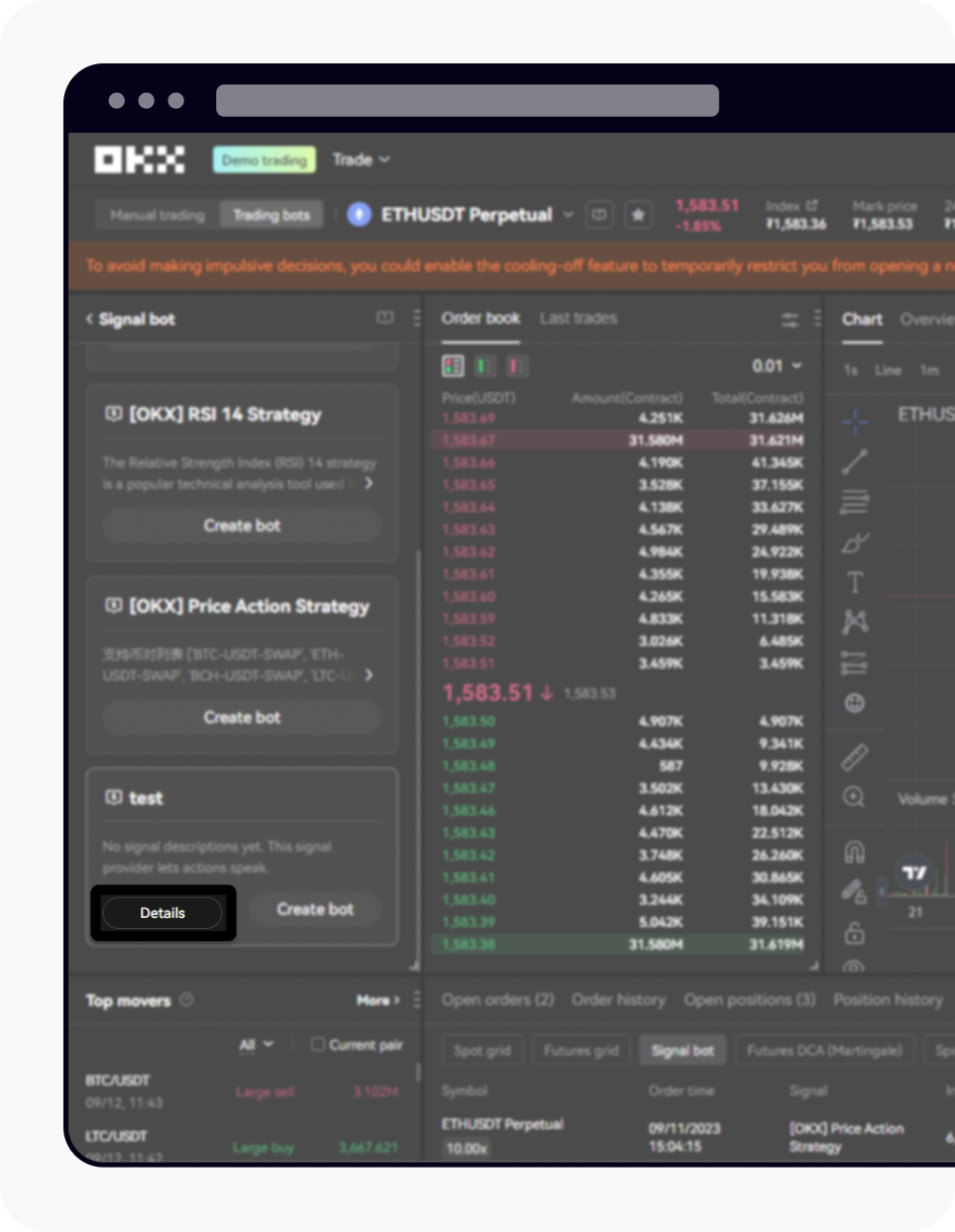

On the Demo Trading page, select Trade > Trading bots > Marketplace

Open Marketplace in Demo trading

Go to Signal bot and Create

2. How do I diagnose why my signals are not working as expected?

If you're facing issues with your signals not working as expected, you can follow these steps to diagnose and troubleshoot the problem:

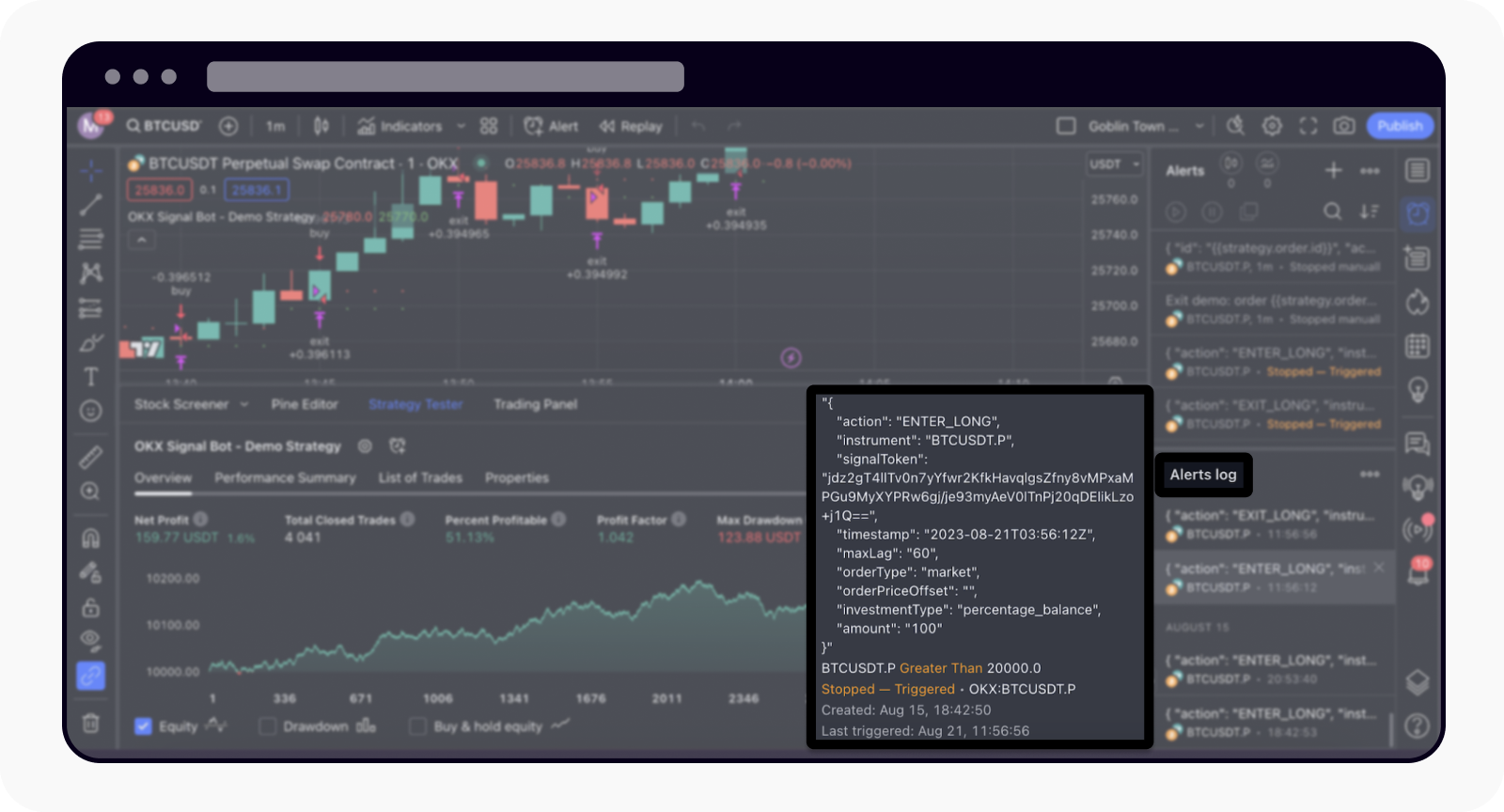

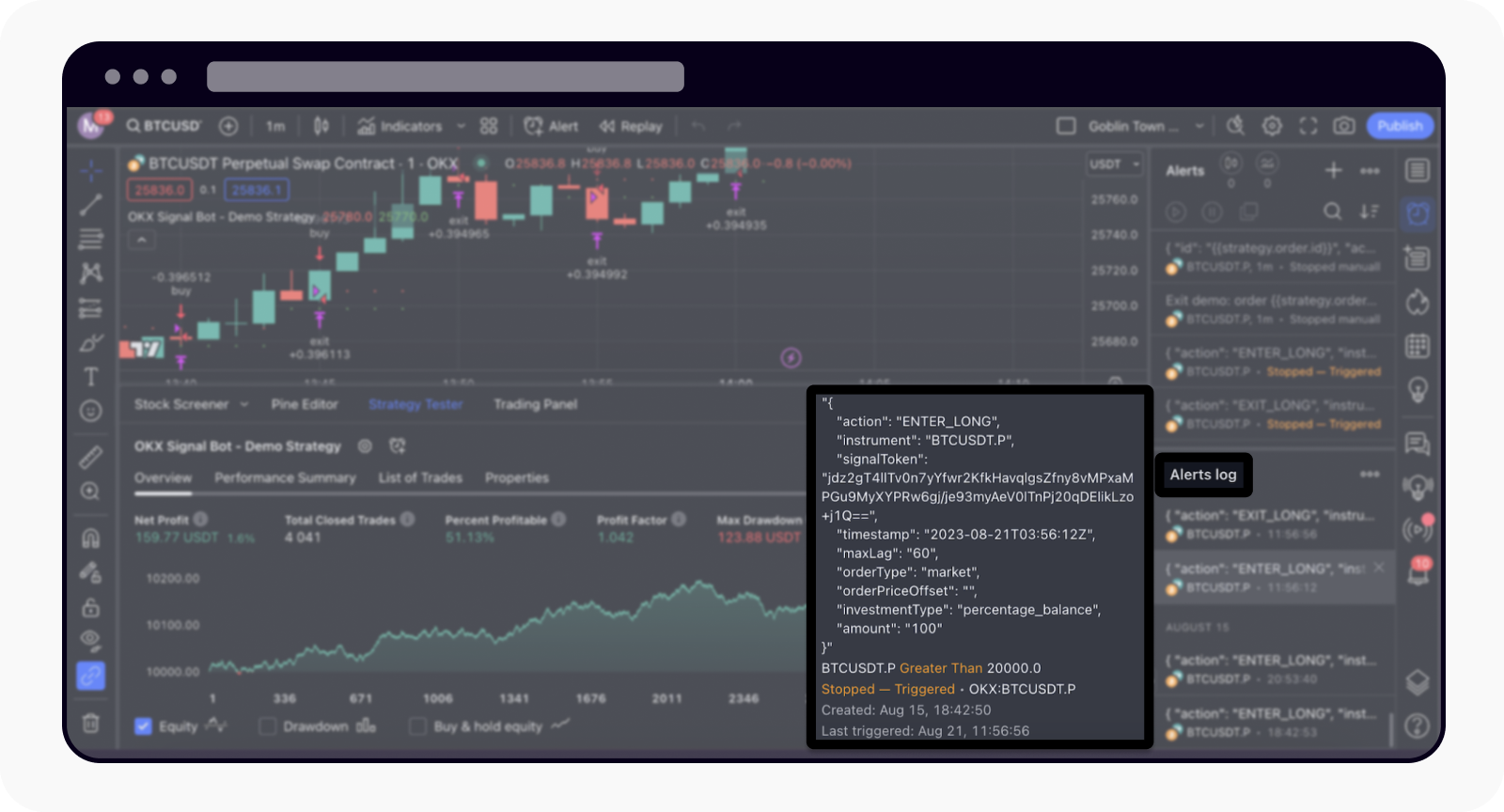

Check your Alerts Log on TradingView Begin by examining your alerts log on TradingView. Ensure that the alert you're expecting to trigger has been activated.

Check your alerts log on TradingView

