What's Futures DCA bot and how do I maximize my efficiency with automated crypto trading through it?

What's Futures DCA bot?

Futures Dollar-Cost Averaging (DCA) is a trading bot that helps you to automate your futures trading and take advantage of the Martingale strategy. With Futures DCA, you can set up a DCA strategy to automatically buy more contracts if the price of the asset drops, allowing you to potentially recover losses and make a profit.It's important to note that while the Martingale strategy can be effective, it does come with risks. It's crucial for traders to use caution and set up stop-loss orders to manage risks. Don't forget to set up stop-loss orders and carefully consider your risk profile before using this strategy. Learn more about Martingale strategy, Dollar-Cost Averaging (DCA) and how it works here.

When should I use Futures DCA bot?

The Futures DCA trading bot is considered a fit for volatile (significant but short-lived movements) markets, but also works with sideways (trendless) markets as long as the short-term rebounds or corrections exist. With the concept of the trading cycle, Futures DCA can earn profit over multiple trading cycles. The Futures DCA is best used in high-risk, high-reward situations, especially when your strategy is to attempt to earn profits from rebounds in a volatile market but want to save the time for tracking and eliminate the hassle of configuring a series of averaging orders manually. It can also be used if you have a high degree of confidence in the ultimate direction of a particular asset, and want the flexibility to gain better entry positions based on technical indicators, or customize the price step or volume multipliers on safety orders. By doubling your position size after each losing trade, you may recover your losses if the market eventually moves in your favor.

How can Futures DCA bot help me?

Futures DCA is a trading bot that enables traders to automate this strategy in futures trading. The bot works by setting up a series of orders with increasing position sizes. When a position is closed at a loss, the bot will automatically place a new order with a larger position size. This process is repeated until the position is closed with a profit, at which point the bot will start a new cycle. With Futures DCA, you can leverage up to 100x and take advantage of the market's ups and downs. It also allows traders to set up stop-loss orders to limit potential losses. It's highly advisable to set up stop-loss orders. By setting up the stop-loss, traders can limit the risks according to their comfort level.

What's an example of a Futures DCA bot?

Assuming the current price of Bitcoin (BTC) is $25,000, you decide to buy a long BTC contract with value of $10,000 and the take-profit you set is 5%. With the Futures DCA Bot, you can set up a DCA strategy to automatically buy more contracts if the price of BTC drops. For example, you can set up the bot to buy an additional contract if the price drops 2% from your entry position, and another contract if the price drops an additional 4%. Here's how it works:The bot initially buys one BTC contract at $25,000. If the price of BTC drops 2% to $24,500, the bot will automatically buy another contract at this lower price point, bringing the average entry price of the two contracts to $24,750. If the price drops an additional 4% to $23,750, the bot will buy another contract, bringing the average entry price of the three contracts to $24,166.67. Now, if the price of BTC bounces back to $25,375 and reaches your 5% take-profit order, the martingale will sell all three contracts for a profit and then start a new cycle. The Futures DCA strategy can be an effective way to recoup losses and make a profit for users who want to engage in a high-risk, high-reward strategy. Futures DCA enables traders to automate this strategy in futures trading, making implementing it easier and more efficient. However, it's important to use this strategy cautiously and set up stop-loss orders to manage risk. By using Futures DCA, traders can take advantage of the Martingale strategy while minimizing potential losses.

What are the risks to me?

While the Martingale strategy can be a profitable way to trade, it's considered a risky trading strategy. There are three types of risks: risks related to market conditions, risks related to high leverage, and risk of liquidation.

Risks related to market condition: using this strategy, the amount spent on trading can increase rapidly and reach a high value after just a few transactions. This is exacerbated if the price of an asset continues to fall for a prolonged period of time. If a trader continues to double their trades, the probability of loss is infinite. If a trader runs out of funds and exits the trade while using the strategy, the losses faced can be quite high. In addition, the risk-to-reward ratio may not be reasonable for every trader. While using the strategy, higher amounts are spent with every loss until a win, and the final result may only be to break even. Further, if an asset continues to fall in value, there's a chance it could fall to zero, in which case the entire value of the trader's holdings would be lost. It's important to be aware of the risks involved and to have a solid risk management plan in place. For example, it's important to set up stop-loss orders to limit potential losses.

Risks related to high leverage: while high leverage can be an advantage in the right market conditions, it can also amplify losses if the market moves against your position. It's important to use leverage responsibly and to understand the potential risks before trading with high leverage ratios. OKX is entitled, in our absolute discretion, to close one or more or all of your positions.

Risks of liquidation: the use of high leverage can result in a substantial impact on a trader's account balance in the event of a significant price movement against their position. In futures trading, if a trader's margin balance drops below the necessary maintenance margin level, we may liquidate their position to avoid further losses. This may lead to the complete loss of the trader's initial funds. To minimize the risks associated with using Futures DCA, it's critical for traders to comprehend these risks and establish a reliable risk management plan. To avoid the risk of liquidation, traders should consider implementing appropriate stop-loss orders and closely monitoring their account balance.

How do I use Futures DCA bot?

