Infinity Grid

Introduction to OKX Infinity grid bot

A grid bot is a trading bot that automates a trading strategy called grid trading. Grid trading is a strategy where a trader buys and sells cryptocurrencies at specific price levels, typically buying when the price is low and selling when the price is high, with the goal of making gains from the market's volatility. The bot creates a grid of buy and sell orders at specific price intervals, and as the market moves up and down, the bot automatically executes these trades, accumulating growth along the way.

What's the difference between spot grid and infinity grid?

The major difference between spot grid and infinity grid is the upper limit setting. Spot grid requires traders to set upper and lower limits when creating a strategy, which often results in missed opportunities when the price exceeds the upper limit.

Additionally, spot grid is suitable for short-term trading, while infinity grid is more suitable for long-term trading. Spot grid enables traders to capitalize on short-term market fluctuations, while infinity grid allows traders to hold onto their digital assets for an extended period and capitalize on long-term market trends.

How does OKX Infinity grid bot work?

The infinity grid bot can automatically buy low and sell high, ensuring that traders never miss opportunities limited to a predefined price range. It also automates placing orders to avoid market sentiment leading to less than optimal trades. As long as the market fluctuates up or down, the bot will execute trades.Moreover, infinity grid is particularly suitable for traders who want to avoid the downsides of spot grid trading. One of the main drawbacks of Spot Grid trading is that upper and lower limits need to be set, which often leads to missed opportunities for the user when the price exceeds the upper limit.

How to get started

Web: Navigate to Trade, select trading bots - Marketplace, and click Infinity grid.

App: Navigate to Trade, select Trading bots, and press Infinity grid.

Enter parameters manually, copy traders' bots, or use backtested AI parameters, and confirm the total investment amount to create an Infinity grid bot (After you create a bot, the initial funds will be isolated from your Trading account and used for grid trading only).

Setup Options

Manual: Set parameters based on your own analysis of the market.

AI strategy: Use the parameters recommended by backtested strategy (These parameters are based on a weekly backtest of this pair).

Grid Trading Parameters

Lower limit: The bot will stop placing orders when the market price is lower than the lowest price.

Profit per grid: The profit per grid influences both the size of your profits and the frequency of trades. Smaller grids (for instance, less than 1%) lead to more frequent trades with lower profits, while larger grids produce fewer trades but with higher profits per trade.

Amount: It refers to the amount of chosen currency invested in the bot. The maximum available amount of the chosen currency equals the current maximum transferable amount of that currency in your trading account.

Take-profit (TP) price: The bot ends trading when the price reaches TP price, and the bot will sell all base assets at the corresponding market price.

Stop-loss (SL) price: The bot ends trading when the price falls to the SL price, and the bot will sell all base assets at the corresponding market price.

Managing your Infinity grid bot

Web: Head to OKX Trading Bots homepage, and select 'My bots'. You will be brought to a bot dashboard where you can manage your running bots.

App: Head to OKX Trading Bots homepage, and select 'My bots'. You will be brought to the "My bots" page where you can manage your running bots.