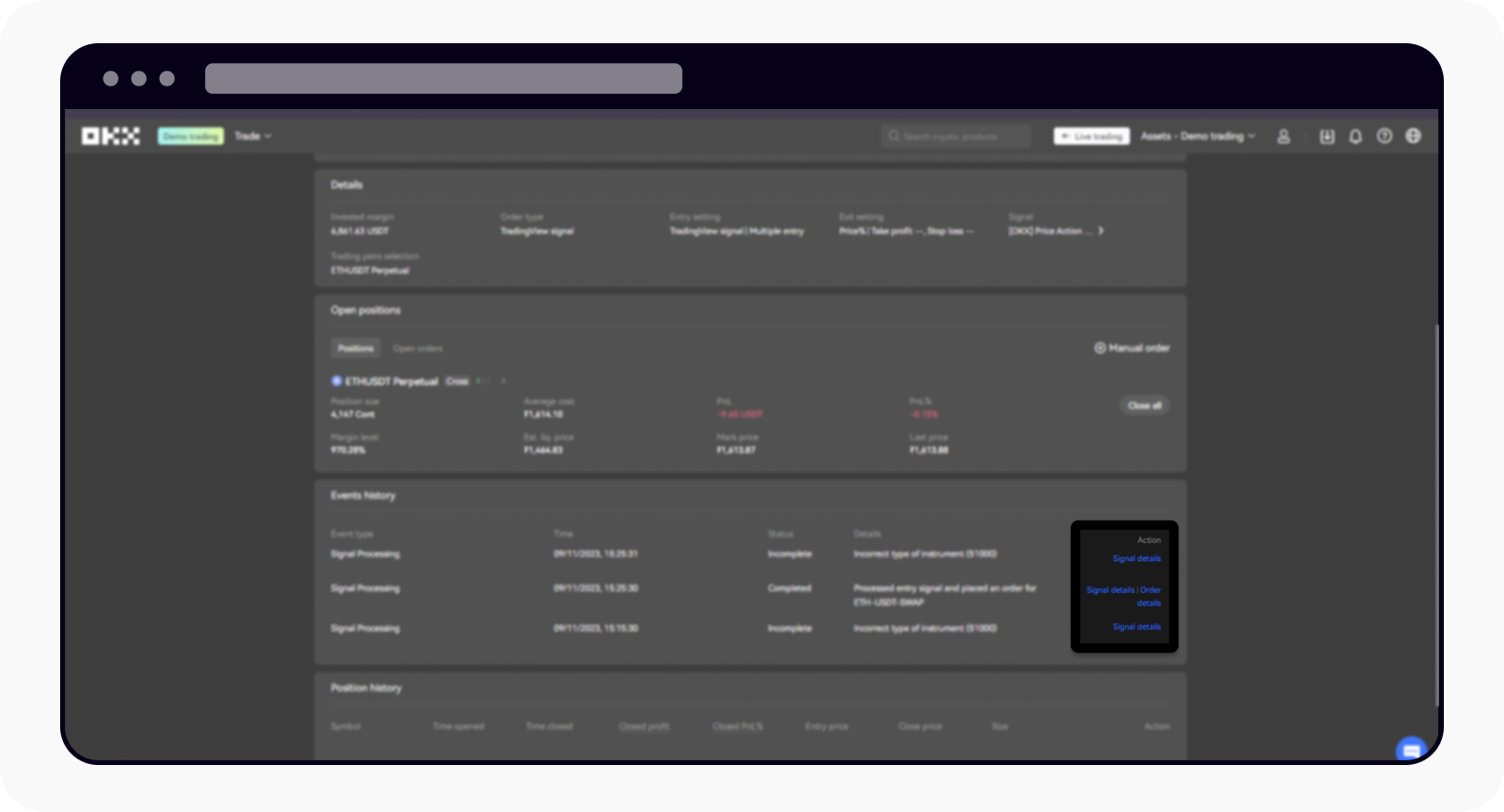

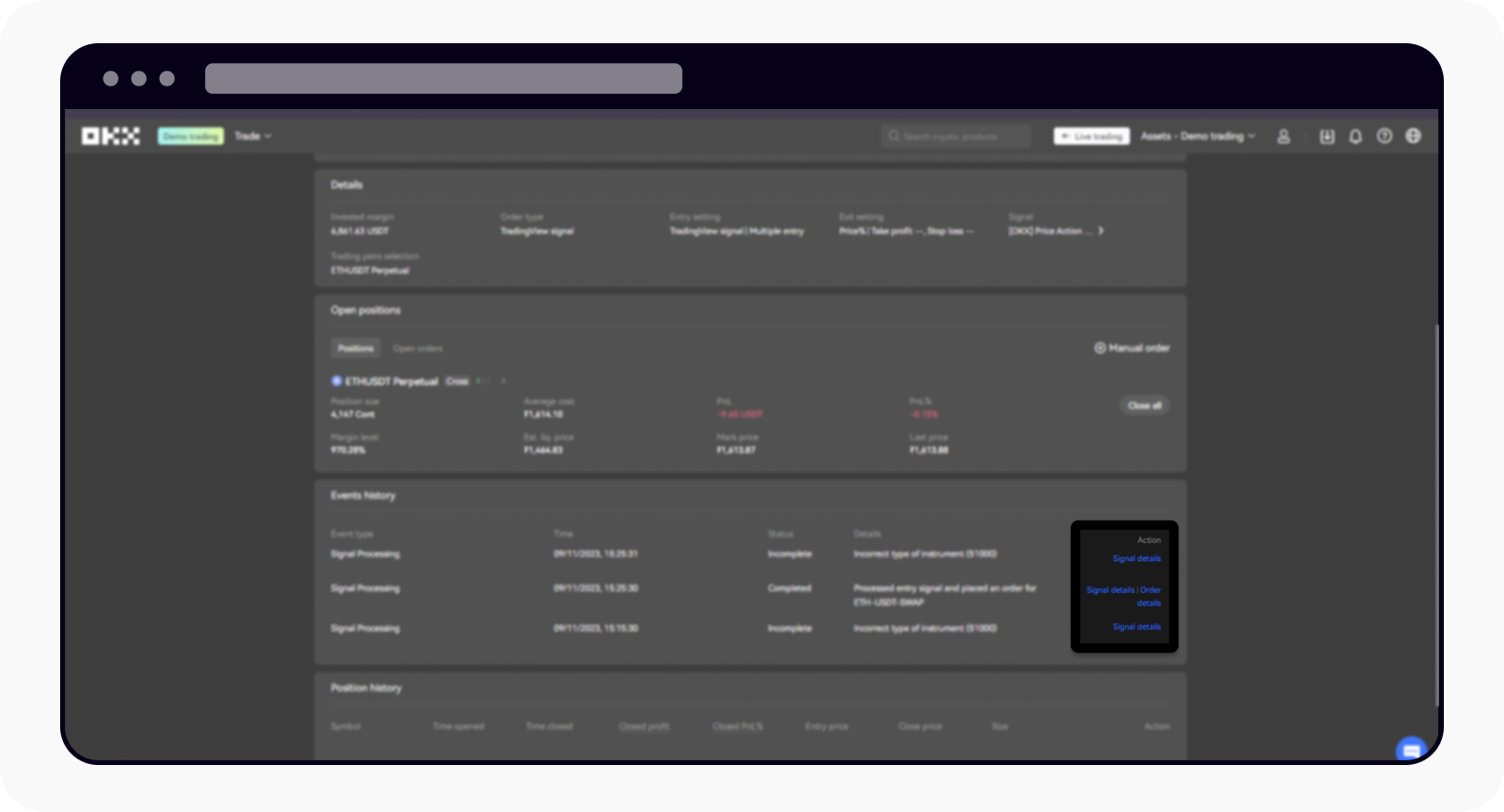

Open the details of your Signal bots and check Events history to see if the alert on TradingView has been triggered. Refresh this page and look for any logged events that occurred around the same time as the message trigger.