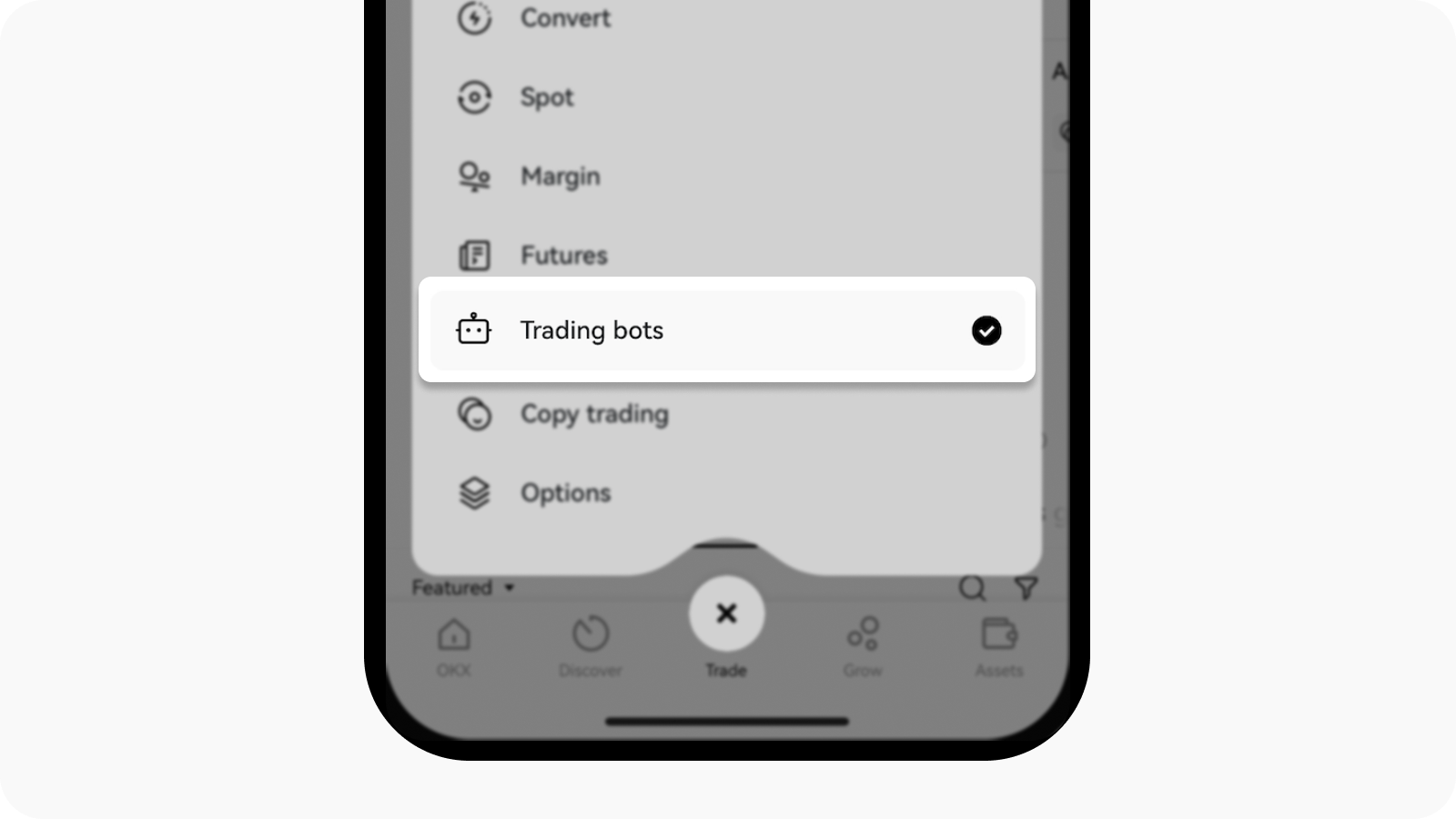

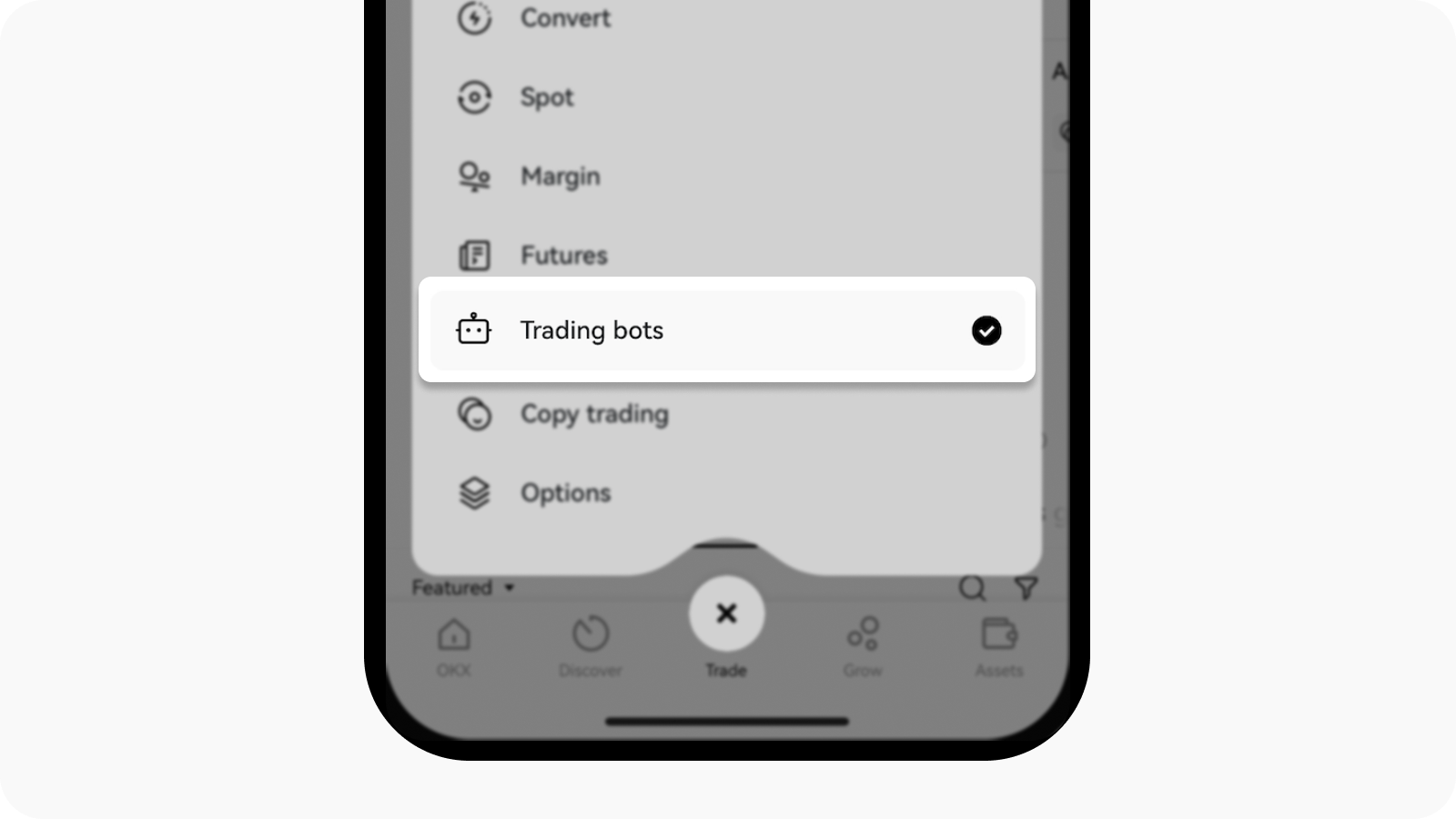

Accessing the Futures DCA (Martingale) bot: start by selecting Trading, then select Trading Bots. This will take you to our Bot Marketplace