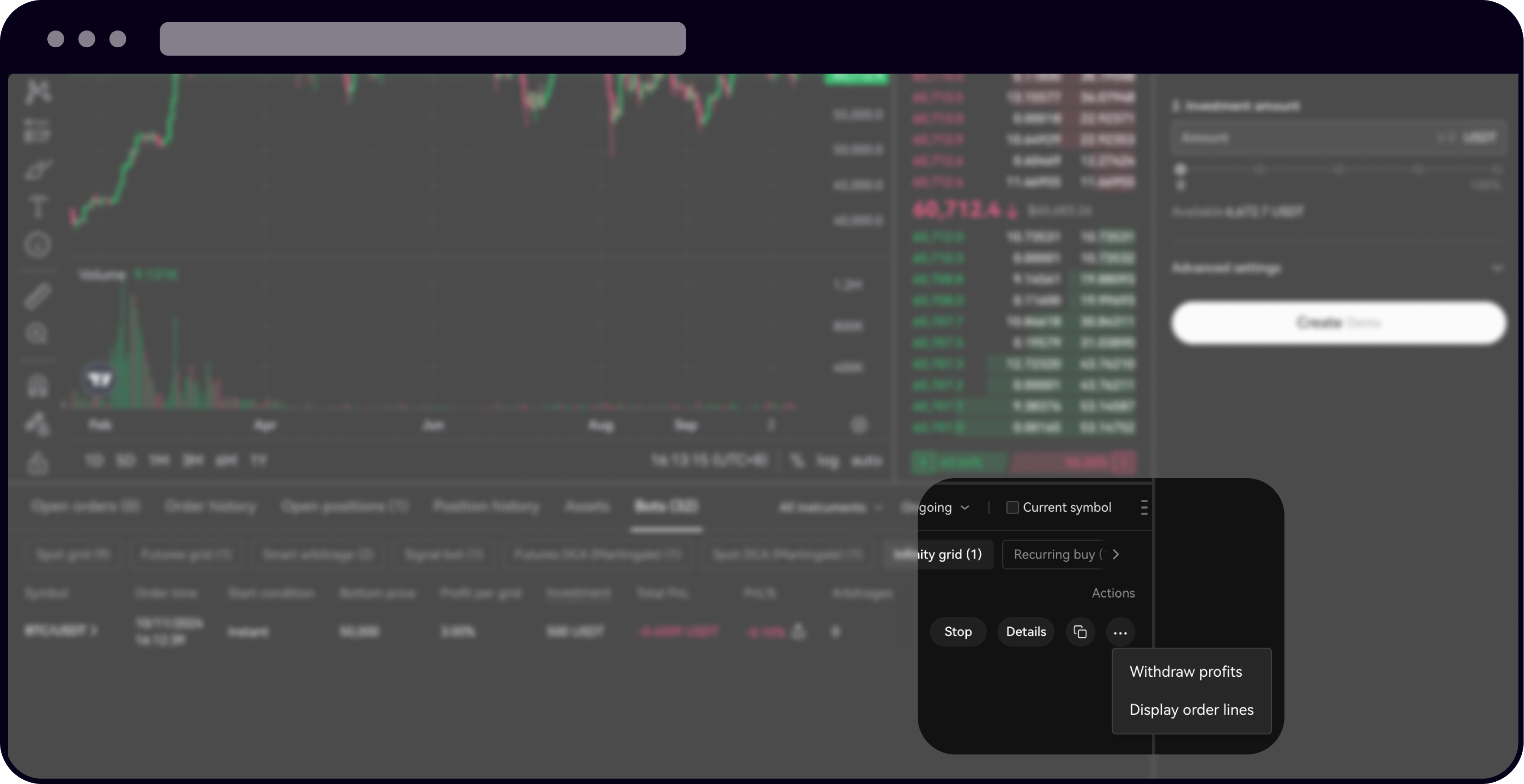

Grid bot management features

Stop your bot: When you stop this bot, the system will cancel all pending orders and sell your crypto at market price. Funds from the sale will be returned to your trading account.

Details: View more details about your running bot by accessing the Bot Details page.

Replicate parameters: One-click set-up to recreate your running bot with the same parameters

Withdraw profits: The total withdrawable grid profit. The profits will be transferred to your trading account.

TPSL: You may edit your TPSL settings after bot creation.

Display order lines: View the details of your running bot's unfilled orders on the chart.

Case study

Trading Pair: BTC/USDT (Assuming current price is $25,000)

Lower limit: 22,500 USDT

Profit per grid: 1%

Investment Amount: 5,000 USDT

Running the Bot

Stage 1 – initial order placement: Once you start the infinity grid, the bot will buy BTC for approximately 4,500 USDT, keeping the remaining 500 USDT in case the price falls below the bottom price. The bot will ensure that your BTC holdings are always worth 4,500 USDT.

BTC price (USDT) | Price fluctuation % | Value of BTC positions (USDT) | Profits (USDT) |

|---|---|---|---|

25,000 USDT | -- | 4,500 USDT | -- |

25,250 USDT | +1% | 4,500 USDT | 34.65 USDT |

25,500 USDT | +1% | 4,500 USDT | 68.18 USDT |

Stage 2 – bot operation: If the price rises by 1% and reaches 25,250 USDT, your BTC would increase to 4,534.65 USDT. The bot will then sell 34.65 USDT worth of BTC to maintain a BTC value of 4,500 USDT. Your USDT balance in the bot will increase to 565.35 USDT. If the price rises by another 1% to 25,500 USDT, the BTC value would increase to 4,568.18 USDT. The bot will sell 68.18 USDT worth of BTC to maintain a BTC value of 4,500 USDT. Your USDT balance in the bot will increase to 633.53 USDT. The bot will continue to sell BTC and increase your USDT balance with every price increase, while ensuring that your BTC value remains at 4,500 USDT.

If the price falls, the bot will do the opposite to maintain your BTC value at 4,500 USDT. Whatever the price does, the infinity grid bot will make sure your BTC value in USDT always stays the same and with every change. The bot will keep doing this "infinitely" as long as the price stays above your lower limit of 22,500 USDT.

Risk reminder and notes

If the price falls below the lower limit, the bot will not continue to place additional orders. If the price continues to fall and does not return back to above the lower limit, the crypto asset held at this time will suffer losses. Therefore, it is recommended to set a stop-loss price below the lower limit to avoid taking excessive risk on your position.

The fund invested in the grid will be isolated from your Trading account and used independently for the Trading bot. Therefore, users need to pay attention to the risk of overall positions in your Trading account after transferring funds.

Your assets will be sold at market prices when the Bot is stopped manually or when the stop-loss price is triggered.

While the Infinity grid bot is running, if it encounters unpredictable circumstances such as suspension or delisting of the underlying crypto asset, the bot will be automatically stopped.