Select details of the signal bot

If there's no corresponding record on your Events history, verify Alert Configuration on TradingView:

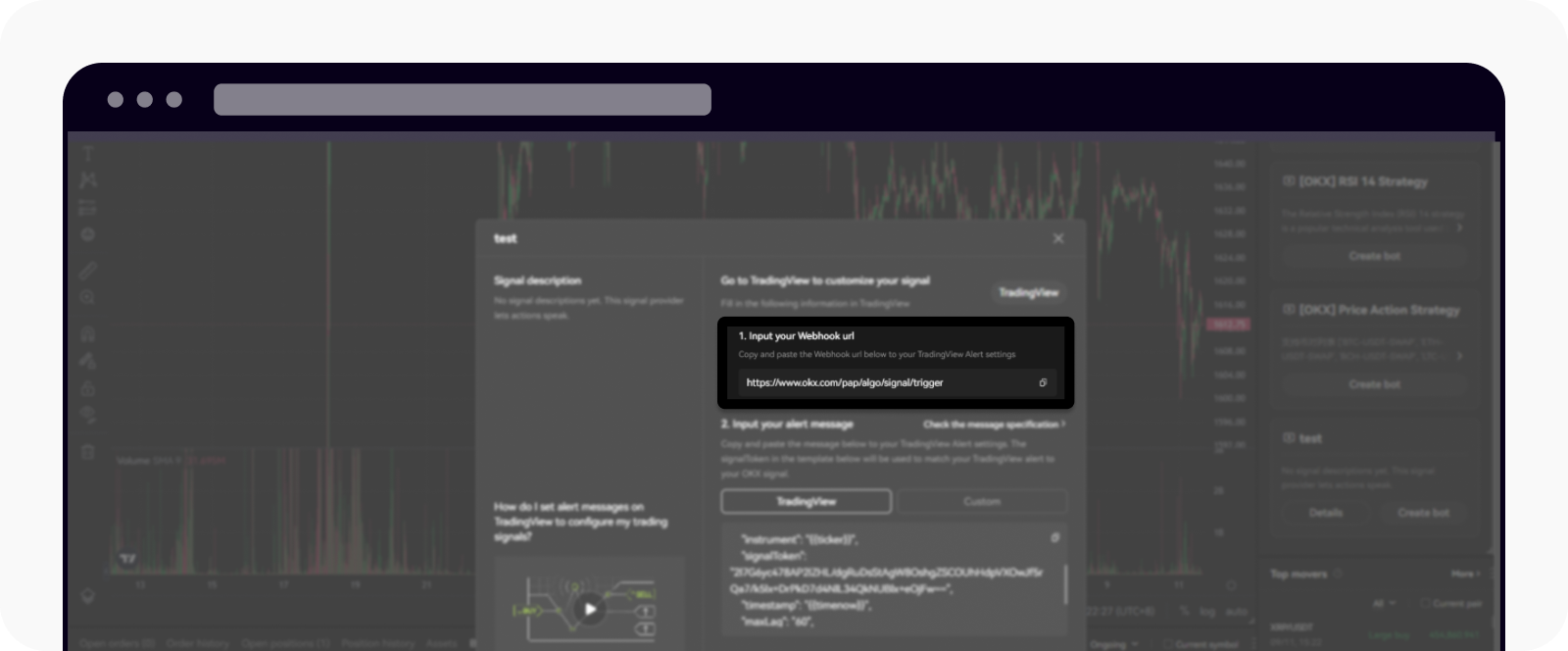

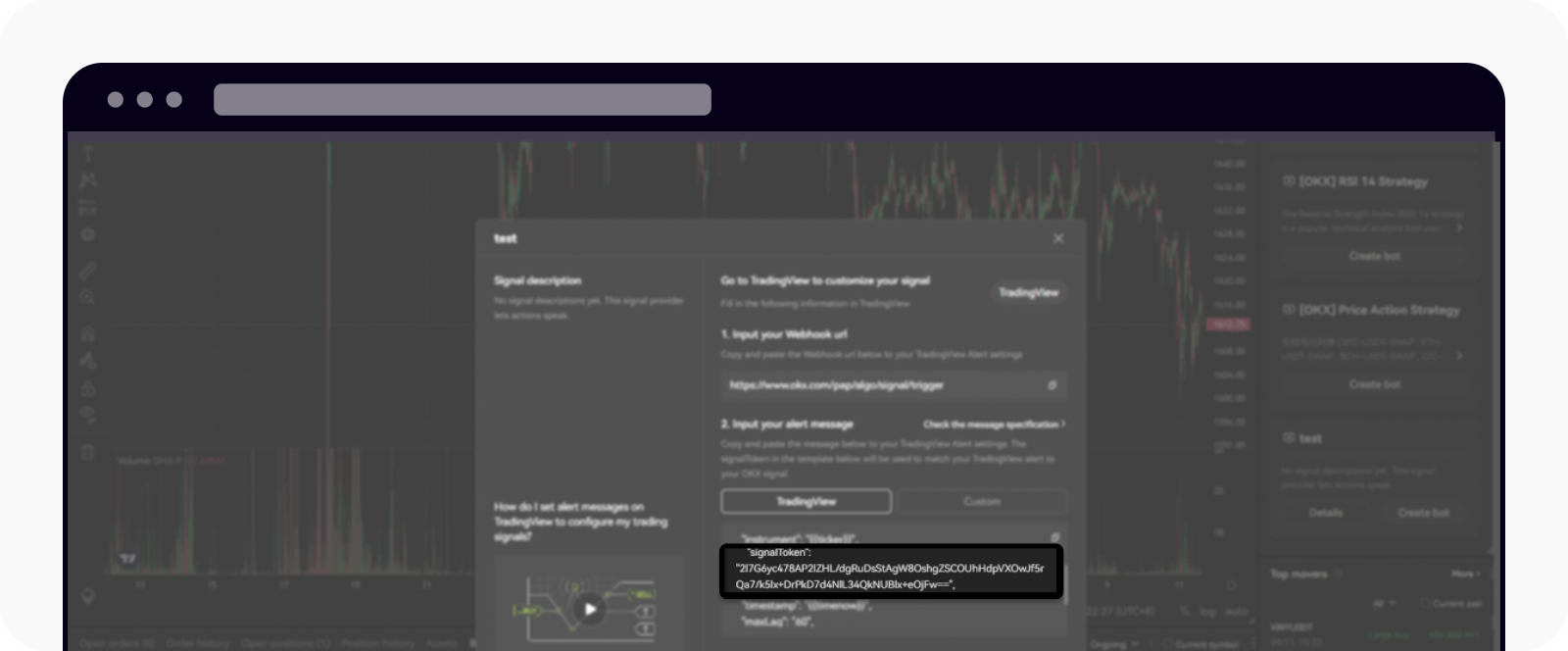

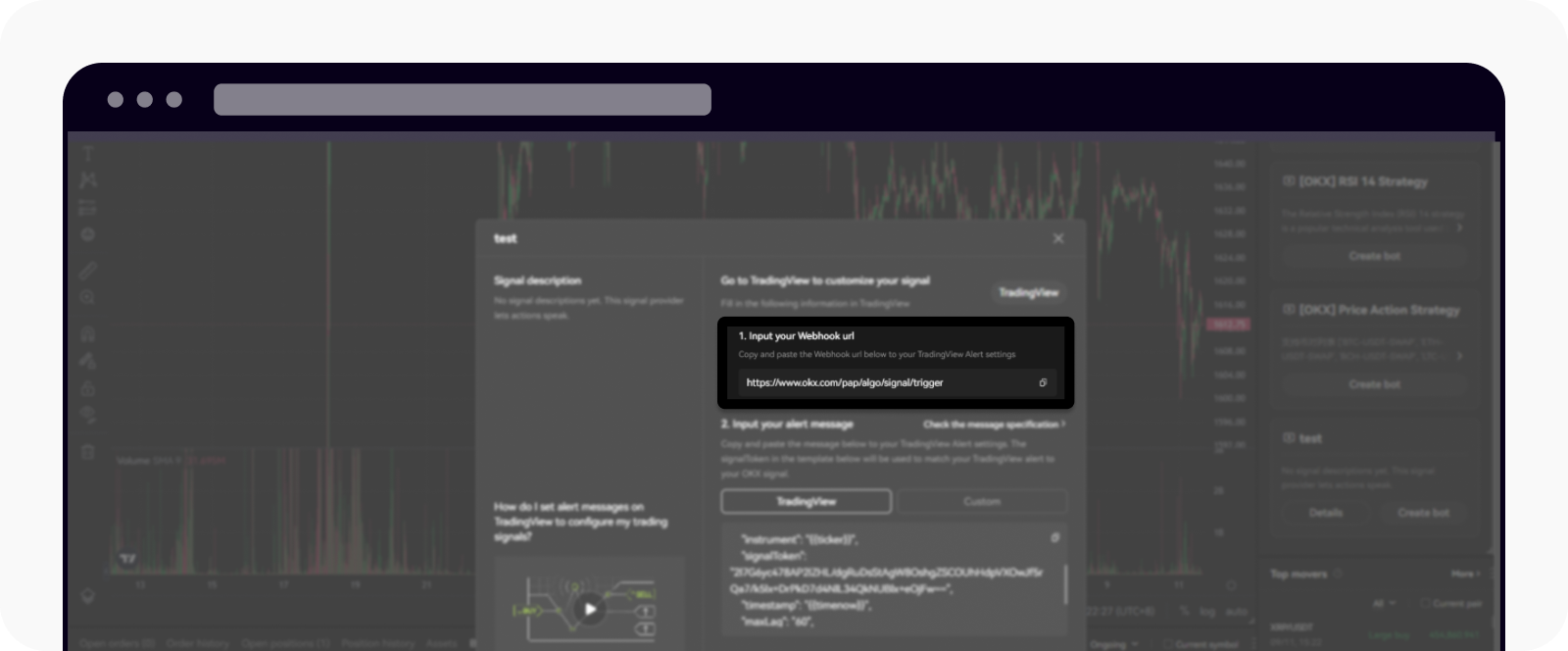

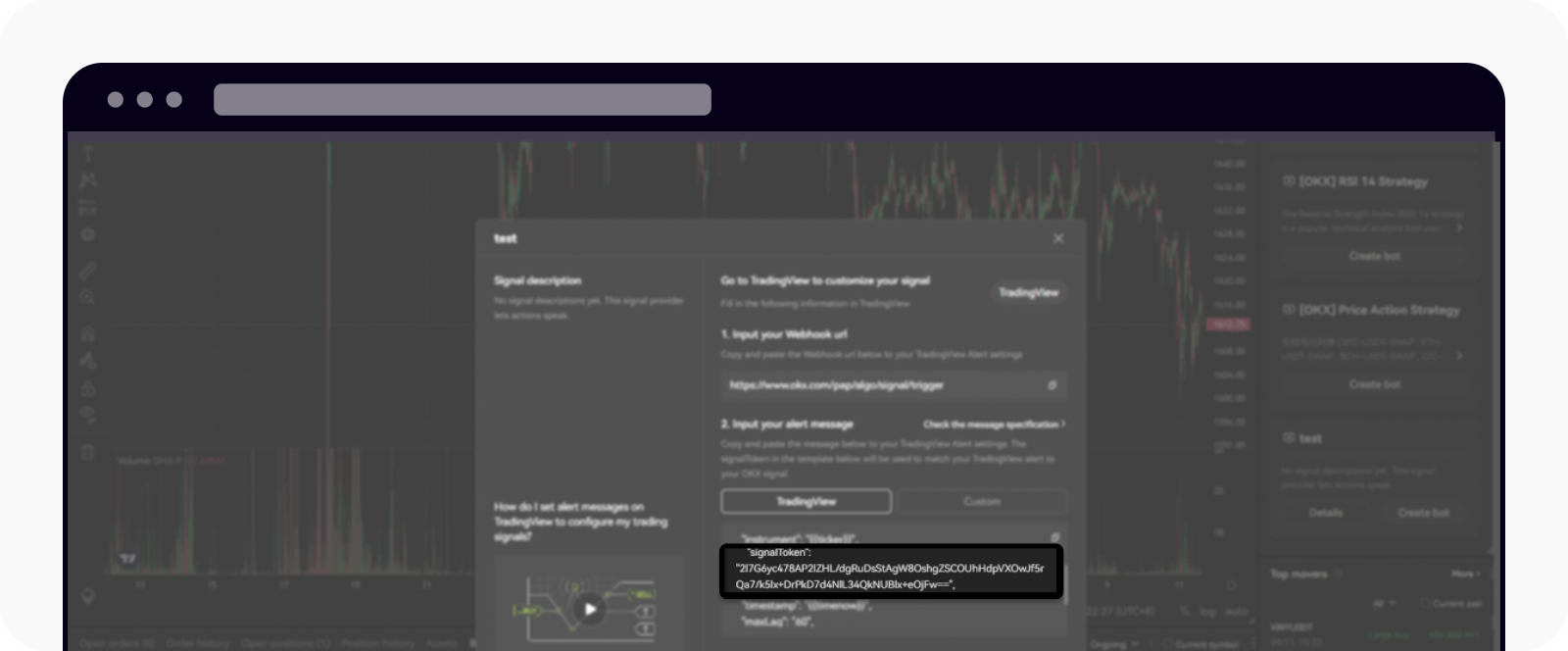

Webhook URL: Confirm that you've correctly input the Webhook URL in your alert settings. The Webhook URL for your alerts should align with the URL provided to you in the signal configuration view.

Check your Webhook URL

Note: Webhook URLs vary between Live Trading and Demo Trading. Be cautious and copy the correct URL for your environment:

Live Trading:

Demo Trading:

signalToken: Ensure that the signalToken field in your alert message is accurately entered. The signalToken field for your alerts should also align with the signalToken suggested to you in the signal configuration view.

Check your signalToken

If you find a successfully recorded line item in Events History, you'll need to analyze details of recorded events to understand more insights into what might have gone wrong. Use this information to make necessary adjustments to your alert message. Should you need guidance on formatting your alert messages, you can find detailed specifications in the Alert Msg Specs document.

Open the Signal details By following these steps, you can effectively diagnose and address any issues with your signals to ensure they function as intended. If you continue to encounter difficulties, don't hesitate to reach out to our support team for further assistance.

3. Does the OKX Signal Bot support spot or derivatives?

As of now, the OKX Signal Bot exclusively supports trading in perpetual contracts. This means that you can engage in trading activities within the realm of perpetual swaps, which are listed on OKX. The Signal Bot empowers you to trade these perpetual contracts while offering the advantage of configuring leverage to suit your trading preferences. Please note that spot trading is not currently supported through the OKX Signal Bot.

4. Are my signals from TradingView logged somewhere? Will errors in my alert messages on TradingView displayed somewhere within my bot?