Kickstart your Futures DCA bot trading journey by selecting Trading bots

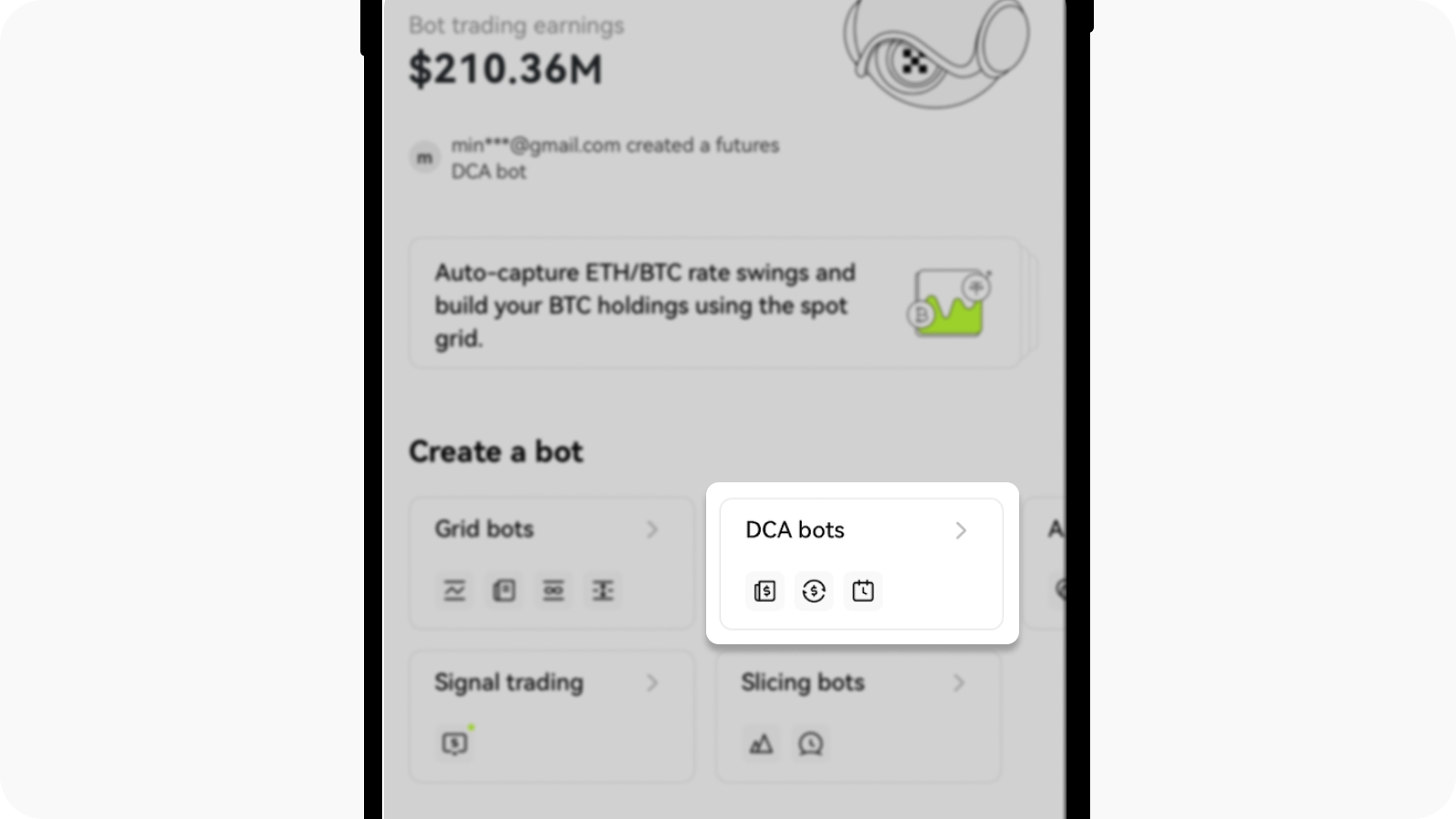

Within the Bot Marketplace, select DCA Bots and then select Futures DCA (Martingale)