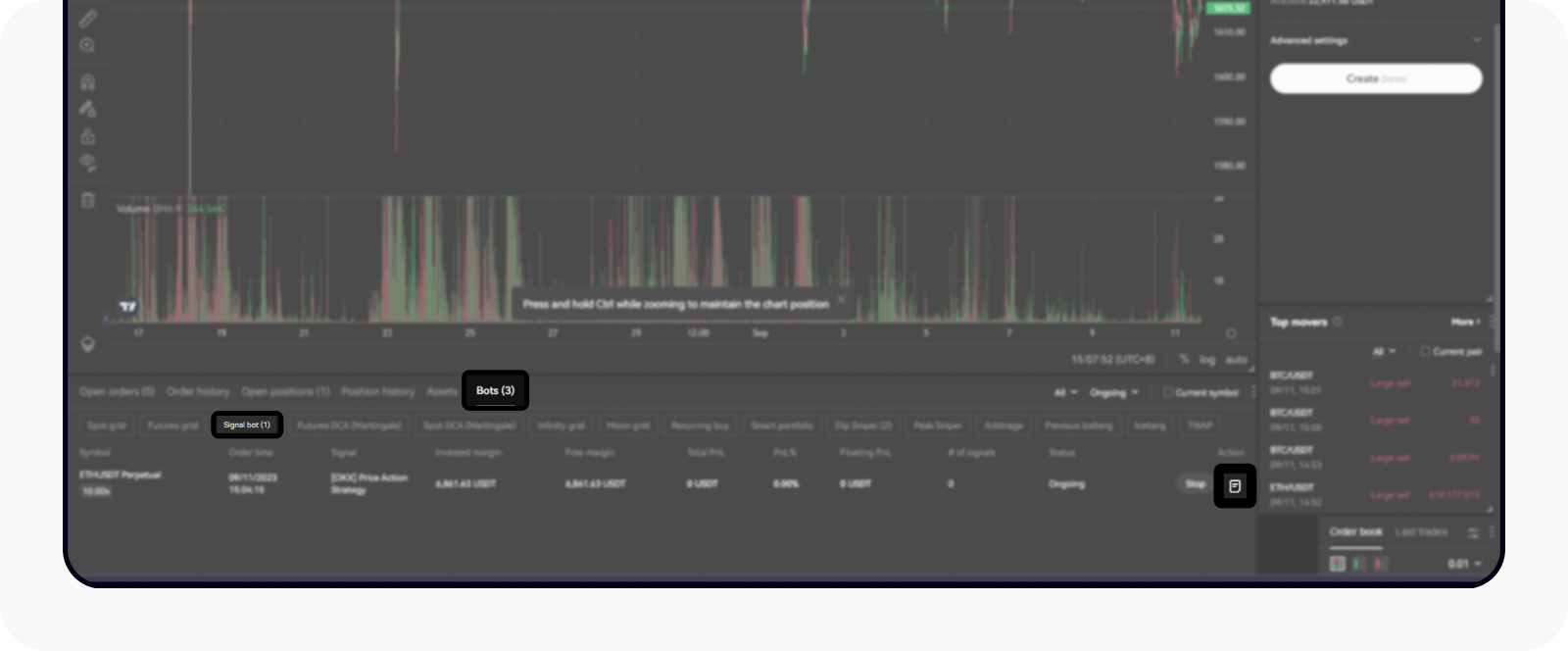

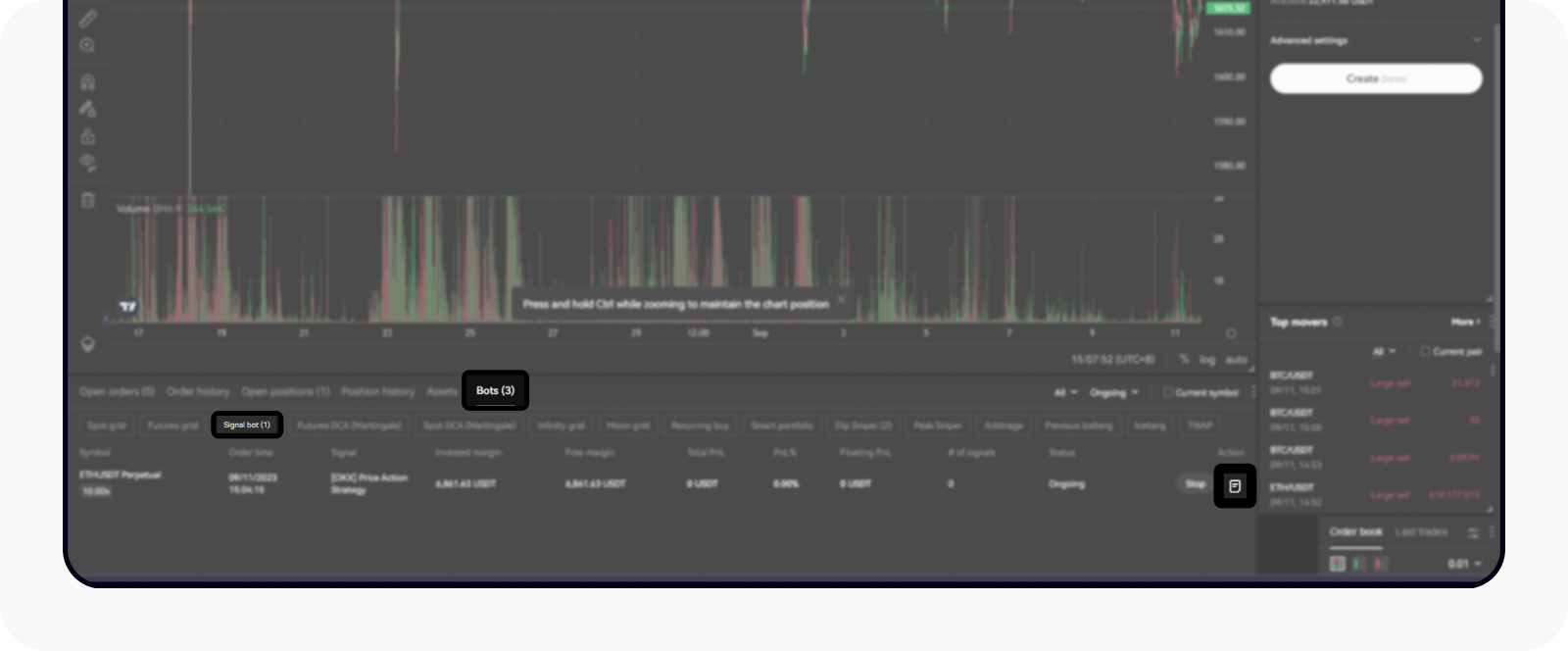

Yes, your signals from TradingView are indeed logged and tracked. If there are errors in your alert messages on TradingView, these issues are documented within your bot for your reference.

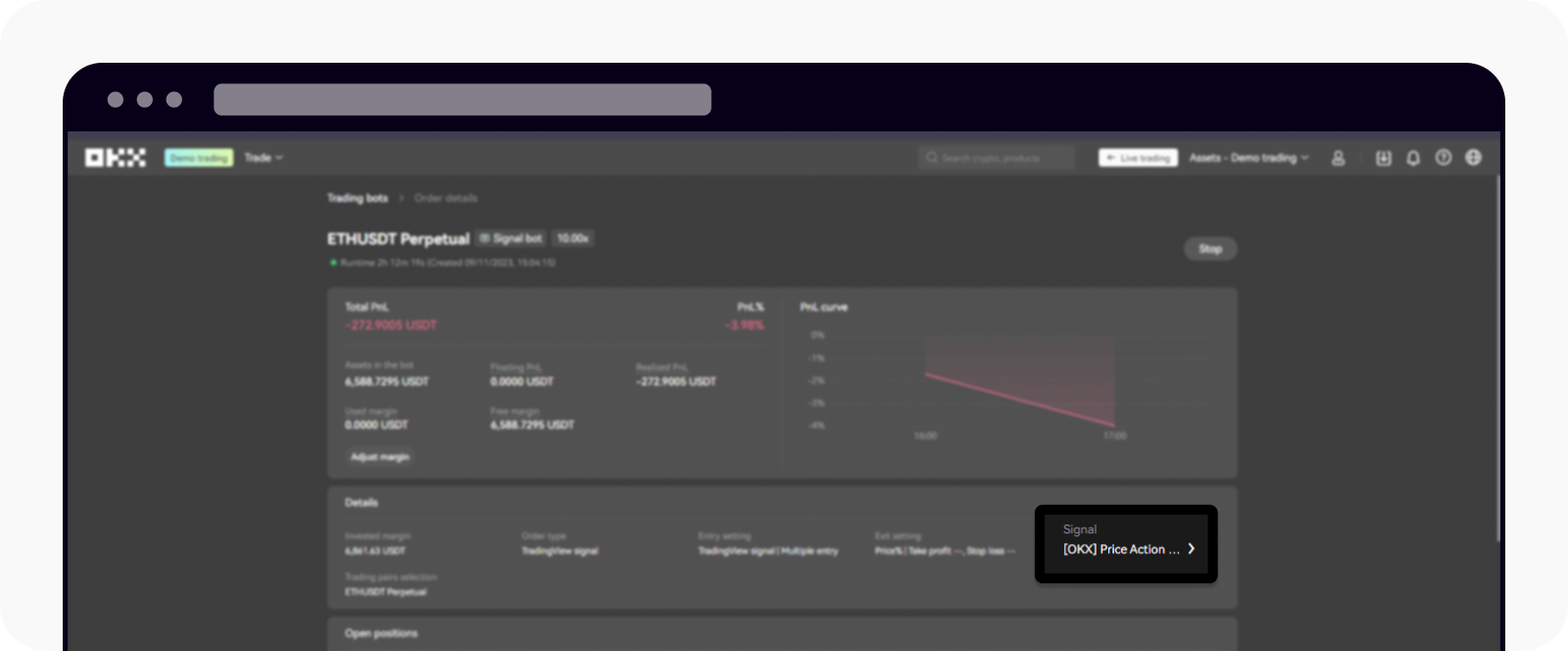

You can access this information from Bots > Signal bot > Details of the specific bot you wish to access > Events History. This section houses a chronological sequence of logs that detail the incoming alerts from TradingView along with the corresponding actions executed for each alert. The logs are designed to be self-explanatory and provide context for any actions taken. This comprehensive log can be immensely helpful in diagnosing errors or discrepancies in your alert messages.

By analysing the Event History section, you can identify any potential issues, understand their cause, and take action to maintain the efficient operation of your trading strategy.

5. What format can I send my alert messages in? Is there a specifications document?

Certainly! We provide a comprehensive Alert Msg Specs document that outlines the format you should use for sending your alert messages. This document serves as your guide to ensure that your messages are structured correctly and effectively interpreted by the system.

Tailored Formats for Pine Script™ Strategy Creators:

For Pine Script™ strategy creators who rely on strategy functions to transmit their trading signals, we offer a specialized format that seamlessly integrates strategy functions.

One-Size-Fits-All Approach:

Alternatively, we offer a versatile and general-purpose format suitable for all users. Regardless of whether you use scripts (strategy or study), indicators, or manual charting alerts, this "one-size-fits-all" format adapts to your needs.

Both these formats, along with detailed specifications, are readily available in the Alert Msg Specs document. This resource empowers you to craft and send your alert messages with precision, ensuring smooth communication between your trading strategy and the OKX platform.

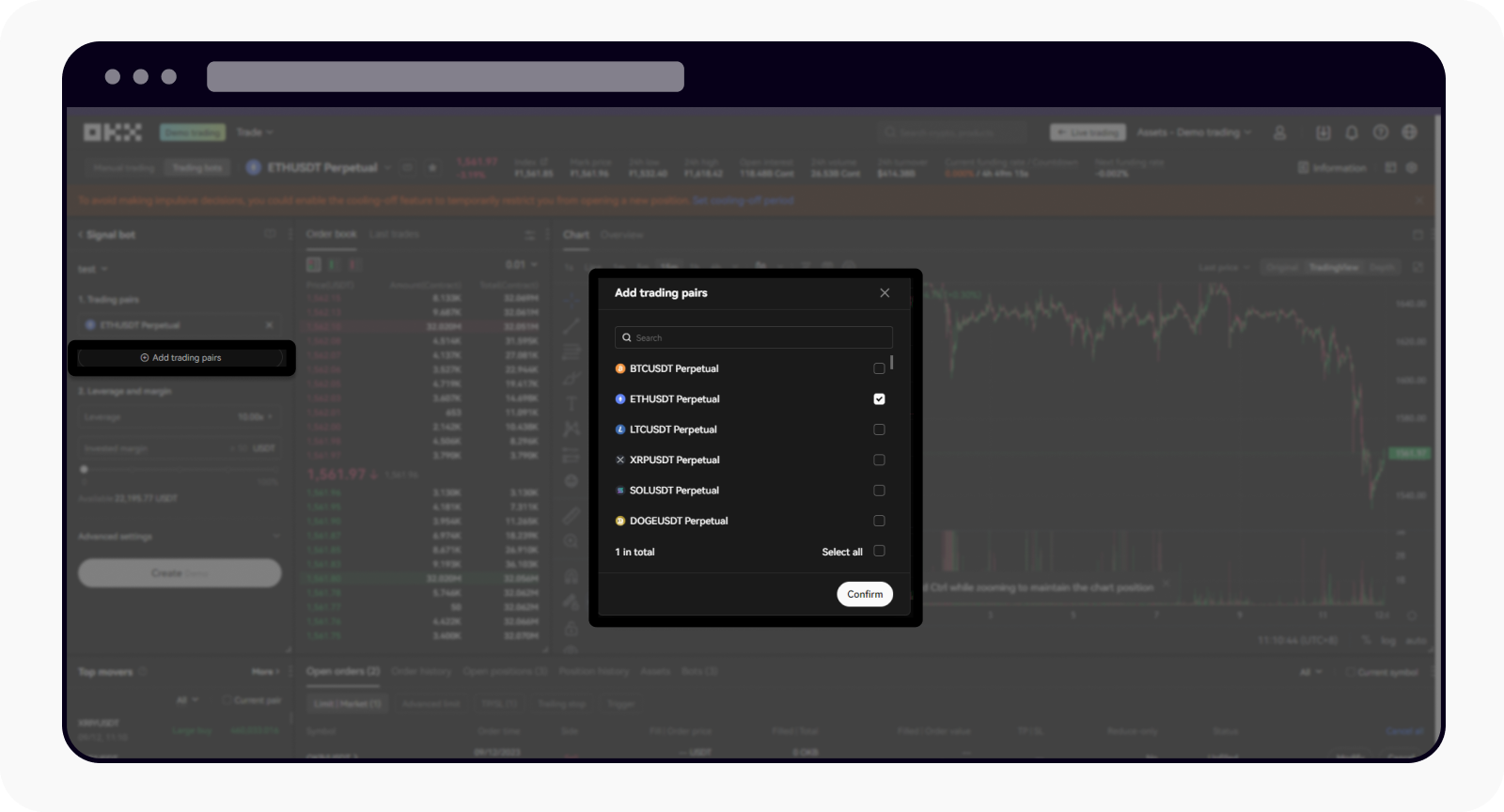

6. Can I set up multiple trading pairs in one signal bot?

Absolutely! You can efficiently manage multiple trading pairs within a single signal bot. During setup, you can select Create > Add trading pairs you want to include, allowing you to effectively monitor and execute trading signals for those specific pairs. Signals for pairs not chosen during setup will be filtered out.

Add the trading pairs

7. I received an error - "Incorrect type of instrument (51000)". What does this mean?

This error message indicates that the value you've entered for the "instrument" field in your alert message doesn't match the required format specified in our Alert Msg Specifications. To address this issue, refer to the documentation for a comprehensive breakdown of the expected content for each field.

For example, a common mistake involves entering the instrument as "BTCUSDT" instead of "BTCUSDT.P," inadvertently omitting the ".P" at the end. This specific format is crucial because we're dealing with perpetual contracts rather than spot trading.

By aligning your instrument field with the correct format as outlined in the specifications, you can resolve this error and ensure seamless signal transmission.

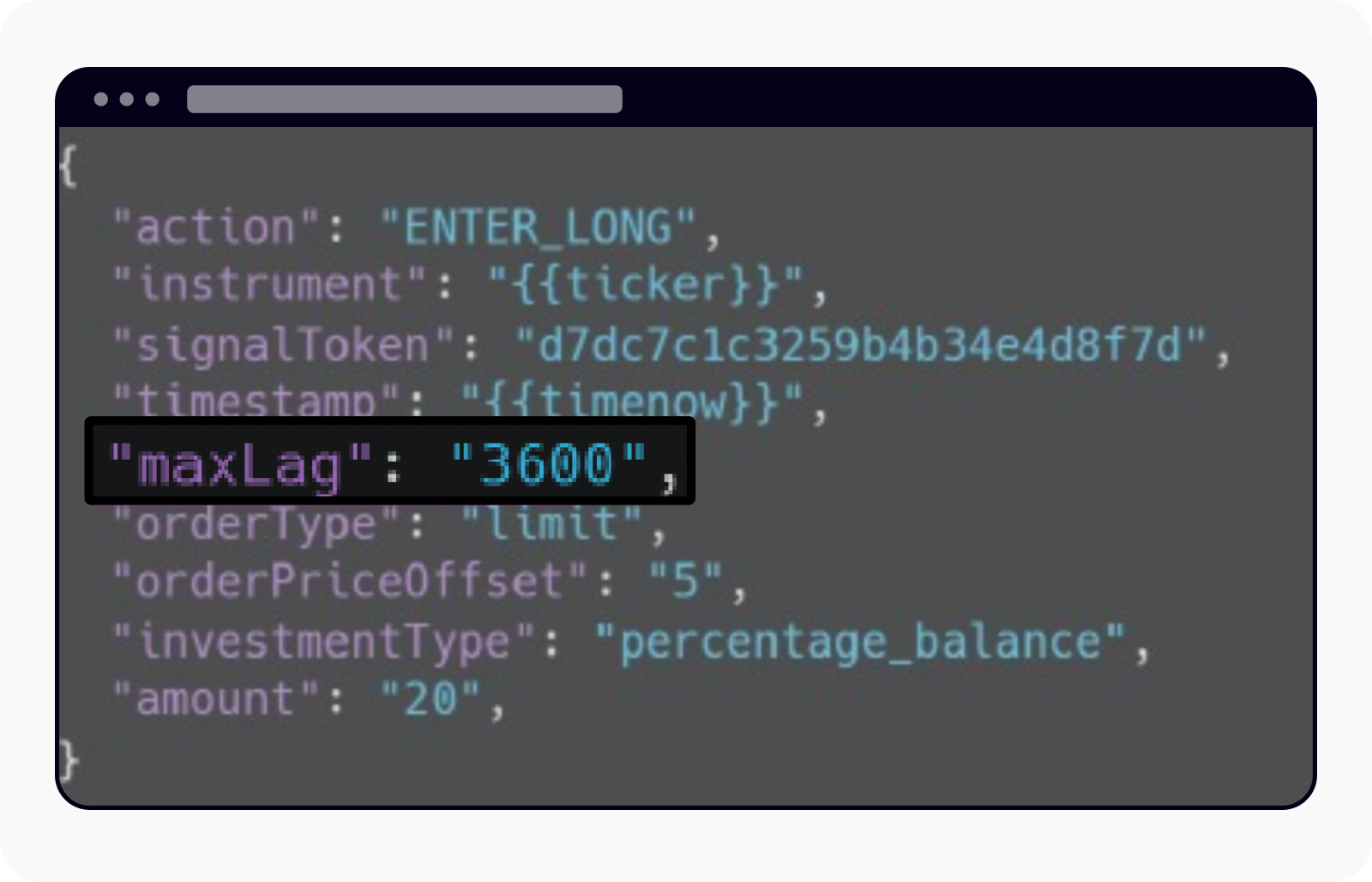

8. I received an error - "maximum allowed lag time being exceeded". What does this mean?

This error message indicates that there was a delay longer than the permitted duration for your alert to reach OKX from TradingView. Your alert message comprises a field known as "maxLag," which establishes this time limit (in seconds). In essence, maxLag signifies the maximum duration you allow between sending a signal via TradingView (as reflected by the "timestamp" field in your alert) and the moment it's effectively received and processed by OKX.

Maxlag in your alter message

To address this situation, consider adjusting the maxLag value in your alert messages to a higher threshold. This extended limit should accommodate any potential delays more effectively. However, if you continue to encounter this issue despite allowing ample time, feel free to contact our Support team. We're here to assist you in resolving any persistent concerns.