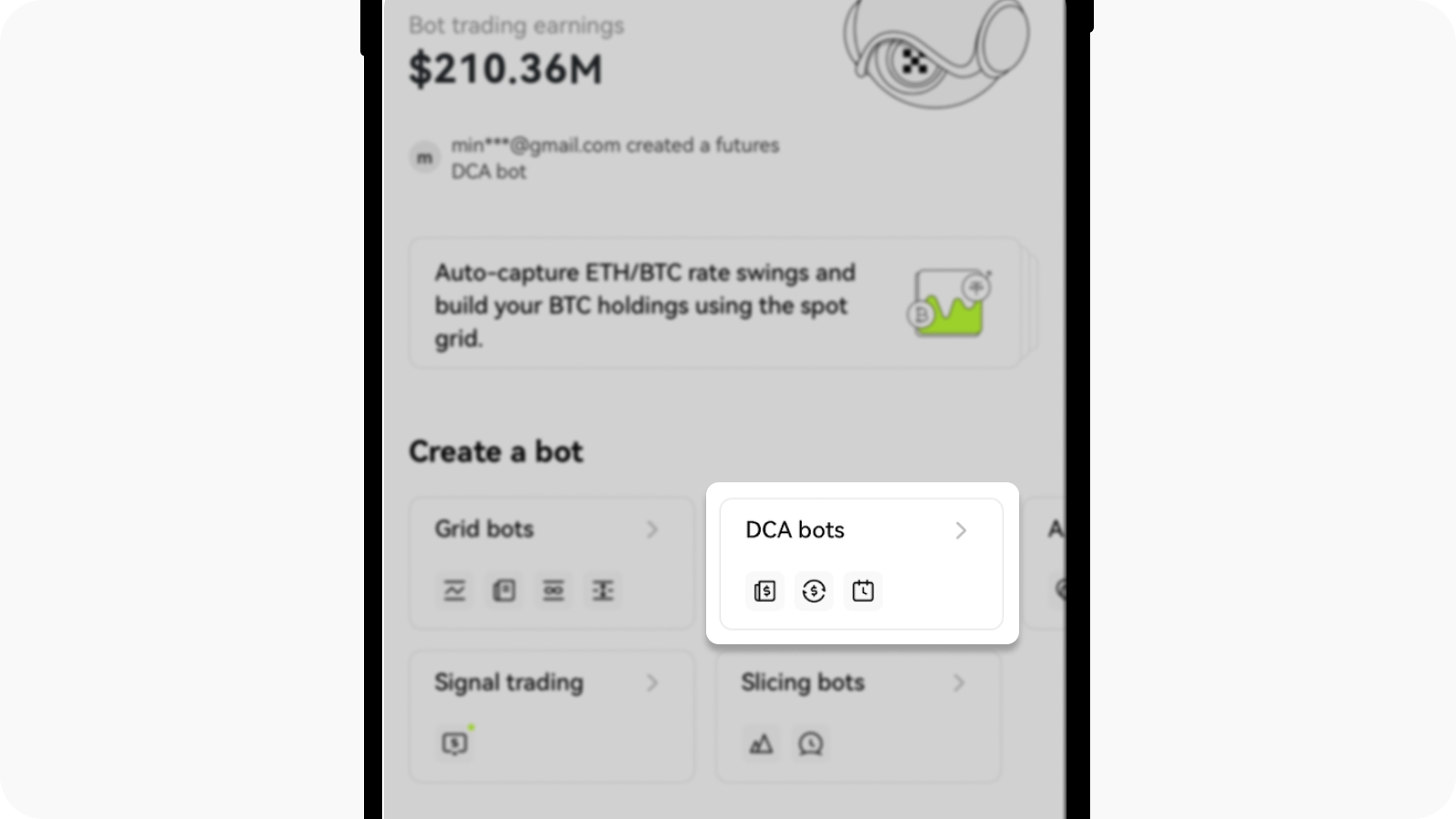

Select DCA bots from the Create a bot menu

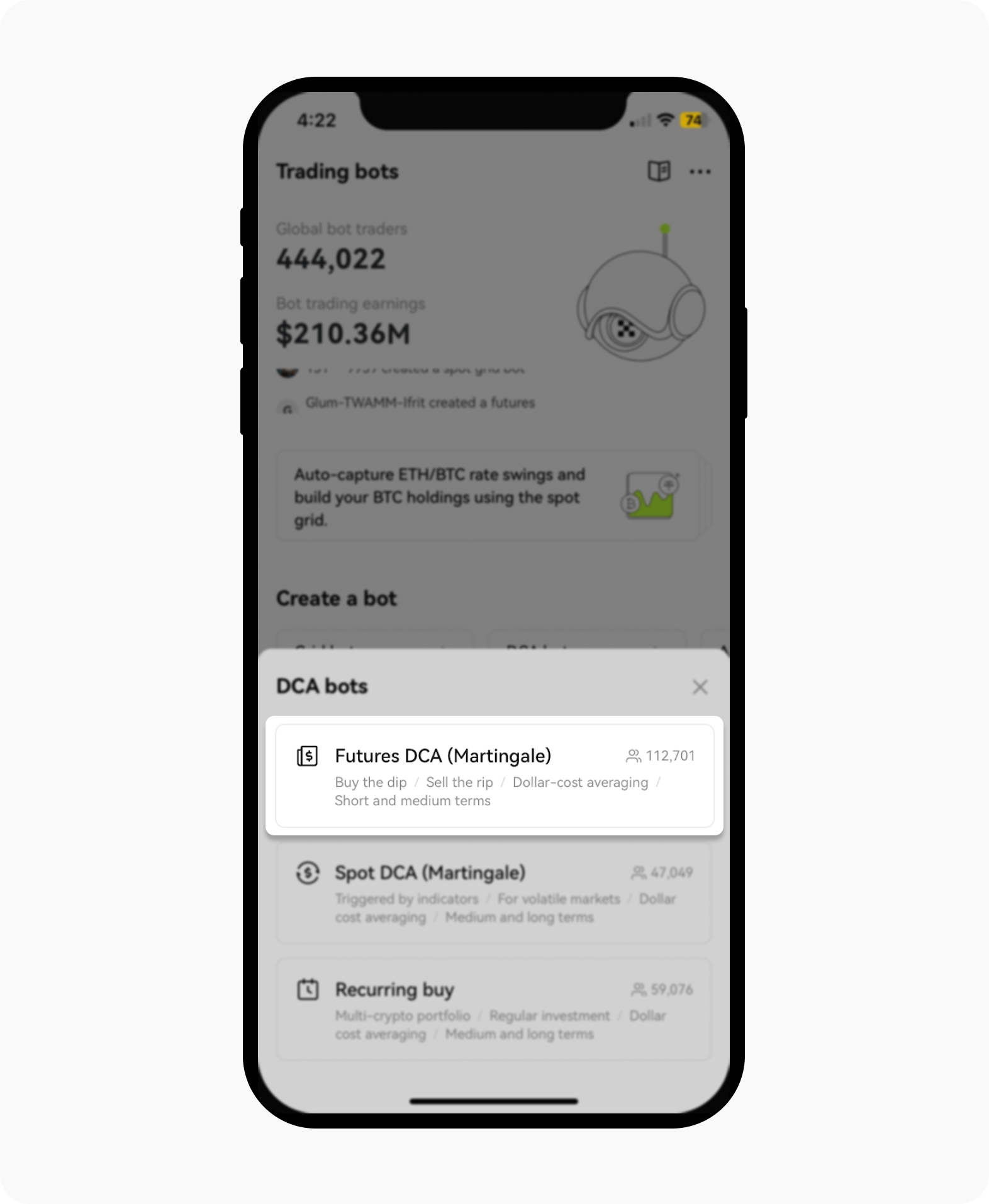

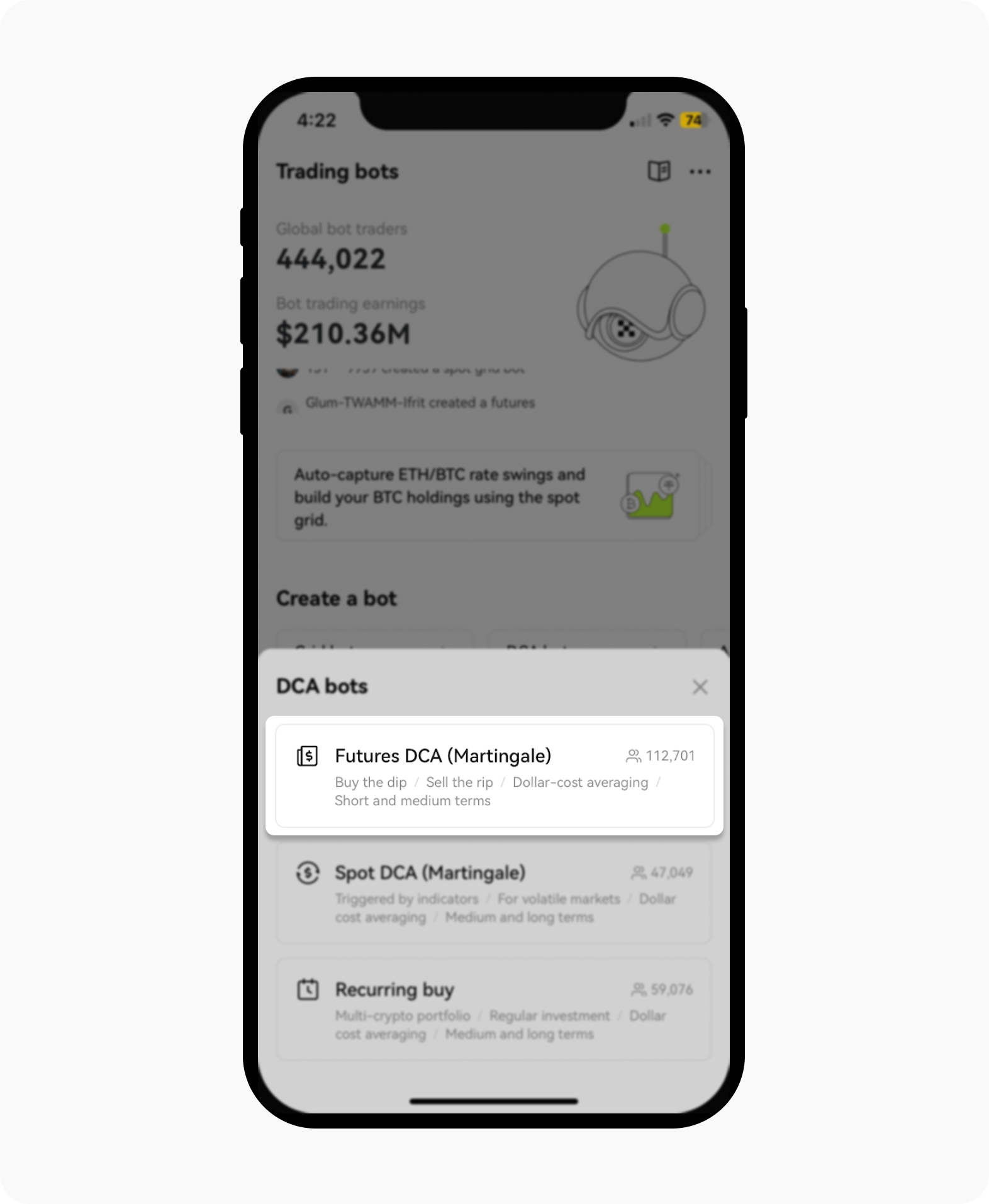

Select Futures DCA from the DCA bots list off the pop-up

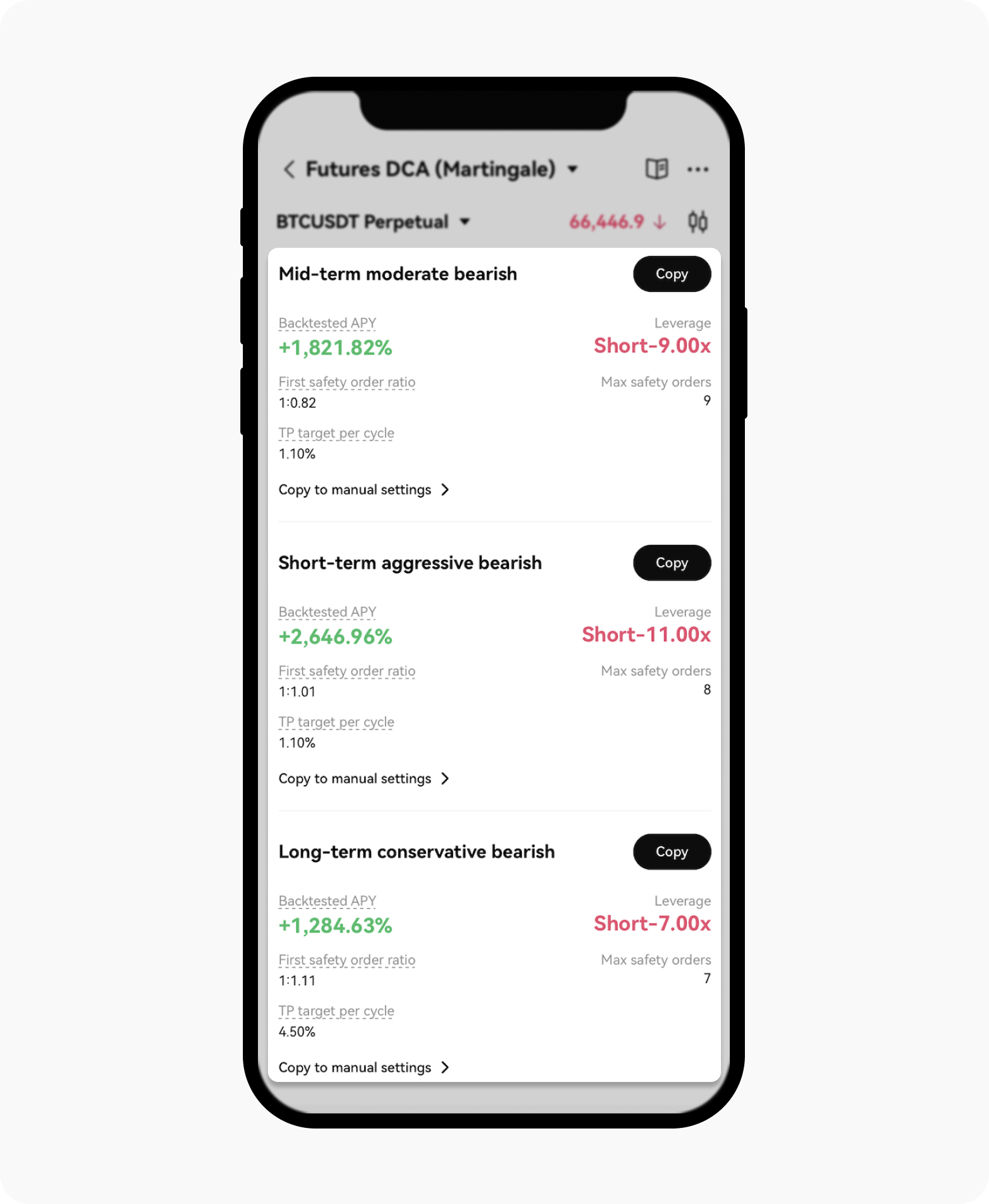