9. Where do I find my signalToken?

Select your signal Details

Open your signal details

Find your signalToken in the alert messages

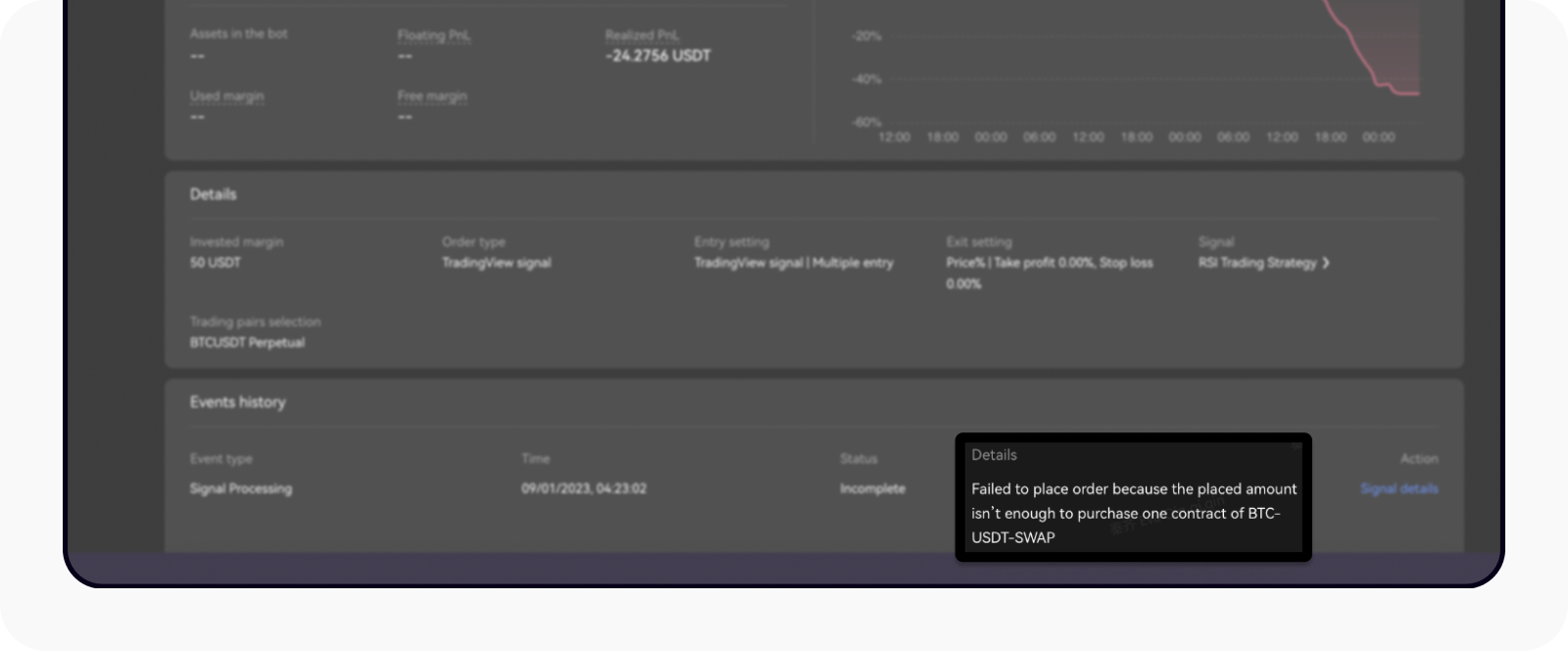

10. Is an order rejected when it's below the minimum order size?

Yes, if an order falls below the minimum order size, it'll be rejected. You'll receive an error message indicating the specifics of the rejection in the details, as shown below:

Example of error message in events history

For comprehensive information regarding contract sizes, please refer to the details provided here. It's important to make sure that the size of your order meets the minimum requirements for successful execution, as contract sizes vary between Demo Trading and Live Trading.

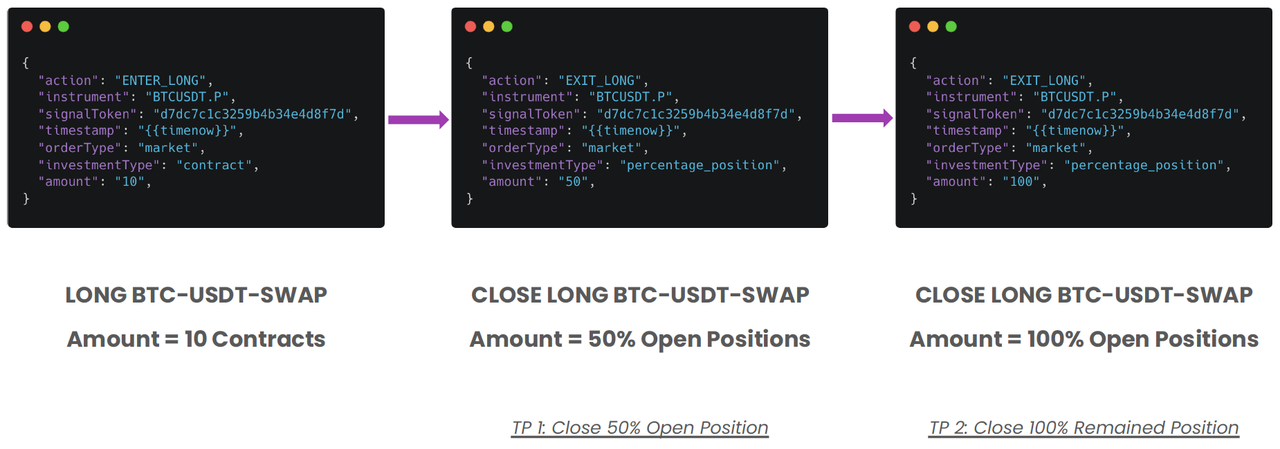

11. Can I use the OKX Signal Bot to do partial Take Profit?

Yes, the OKX Signal Bot supports partial Take Profit functionality. Here's an illustrative example of how you can implement this approach:

Let's say you want to execute partial Take Profit at two levels, 50% and 100%, respectively. You can encode these conditions within TradingView and send corresponding alerts indicating the partial exit along with the desired position size to be closed out.

For a more in-depth understanding of the specifications and a detailed example, refer to our comprehensive Alert Message Specifications guide. This resource provides you with the necessary insights to effectively employ partial Take Profit strategies using the OKX Signal Bot.

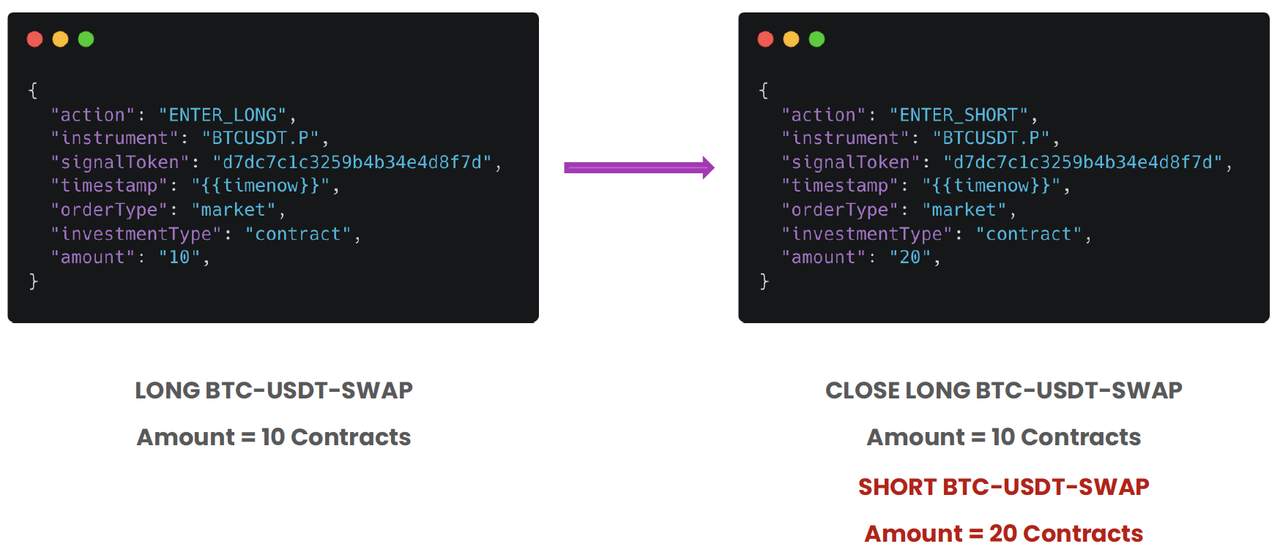

12. Can I use the OKX Signal Bot to do one-step reversals (i.e. long to short or short to long)?

Absolutely! The OKX Signal Bot fully supports one-step reversals. You don't need to send two separate messages: one for closing an existing position and another for opening a new position in the opposite direction. A single message is sufficient for the bot to intelligently execute the reversal directly.

Here's an illustrative example: Suppose you have a long position, and you want to execute a reversal to a short position. You can send a single alert message indicating the desired direction and size of the new position, and the bot will seamlessly handle the reversal for you.

For a more in-depth understanding of the specifications and a detailed example, refer to our comprehensive Alert Message Specifications guide. This guide provides a comprehensive understanding of how to efficiently perform one-step reversals using the OKX Signal Bot.

13. Where can I view signal details such as recommended alert messages and webhook URL if I missed out on pasting these during creation?

You can always view essential signal information by using these 2 methods:

Signals View: select Details in your Signal

Bot Dashboard: go to Bots > Signal bot > Details > Signal

Check Signal details

14. Can I simultaneously have long and short positions open in my bot?

The bot operates in a one-way position mode. This means that for a single trading pair, you can hold a position in only one direction at any given time.

However, when considering multiple trading pairs, you do have flexibility. For instance, you can simultaneously hold a long position in BTCUSDT while also maintaining a short position in ETHUSDT. This ability to manage distinct pairs with different positions adds versatility to your trading strategy.

15. What happens if I set up 2 or more bots on the same signal?

When you set up multiple bots using the same signal, all of these bots will execute actions based on that shared signal. Each bot can be configured with distinct settings, such as operating on different trading pairs, leveraging varying leverage ratios, or even adhering to distinct margin requirements.