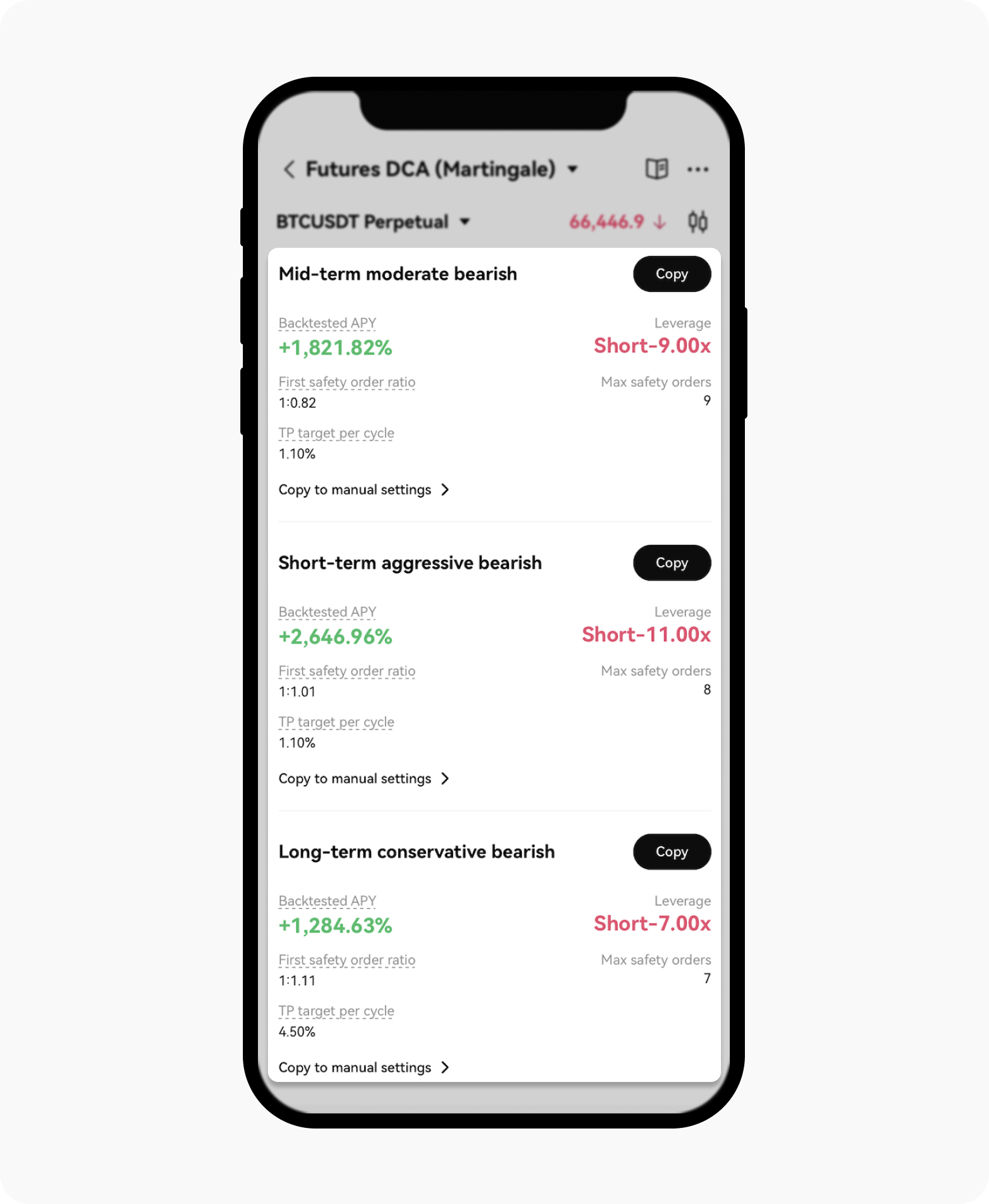

Setting up the Futures DCA (Martingale) bot with pre-set parameters: select the AI Strategy and choose whether you want to go Long or Short. You can then choose from moderate, aggressive or conservative risk profiles

Set up your preferred AI strategy conveniently

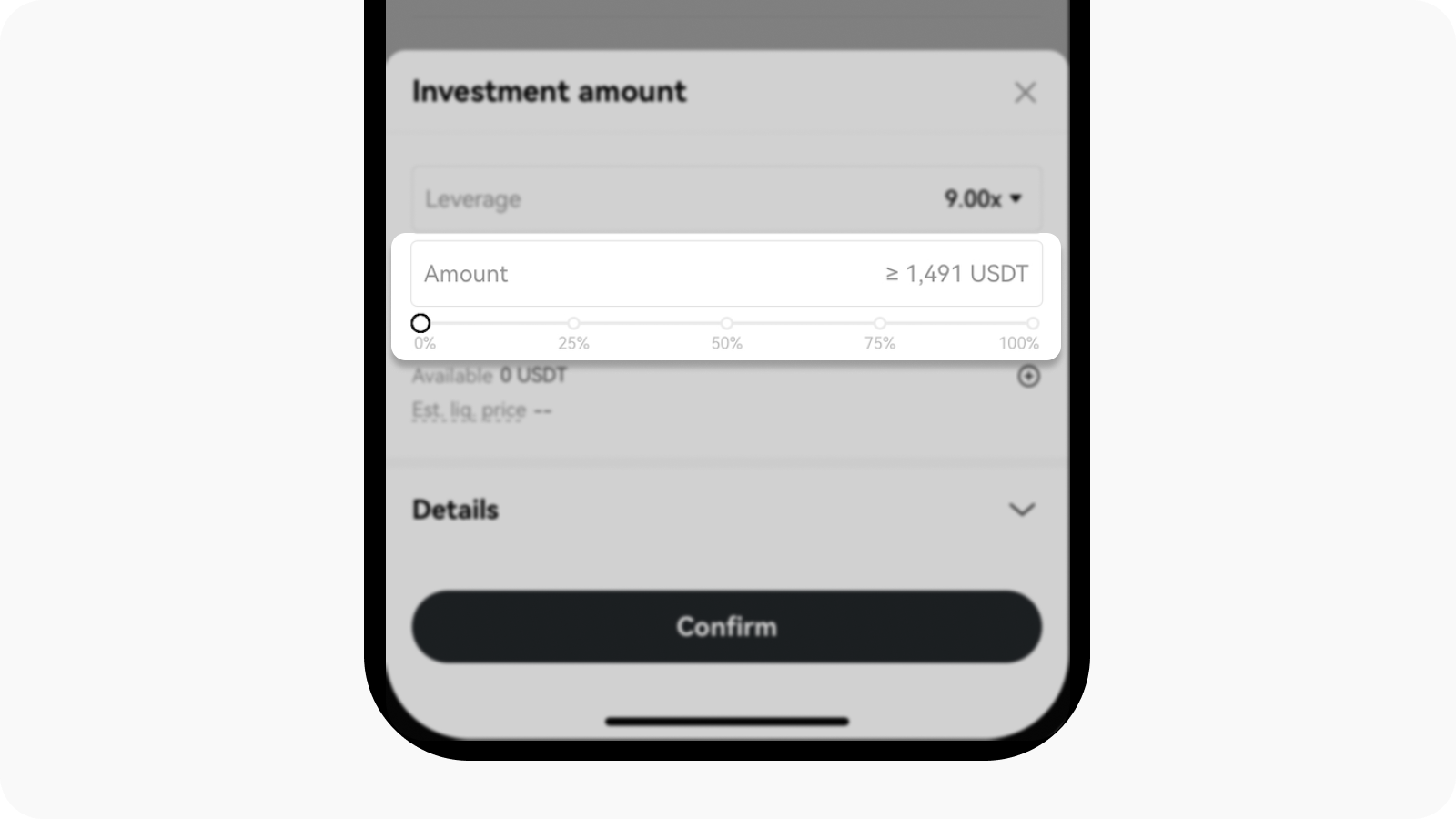

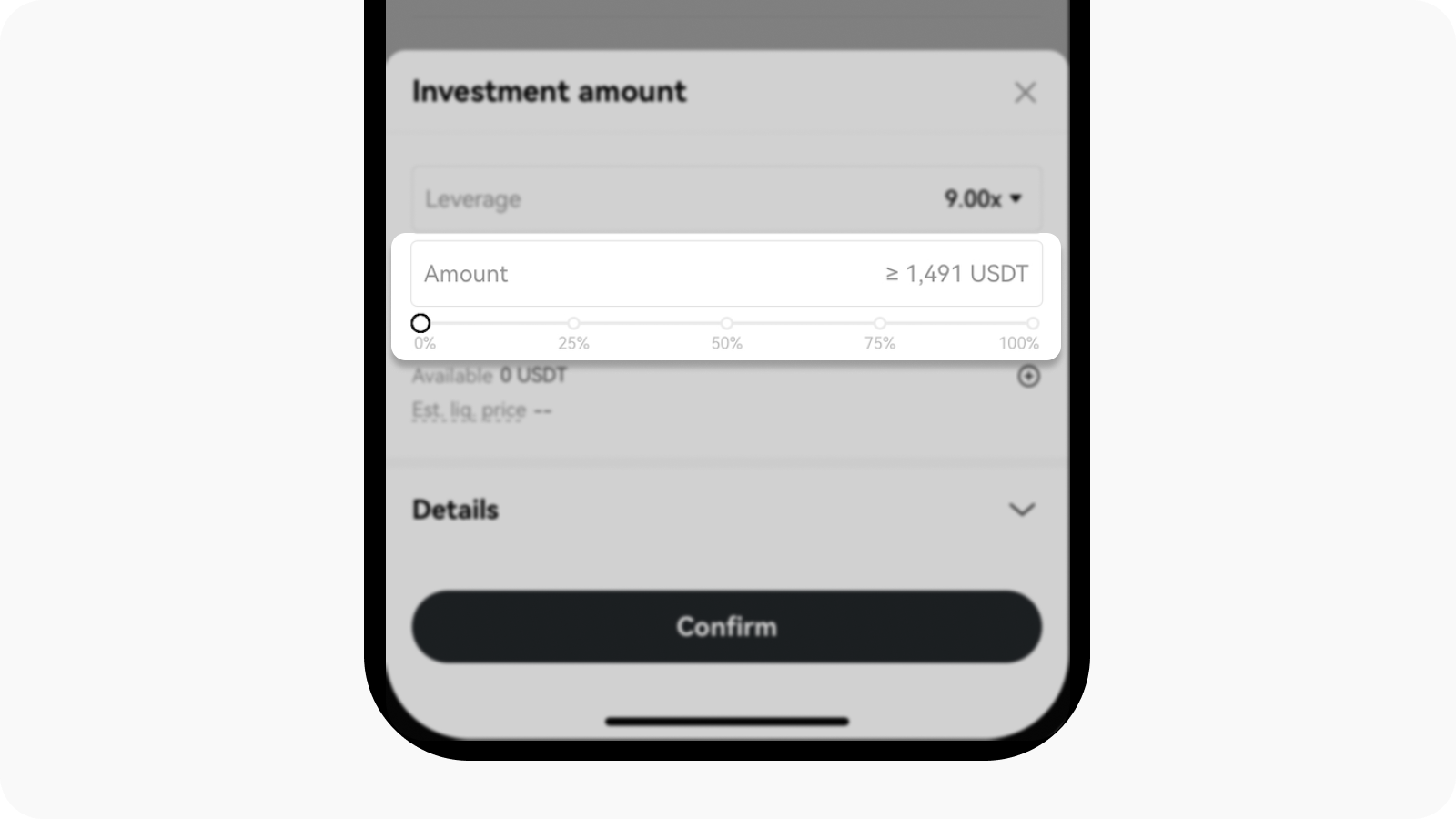

Simply enter the amount you want the bot to trade with, and select Confirm. The DCA bot will then begin functioning with pre-set parameters