While these bots can possess differing configurations, they'll essentially be acting upon the same underlying signal. This means that orders will be executed based on the information conveyed in your signal, merged with the unique settings of each individual bot.

Setting up multiple bots on a single signal allows for flexibility and customization, enabling you to tailor your trading strategy to diverse market conditions and preferences.

16. Is there a Signal Marketplace? I'd like to use signals from professional traders.

Yes, it is! It's now available on our OKX Trading Bots page under the Signal Marketplace here.

17. How can I become a signal provider?

Any individual or entity interested in becoming a signal provider is required to complete a dedicated application form. The application will undergo a thorough evaluation by OKX, which will encompass an assessment of factors like reputation, historical performance, and engagement within the community. As part of the application process, you will be requested to furnish specific details.

These details include:

The value you intend to contribute as a signal provider.

Your established track record in trading or signal provision.

Information regarding your presence on social media platforms and within various communities.

By gathering this information, OKX ensures a comprehensive understanding of your potential as a signal provider. This meticulous selection process aims to bring onboard individuals or entities who can enhance the quality and diversity of signals provided through the platform.

18. Is there any way to reach out to OKX regarding the Signal Bot?

Yes, for any inquiries related to the OKX Signal Bot, you can easily get in touch with OKX Support through this link.

Additionally, we've established a dedicated Telegram channel for OKX Signal Bot. This channel serves as a platform where you can ask questions, share your queries, and stay updated on forthcoming features. Join us on Telegram through the following link: [Official] OKX Signal Trading. Your engagement is valued, and we're here to provide the assistance and information you need.

19. I've purchased an invite-only TradingView script from a provider. How do I execute this on OKX?

The process largely depends on how your script provider has encoded alerts to enable you to transmit signals from the script to OKX or any external platform. Certainly, the most fundamental step in this process involves creating alerts based on your script's conditions and then sending these alerts to the OKX Webhook URL. However, it's important to note that each script may have a different approach.

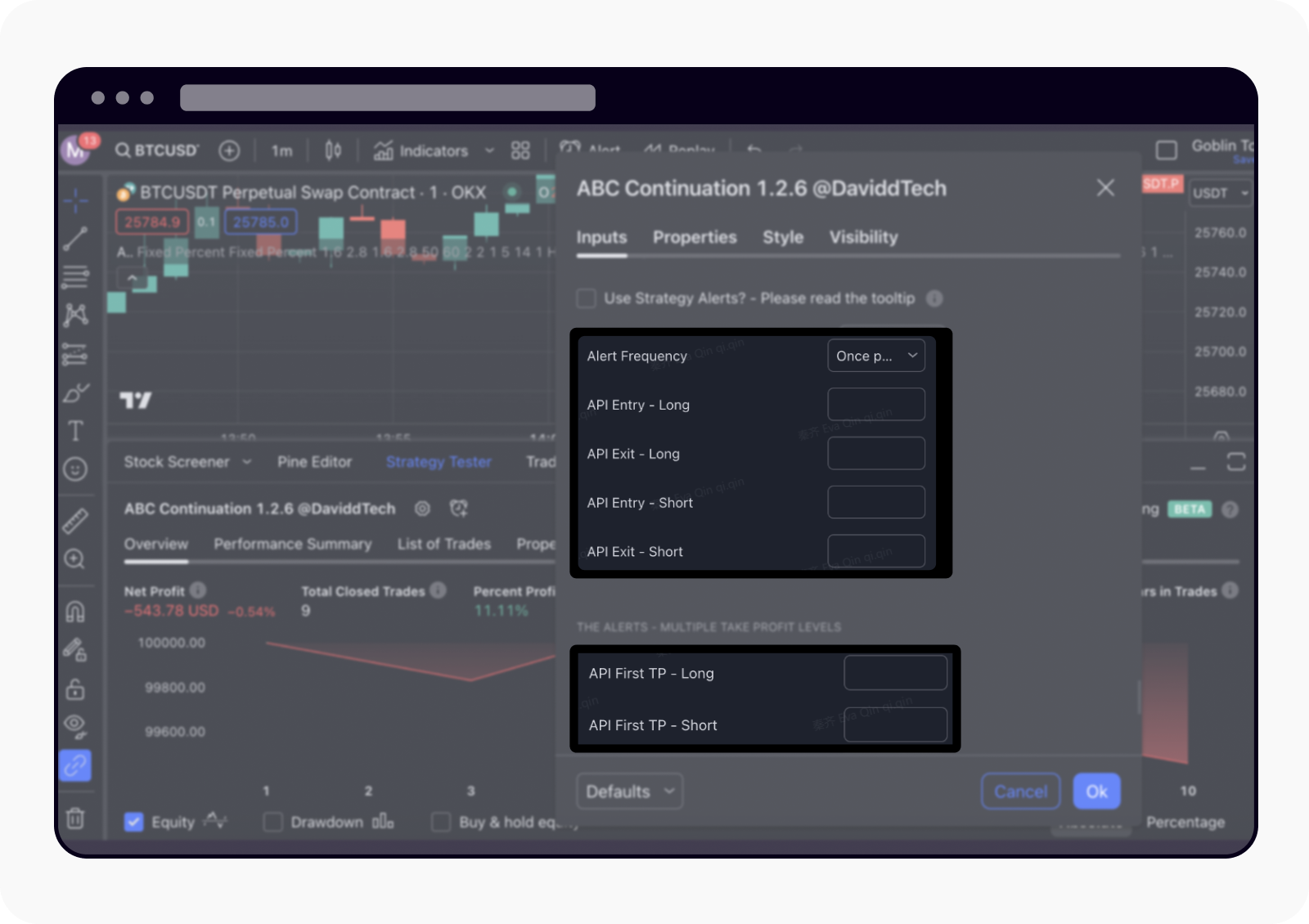

For example, some script providers may have included input functions in their script, allowing you to enter messages based on specific signal categories like Enter Long, Exit Long, Enter Short, or Exit Short.

Example of some script providers that include input functions in their script

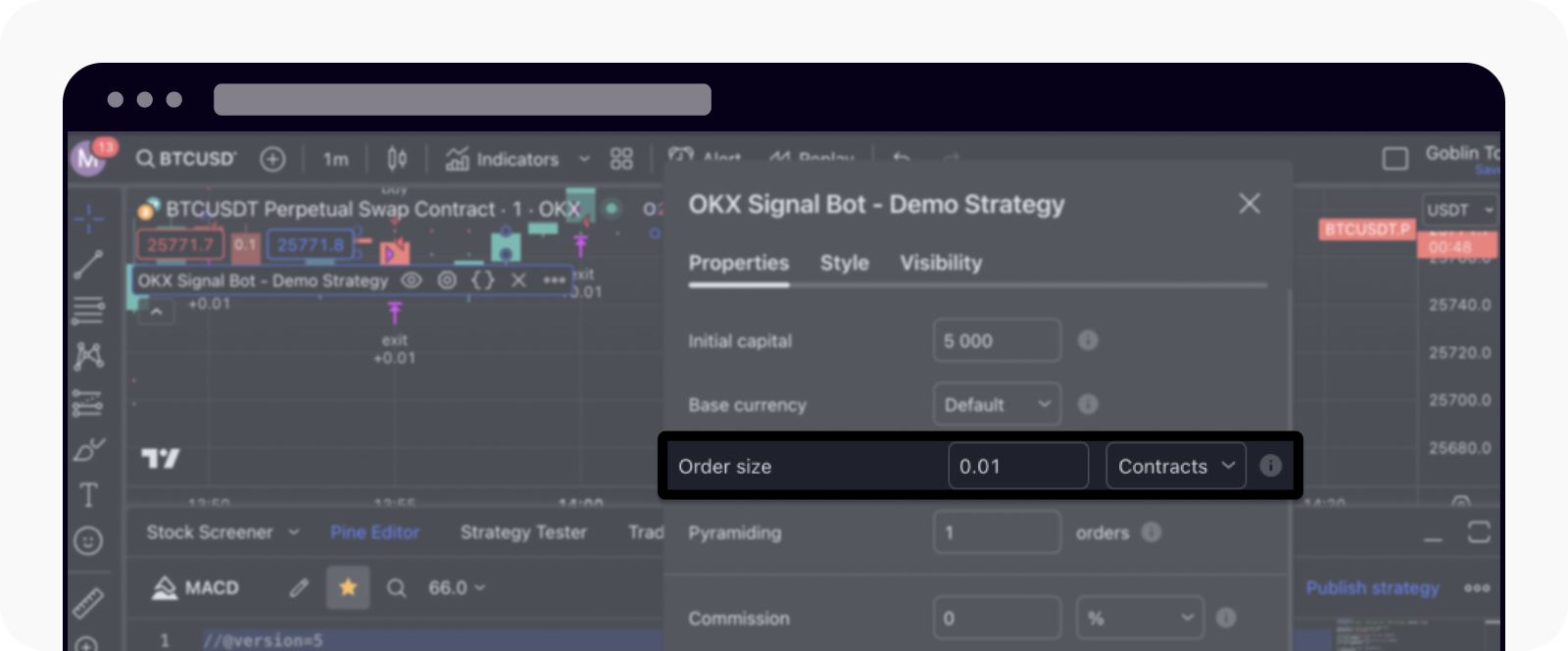

On the other hand, some script providers might automatically generate alert messages for you based on your strategy properties, such as order size.

Example of some script providers that automatically generate alert messages

To ensure a smooth execution, we recommend reaching out to your script provider and seeking guidance on the steps required to use their scripts for execution on OKX.