Insert the amount of your preference before confirming with the set-up

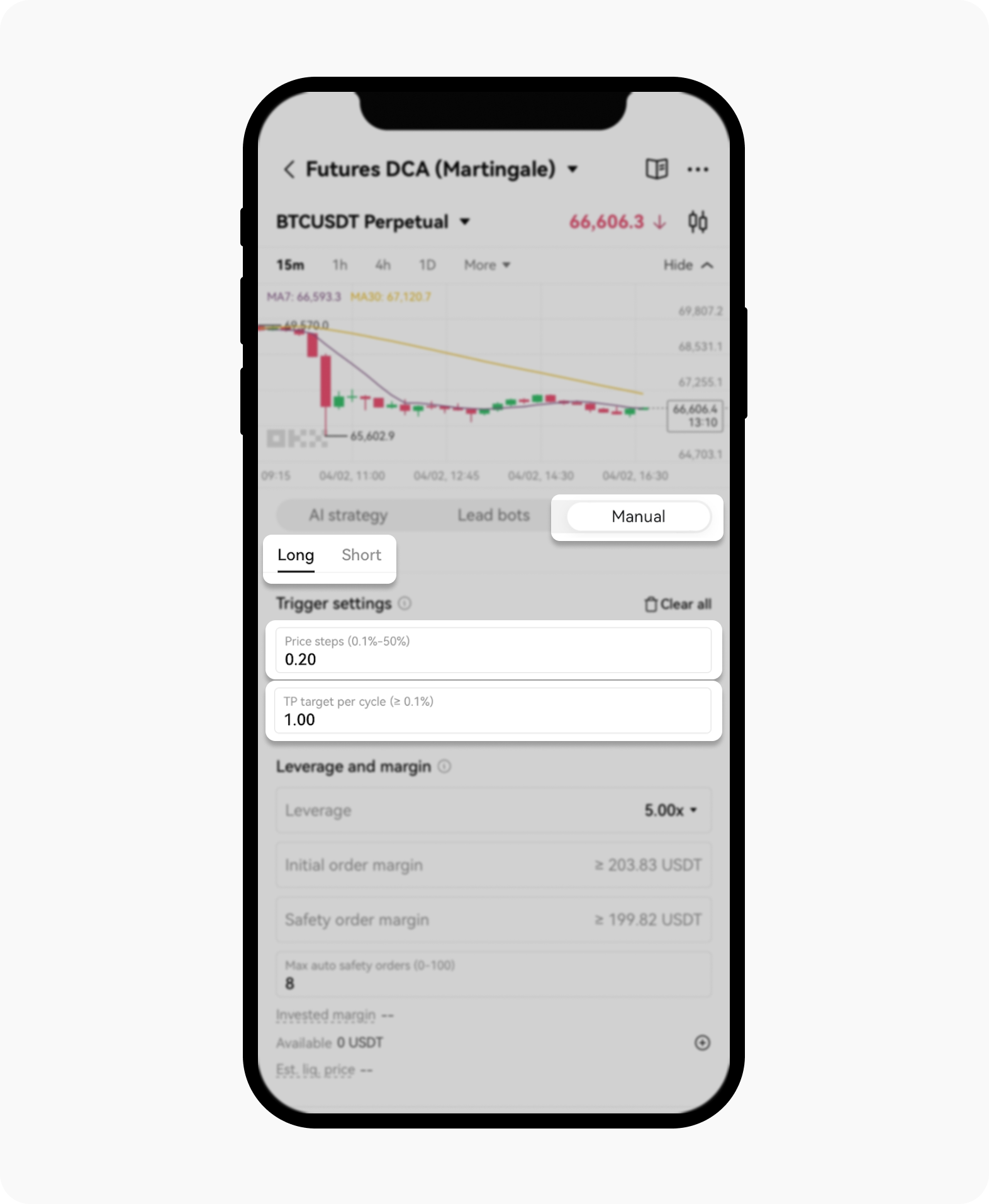

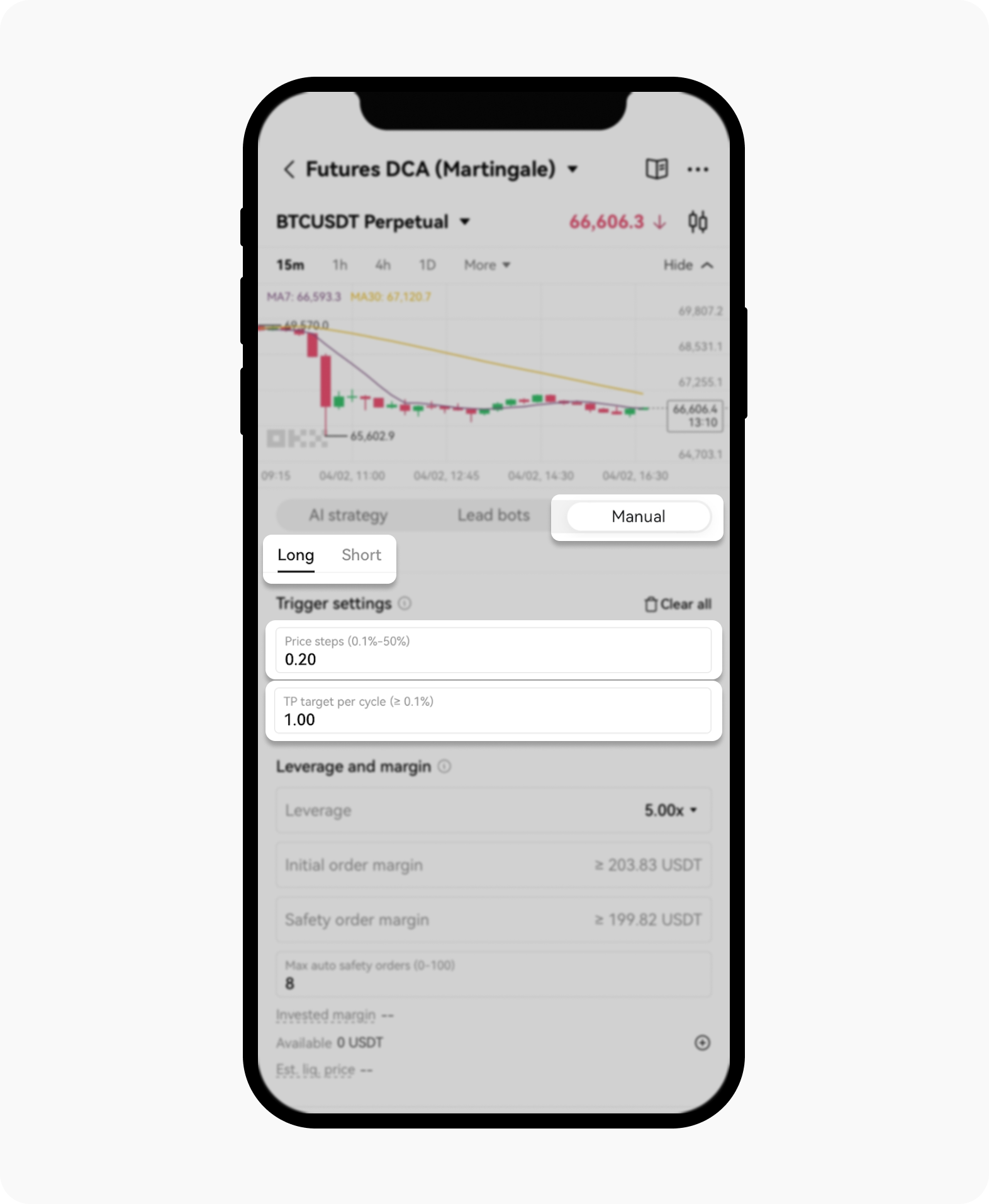

Customizing the Futures DCA (Martingale) bot parameters manually: if you want to customize your own parameters, select Manual and then select Long or Short. This will allow you to customize various parameters, including price steps, take profit targets per cycle, and leverage

Set your parameters manually by inserting the details, once you select Manual from the available options

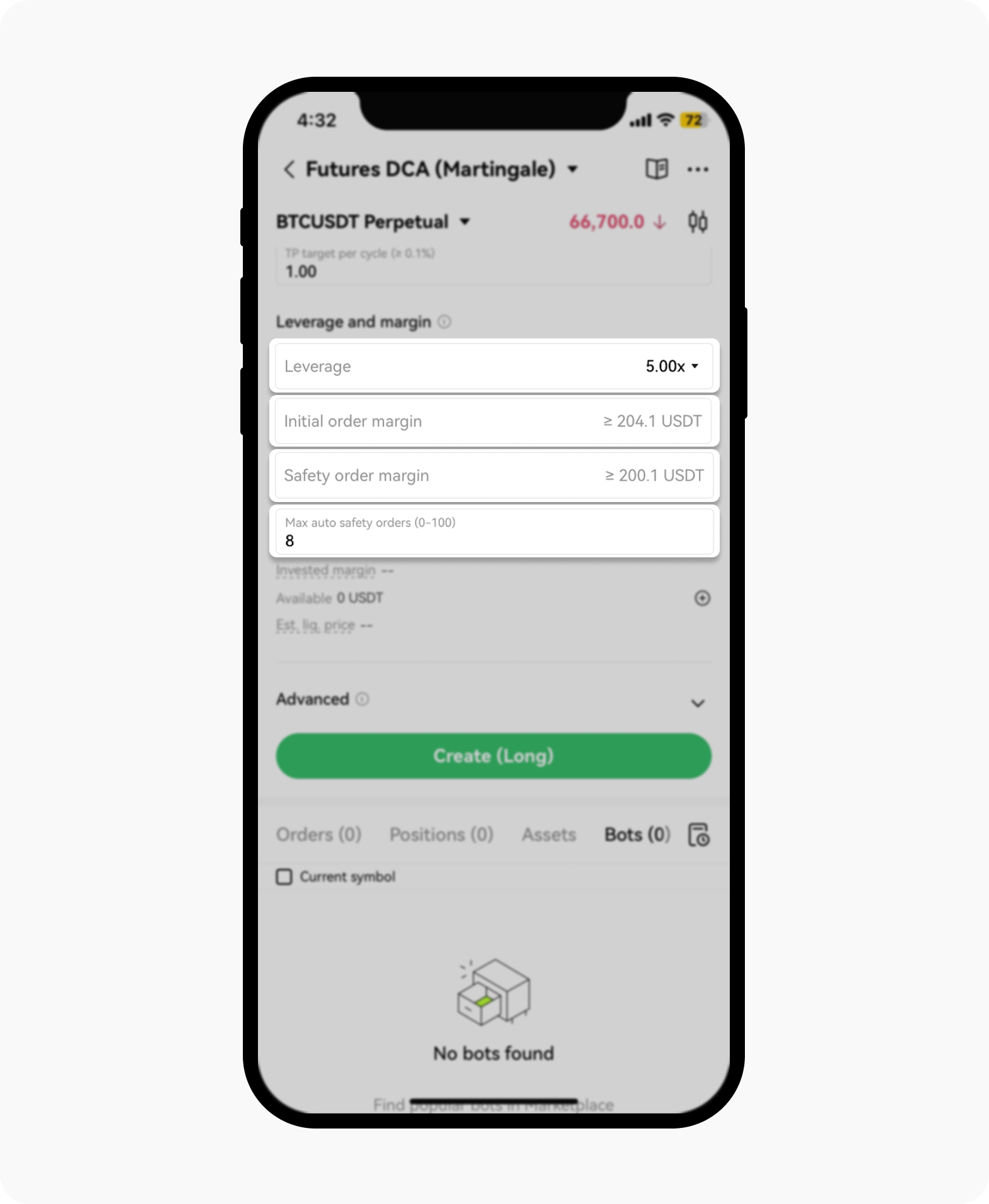

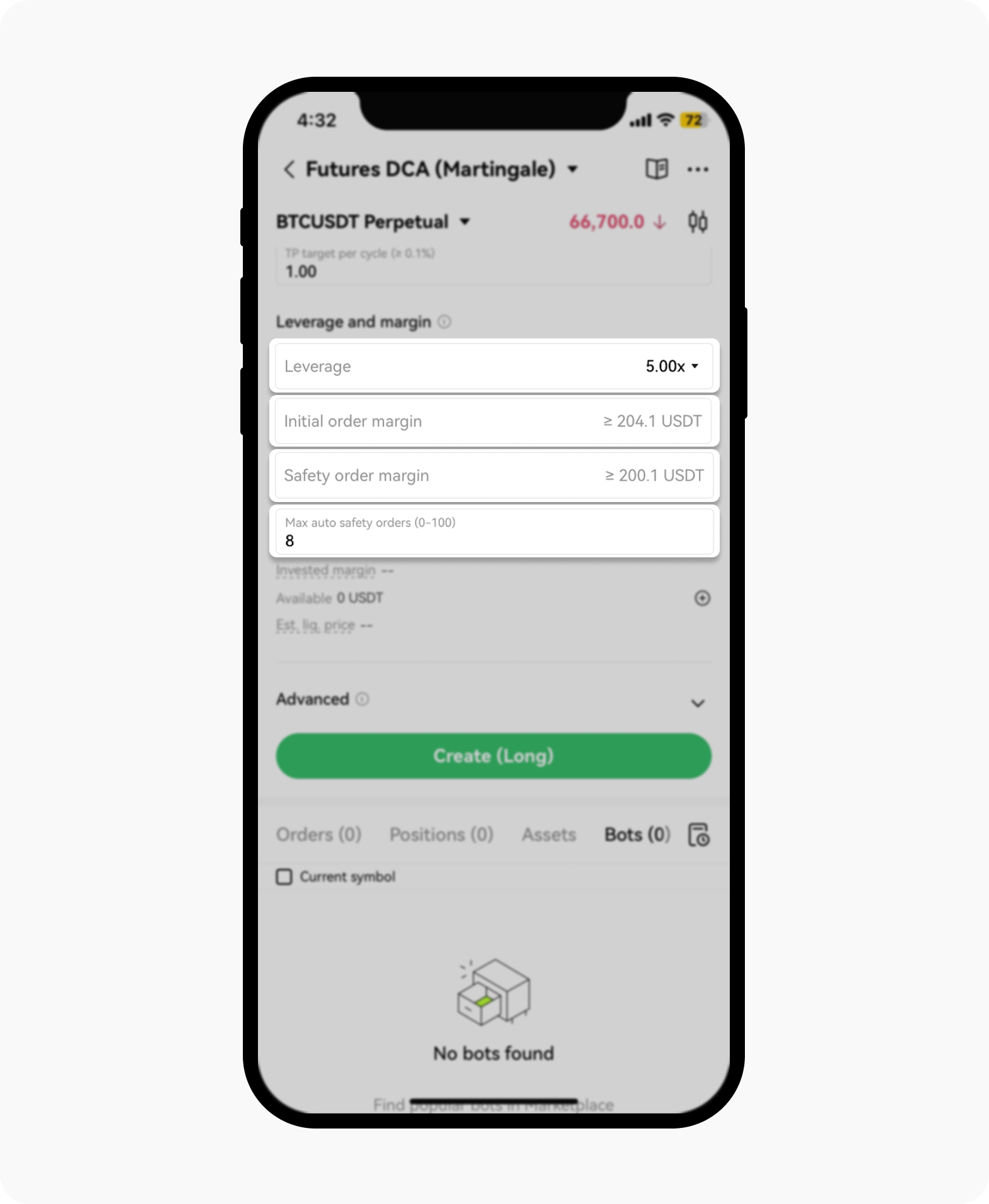

Once you've set your preferred parameters, enter the amount you want the bot to trade with and select Create. The DCA bot will then begin functioning with your customized parameters

Confirm your details before selecting Create to begin your trading